We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Cathay Pacific Credit Card and 20k Amex points with Air France $1k purchase

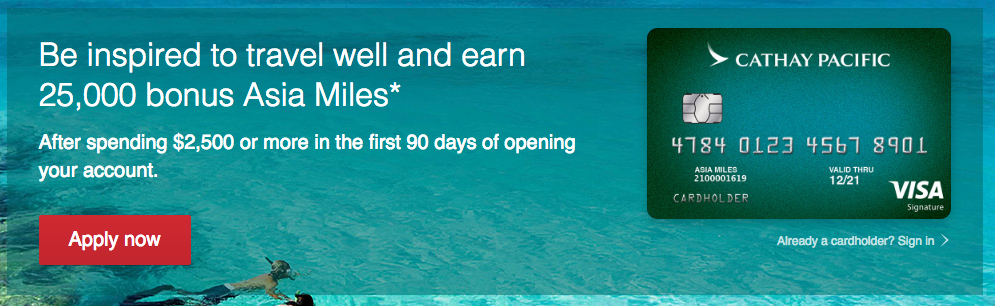

These are the two big stories floating around the interwebs today. Cathay has released a new credit card with a 25k offer and Amex is running a promotion whereby spending $1k or more on the Air France app or Airfrance.us will net you 20k Amex points. Let’s take a look at the details on these offers.

The new Cathay Pacific Credit Card. 25k Bonus points after $2500 in 90 days. $95 annual fee.

The Deets and perks

- 25k Bonus Asia Miles after $2500 spend in 90 days

- Will affect your 5/24

- 1.5x Asia Miles on dining in U.S. and abroad

- 1.5x Asia Miles on all International purchases ( outside U.S.)

- No foreign transaction fees

- Marco Polo Green Tier Status

My thoughts:

This isn’t a card that I’ll be putting in my wallet anytime soon. Asia Miles are pretty easily gained through Citi Thank You, SPG, and Amex MR cards which are all transfer partners. I’m already over 5/24 and wouldn’t add a personal card to my arsenal if it didn’t add considerable value. Everyone’s situation is different, but it’s not the best fit for me.

The other big deal of the day: 20k Amex points with Air France $1k purchase

If you’re looking to see if you’ve been targeted it will be in your Amex offers and look like:

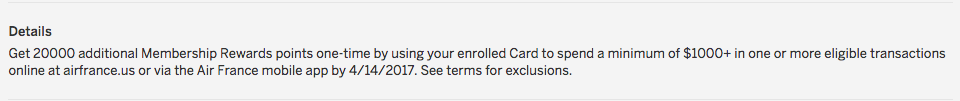

Here are the details:

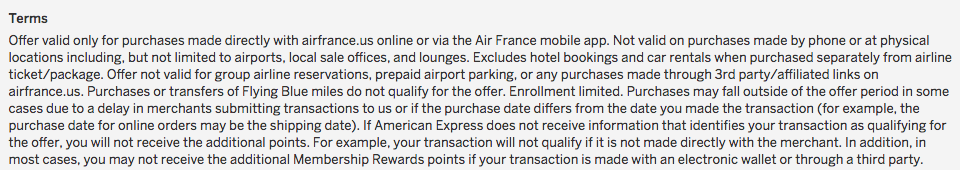

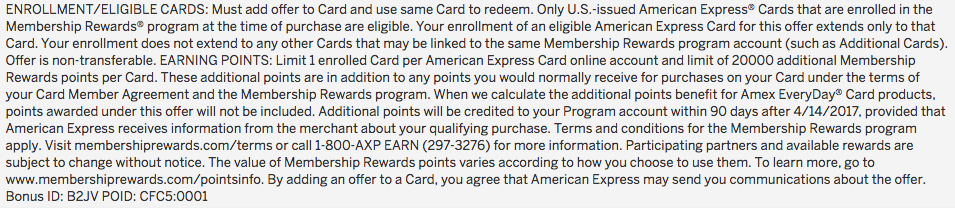

Terms and Conditions:

- Must spend $1k+ by 4/14/2017

- ONLY valid using the Air France app OR Airfrance.us

- US based Amex cards are eligible.

- Buying points won’t qualify

My thoughts on the deal. Outstanding.

In a worst case scenario I can redeem Amex points for $0.o2 because of my Amex Biz Plat. So this deal is worth at least $400. With that being said, I’m not going to run out and buy an Air France ticket, but I’ll take this offer into consideration when comparing my options for flights abroad.

One thing that I do really like…Air France is a partner of Alaska and I’m trying to re-qualify for MVP GOLD 75 this year. That’s pretty awesome.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.