We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

One of the Best results of this merger is the ability to use Marriott Rewards for SPG Cash & Points

The Transitive property of Ballerness has poked its head out again. In case you’re unfamiliar with this property, check out this post where Miles and I explain the transitive property of ballerness and benefits. Marriott points transfer to SPG at a rate of 3:1 and vice versa. This creates some interesting value propositions going forward and lead me to investigate some redemption options with Starwood. I’ve encountered a number of times when it’s tough to get more than $0.007 per Marriott Reward point. I often find it a good deal getting a just penny a point. What I’ve found with transferring points into SPG is the redemption values go up as does choice of property. I think one of best results of this merger is the ability to use Marriott Rewards for SPG Cash & Points rates.

What are SPG Cash + Points rates?

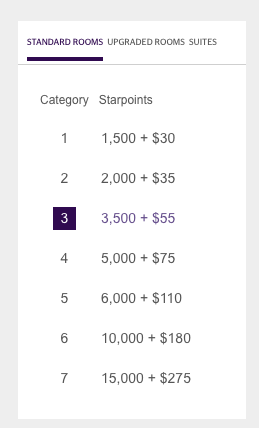

Here’s a look at the rates for SPG Cash + Points. Up to about category 5 there are some amazing deals to be had. I only say Category 5 because the rates start to make considerable cash and point jumps.

What do these look like when converted you use Marriott points to convert into SPG?

| Category | SPG Cash + Points | Marriott Rewards needed |

|---|---|---|

| 1 | 1500 + $30 | 4500 |

| 2 | 2000 + $35 | 6000 |

| 3 | 3500 + $55 | 10500 |

| 4 | 5000 + $75 | 15000 |

| 5 | 6000 + $110 | 18000 |

| 6 | 10000 + $180 | 30000 |

| 7 | 15000 + $275 | 45000 |

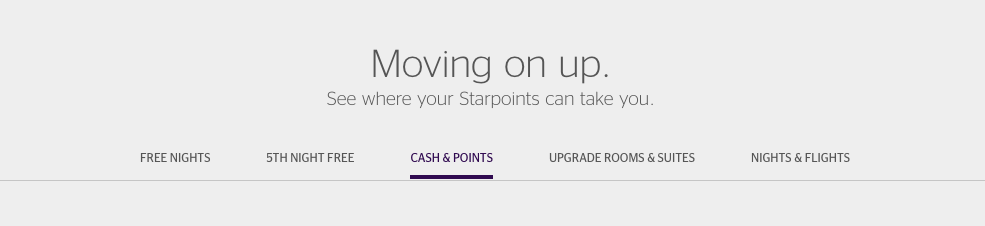

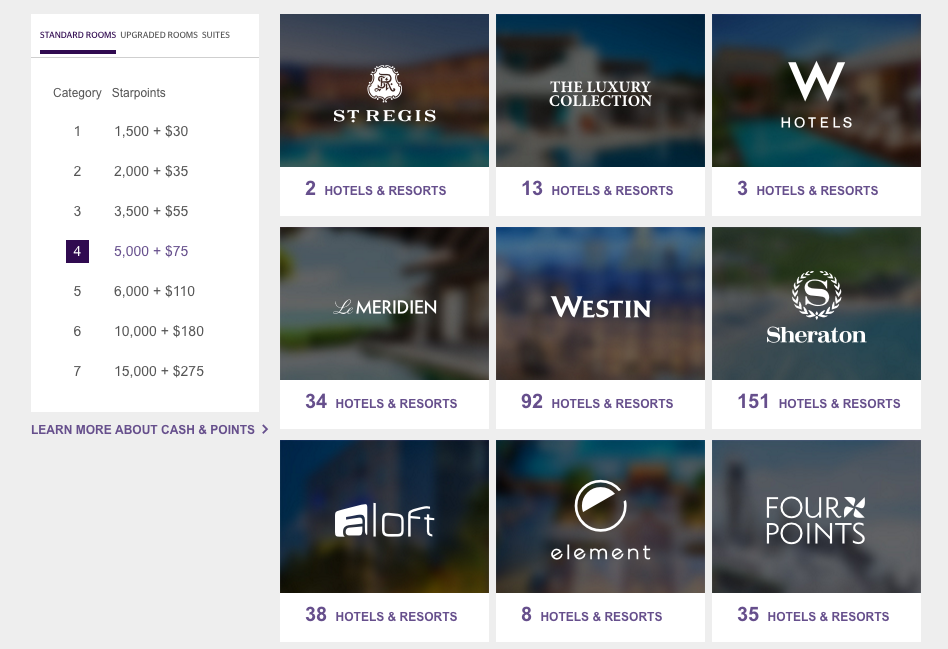

What are some properties that can be had for these rates?

I love that SPG provides a very streamlined way of searching. I really like how it allows me so to see which brands are represented under each category. Click the link above if you’d like to do some of your own searches to investigate redemption options.

Go here and search Cash & Points

From there you can select the category: let’s go with Category 4 which would end up costing 15,000 Marriott + $75

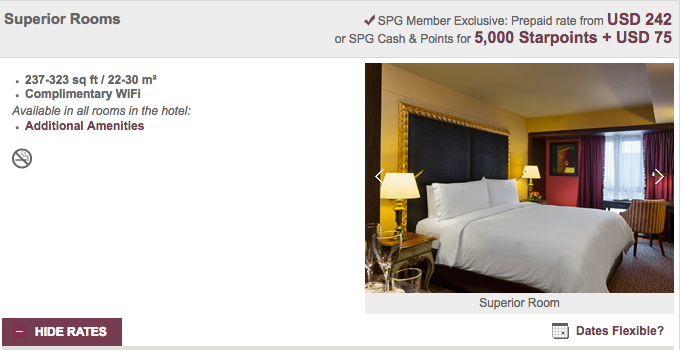

A very cool property is listed: Palacio Del Inka, a luxury collection hotel. This hotel is located just outside Machu Picchu. A destination high on travelers’ bucket lists.

What would those rates normally be for this property?

Here’s the rate for a random weekend in October. Low Season for tourism.

Doing the math this would mean your Marriott Points are worth (242-75)/15000 = $0.011 per point. This is quite a bit more than the consensus valuation of $0.007 per Marriott Rewards point. The prices of this hotel go up considerably during High Season.

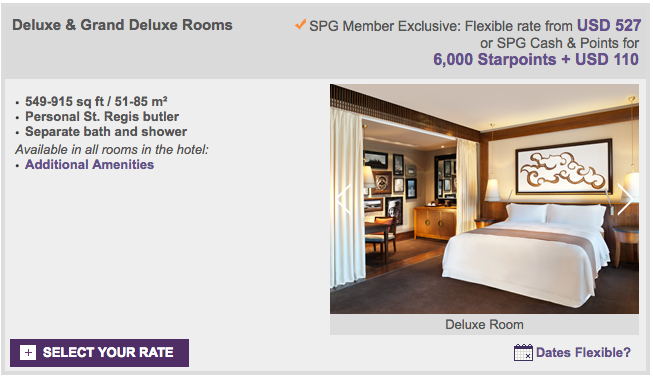

Sticking with Bucket List destinations: Let’s take a look at the St Regis Lhasa, Tibet

Let’s take a look at a Category 5 hotel: The St. Regis Lhasa which would cost 18000 Marriott Rewards + $110

Holy Cow! This property gives Marriott Rewards a great valuation: (527-110)/18000 or $0.023 per point. Three times what experts say Marriott Rewards are worth.

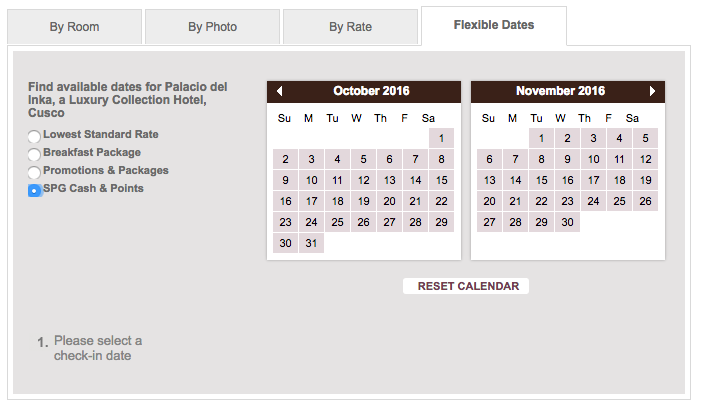

The downside of Points & Cash

The biggest downside is that the rates aren’t always readily available. The great thing is that SPG provides a way to search for availability based on the rate. This makes planning a trip much easier, especially if you’re dead set on using Cash + Points.

Honestly, I’m loving this Merger and this is another way to enhance benefits

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.