We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The End of an Era

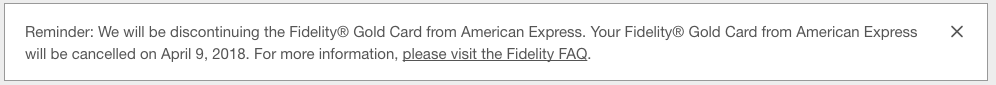

When I was in college I opened up a Fidelity brokerage account to trade stocks. I had a Roth, some savings, and I wanted to start compounding it. One of the benefits of the account was a Fidelity American Express Gold card, fee free. Any charges that you made during the month would be withdrawn from your cash balance, and if you wanted, you could pay a fee to earn Membership Rewards on those purchases. I felt like an absolute BALLER carrying around an Amex Gold in college. In addition to that, I even upgraded the card to a Platinum for a year, downgraded it the next, but since the account number stayed the same I kept using the Amex Plat until its expiration date ( It even continued to get me into Delta lounges at the time.) Not sure that really works anymore. Flash Forward 16 years and here I am today, staring at my long held friend who is about to phased out on April 9th, 2018.

Despite opening many Amex cards since then, it’s been my Amex Fidelity Gold card that established my “member since” date of of 2002. I now wonder, what will happen to that date? It’s unclear by the FAQs on the product cancellation, but I’m hoping my records still support the 2002 date. I never use the card, but it’s brings back a lot of great memories, and was my first “premium” card that I ever had.

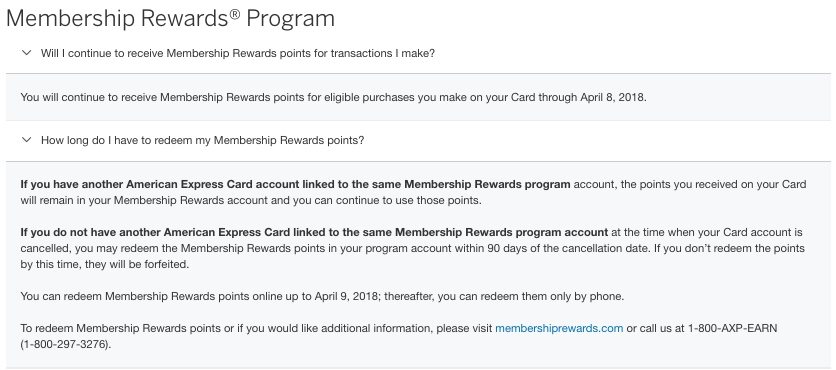

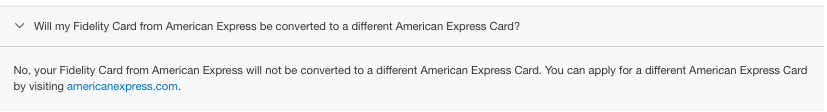

Here are a few of the FAQs…

Did you ever carry one of these?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.