We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

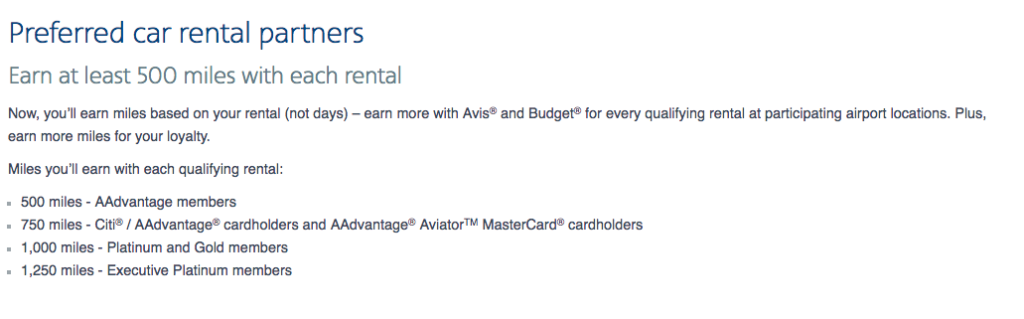

The Chase Freedom card offers 10x points on car rentals through the UR portal. American Airlines is giving up to 1250 AAdvantage miles with Budget and Avis rentals.

I was recently on a flight and saw an ad in the American Way magazine that highlighted the opportunity to earn up to 1250 Aadvantage miles with Budget and Avis. It got me thinking…doesn’t the Chase Freedom Card have a 10x bonus for car rentals during the month of July? YES, IT DOES!!!!!

- 750 miles just for having the credit card! That’s pretty phenom and another reason to keep the card.

This offer is only for Avis and Budget. Which, in case you didn’t know, are part of the same company.

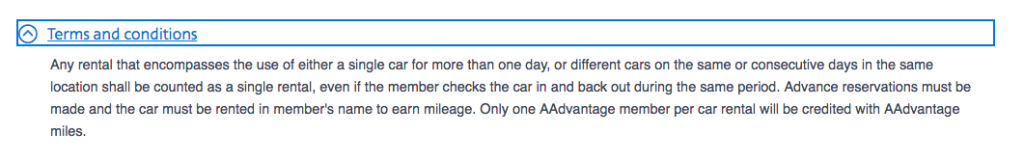

Now I’m sure some of you, like Miles, were thinking you could just do a series of rentals and earn enough for flights. After all, a one way business class ticket is 57,500 miles. If you were Executive Platinum and did this 46 times – Ok, that’s a bit crazy – and could find rentals for $15/day then you could buy a business class one way for less than $700 and have a rental car for a month an a half. However, the terms and conditions stipulate that you can’t do this. However, you could alternate rentals within a household, crediting each account every other day and earn a lot of bonus points.

The Stacking potential with Chase Freedom 10x

Until the end of July you can earn 10x Ultimate Rewards by booking through the Ultimate Rewards portal and paying with your Chase Freedom card.

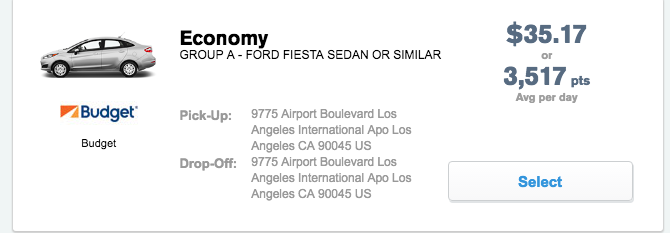

With a rental like this you’d earn

- $35 * 10 = 350 Ultimate Rewards

- AAdvantage bonus: 1000 if platinum

If you value Ultimate Reward points at $0.02 and Aadvantage at $0.018 you’d be getting $7 back and $18 respectively. Bringing this rental down to just $17 net. Not a bad deal!

This was just a random date that I searched for at LAX. I’m sure there are plenty of better deals out there where the rental rates fall below $20/day. At that rate you could come closet to breakeven with rentals. Not a bad deal…at all.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.