We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: What are AA 500-mile upgrades?

Each Monday Miles has decided to drop a tip, hint, tutorial, trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet. This week the Monkey Miles Monday Memo answers the question, What are AA 500-mile upgrades?

So what are AA 500-mile upgrades?

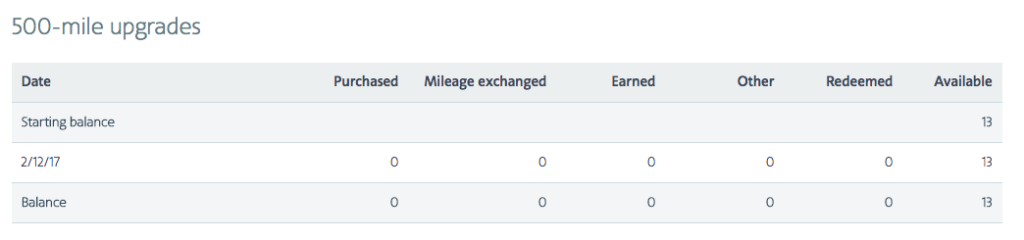

Once you hit Elite status with American Airlines you will earn 500-mile upgrades for every 12,500 EQM you earn. You can redeem the 500-mile upgrades to upgrade from the Main Cabin. One upgrade is needed for every 500 miles of travel.

As an example…if your trip is 1500 miles you will need 3, 500 mile upgrades to upgrade the trip. If it was 1501 you would need 4.

What flights qualify?

American marketed and operated flights.

Can I use 500-mile upgrades to upgrade a domestic 3-cabin flight?

Yes, just not from Business to First Class.

I’m short on 500-mile upgrades…what can I do?

Buy them for $40 a piece

- on aa.com

- the app

- at the airport

- or calling: 800-882-8880

Use miles – 8 upgrades for 40k miles ( not what I’d recommend)

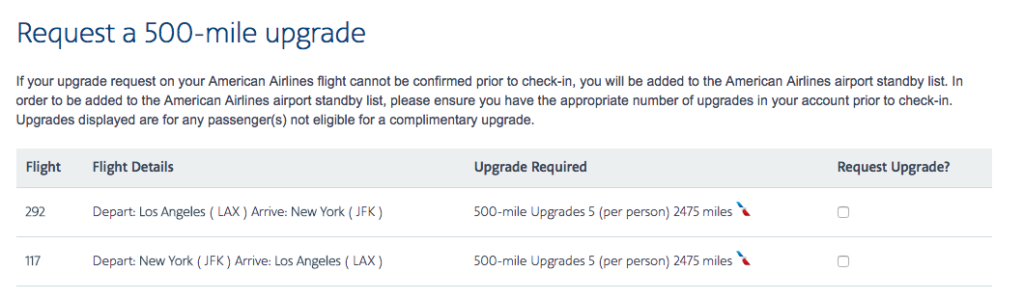

How do I signify that I’d like to use my 500-mile upgrades?

You will be prompted when buying the flight.

Who is given priority?

- Elite Status

- Date and Time of original request

The one thing that I would assume, because it’s effective with Executive Platinum SWU, is that your EQD would play an impact in priority as well. Whether that would trump status is unclear to me at this point. Meaning, would a Gold who wants to use 500s and has spent $12k trump a Platinum, who has spent $5k? Most times

What was my success like?

500-mile upgrades are iffy. You’re up against Exec Plats and Platinum Pros who get complimentary upgrades and don’t even have to use 500s. I was Platinum last year and got upgraded about 50% of the time I elected to use them. But everyone who’d accumulated 50-100 EQM/EQP was on the same playing field. I wasn’t up against a new elite status, Platinum Pro, and mainly applied them to flights where I thought I’d have a really good shot. I did clear on a LAX-MIA flight that utilized a 77W. That was pretty awesome…even with a broken seat. The day before I cleared there were over 20 open seats in business and I cleared as I was boarding.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.