We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The end of any relationship is tough. I happen to think the divorce between Costco and Amex went something like this:

My guess is Visa makes Costco feel dangerous, but also safe.

I feel like the consumer is saying look, Costco… this is just Semantics, if you wanna throw a couple miles at us – we’ll take a couple miles. The important thing is we’re moving forward 😉

You know who took the miles? CHASE FREEDOM. I wrote last week about how Chase Freedom confirmed that Costco would be a 5x category for the rest of the year. That is BIG BIG BIG. In my opinion it makes the Chase Freedom a far stronger card to carry than the newly released Costco Visa. For the next quarter they go head to head:

| Restaurants | Costco | |

|---|---|---|

| Chase Freedom | 5x | 5x |

| Costco Visa | 3x | 2x |

A little History ICYMI

Costco and Amex ended their 16 year relationship last year. The wholesale club with 81 million members basically walked away. It was a loss in the Billions to Amex. Their shares lost 6.5% that day. In fact, it was such big news that there was a whole write up on Bloomberg about it. It’s definitely worth a read if you get a chance. The article points out all sorts of issues the two companies had with one another, mostly stemming from corporate attitude and hubris. The article essentially makes Costco look like the friendly neighborhood punchbowl crew and frames Amex as a choreographed, stilted and gilded, group of prom kings and queens. Well I’d have to say the punchbowl crew held no punches and have emerged quite victorious. Much of American Express’ recent attractive offers have been aimed to entice those with incomes over $125k away from Chase and Citi, and to also retain current Costco customers with the Blue Cash card. This high income segment used to be Amex bread and butter, but Chase and Citi have enriched their programs and left Amex kind of swaying in the wind. Anyways, I could go on and on and on, but that’s for another article.

The New Citi Costco Visa is pretty.

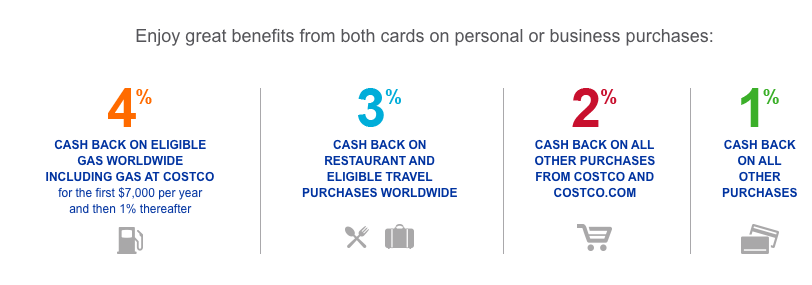

- It’s a cash back card geared to those who with Costco Memberships

- It’s no fee as long as you maintain your Costco Membership

- 4% back on Gas from Costco – maxed at $7000 for the year

- 3% back on restaurants and travel worldwide – great deal!

- 2% back on all Costco purchases and Costco.com

- 1% back on er-thing else.

Will I get one?

I love the 5x Bonus from the Chase Freedom. I love Ultimate Rewards and I also love Costco. So for the rest of the year I’ll be using my Freedom card whenever I’m at Costco. Maybe next year I’ll look into getting this card, but in all reality I probably won’t. It’s just great to be able to use a Visa at Costco, and I have a hunch that the banks that issue Visa cards will be promoting great deals for using competing products. We’ve seen the first competition with the Freedom 5x category and hopefully many more to come!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.