We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

These Credit cards give a FULL refund on Global Entry/TSA PreCheck® fees

Yes, there is a long list of credit cards that will actually reimburse the fee for Global Entry or TSA PreCheck® when you charge it to them. If you carry more than one of the cards down below, and you’re looking to get family members in on the action, you could spread them on various cards. Heck, some cards even extend the benefit to authorized users and give them a fee credit as well. Let’s take a look at the difference between TSA PreCheck® and Global Entry as well as which credit cards will reimburse the fee you pay.

If you’d like to learn more about Global Entry – read this full article

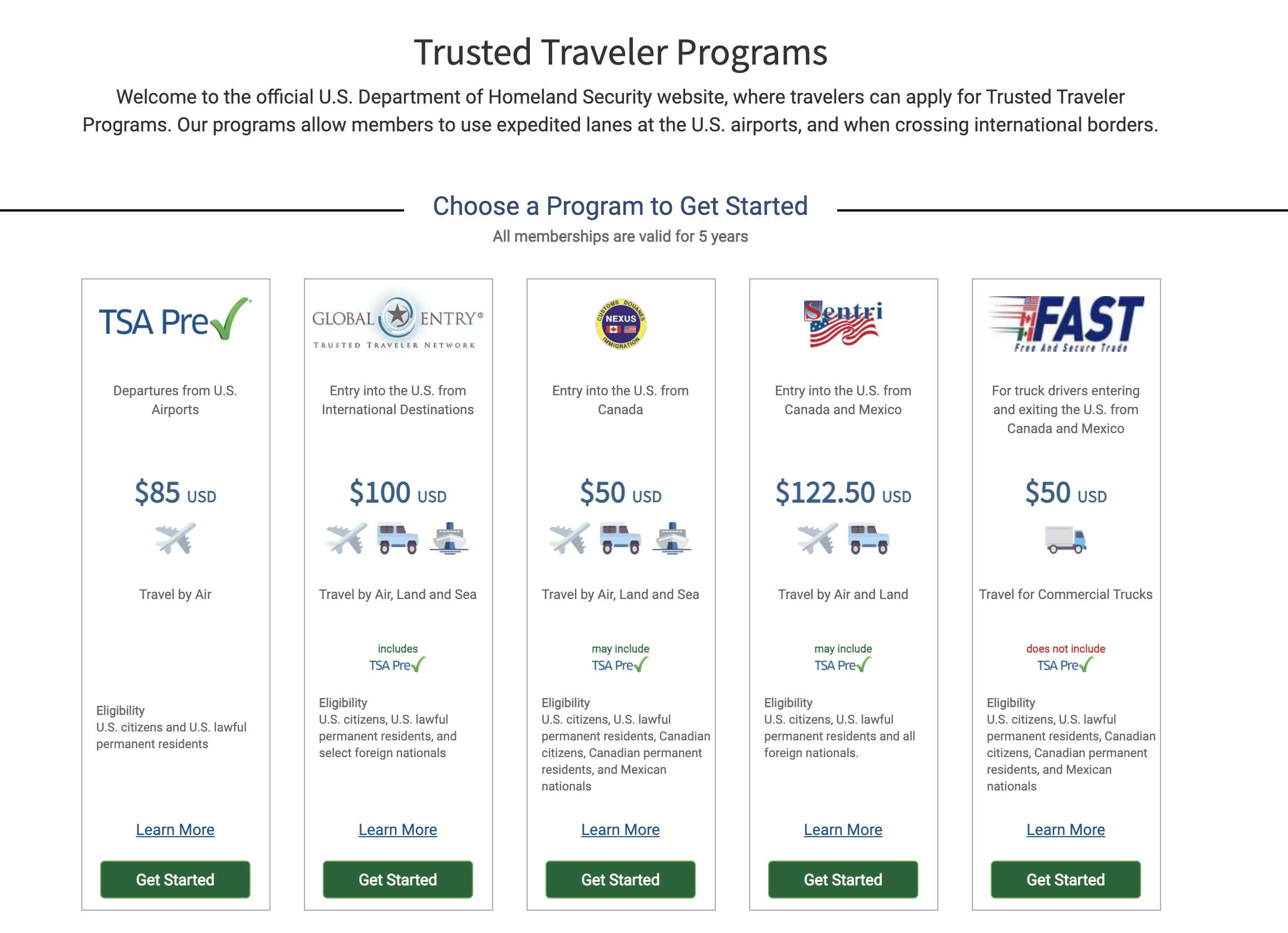

Trusted Traveler: TSA PreCheck® vs Global Entry

Global Entry expedites your immigration and customs process when you’re returning to the USA from a foreign country. TSA PreCheck® expedites your security when you’re going from Check-In to Gateside at airports where TSA operates. Note, some of these are outside the US like in Canada or the UAE.

- TSA PreCheck® can reduce your security wait times

- Global Entry can reduce your immigration and customs wait times

One thing you should realize, Global Entry provides a Known Traveler ID which can be used for TSA PreCheck® as well. Meaning, Global Entry comes with de facto TSA PreCheck® vis a vis the your Known Traveler number, so if you apply for Global Entry and are approved, you’re getting both.

This does not work the other way around, if you get TSA PreCheck®, you don’t get Global Entry.

This is why, if you travel internationally at all, I recommend getting Global Entry. However, if you don’t, its worth your while to get TSA PreCheck® to reduce your security wait times here in the USA.

- TSA PreCheck® = $85

- Global Entry $100

Credit Cards reimburse the TSA PreCheck® or Global Enetry fee.

Note that the fees are reimbursed as statement credits and usually it is once every 4 years for Global Entry and every 5 years for TSA PreCheck®, and you have to choose one. If you’ve received a TSA PreCheck® credit, you won’t be eligible for a Global Entry credit on that credit card until the timeframe passes. This isn’t a hard and fast rule, but generally the case.

If I’ve missed any, just drop a comment and I’ll update the list.

American Express

- The Platinum Card® from American Express – any version

- The Business Platinum® Card from American Express

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Reserve American Express Card

- Marriott Bonvoy Brilliant® from American Express® Card

Barclay

- Barclay Aviator Silver

- Mastercard® Black Card™

- Mastercard® Gold Card™

Bank of America

Capital one

Chase

- Aeroplan® Credit Card

- Southwest Rapid Rewards Performance for Business

- Chase Sapphire Reserve®

- Ritz Card from Chase

- IHG One Rewards Premier Card from Chase

- IHG One Rewards Premier Business Credit Card

- United(SM) Explorer Card

- United Club(SM) Infinite Card

- United Quest (SM) Card

Citi

City National

- Crystal® Visa Infinite® Credit Card

UBS

- UBS Visa Infinite® Credit Card

US Bank

- SkyPass Select Visa Signature® Card

- U.S. Bank Altitude™ Reserve Visa Infinite® Card

- U.S. Bank FlexPerks® Gold American Express®

Suntrust

- Suntrust Travel Rewards Credit Card

Truist

- Enjoy Capital Credit Card

A trick to get TSA PreCheck® faster

Most people think you need to go to the airport, but you don’t. Staples is an authorized enrollment center, and during your application process, you will be given options of where to conduct your TSA PreCheck® interview. You can just search for your local Staples, and save yourself not only a commute to the airport, but a ton of wait time since these locations seldomly have lines.

A trick to getting Global Entry Faster

Global Entry interviews are taking almost a year now to schedule. The trick is to go through the entire application process ( you can learn more here ) and as long as you are conditionally approved, or pending your interview, you can do this when you arrive back from yoru international trip. This is called Enrollment on Arrival.

What do I need to bring?

- A valid passport. If you travel using more than one passport, please bring them all to the interview so that the information can be added to your file.

- Documents providing evidence of residency. Examples are: driver’s license (if the address is current), mortgage statement, rental payment statement, utility bill, etc. This is not required for minors.

- A permanent resident card (if applicable)

Overall

I’d recommend getting Global Entry so you can get both it and TSA PreCheck®. But, if you don’t anticipate any international travel, get TSA PreCheck®, enroll at Staples, and use one of the cards listed above to get a statement credit.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.