We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: Yes, buying points can make sense

Each Monday Miles has decided to drop a tip, hint, tutorial, trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet. This week the Monkey Miles Monday Memo: Yes, buying points can make sense.

Here are the 3 biggest reasons why I have purchased points.

Just to get this out of the way…I’m NOT advocating speculative purchases here at all. I’m just recommending alternative ways of valuing and approaching the points you have. You want to keep their worth high, your expense low, and often times this can be achieved through a points purchase.

-

Shore up account to get a FANTASTIC award.

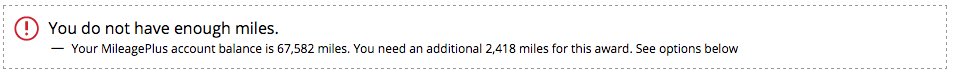

- You see an award you’d like to get, but you don’t have enough points in the account or a partner to transfer from. You can buy points to make up the difference.

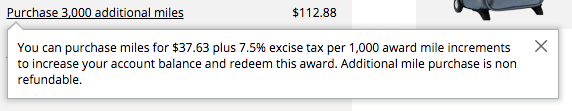

- In the below example I’ve priced out an Austrian Air business class flight using United miles and I’m short by 2418. They’ve given me the choice of buying the remaining points for $112.88. Personally, I have Ultimate Rewards and could shore up the account, but if I was in the position whereby I couldn’t transfer in, I’d probably spend the $112.88 to fly on a several thousand dollar flight.

-

Keep points alive!

- A lot of points expire unless there is activity. You can read this previous MonkeyMilesMondayMemo to see a chart detailing many programs and their expiration policy. An easy way to extend the life of your points is to buy some.

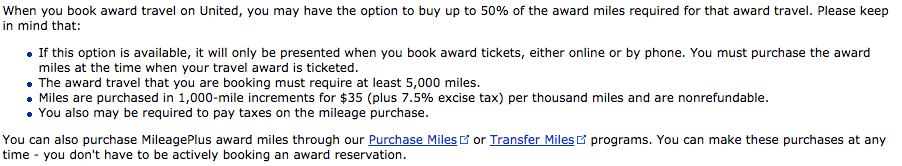

- Using United as an example again…Unless you have activity or carry a co-branded credit card your miles will expire after 18 months. You could keep your points alive buy just buying 1000 points for $35 + 7.5% excise tax.

- This is a horrible price to pay per point, but if you realize your points are going to expire unless you do something, it’s a good option to have.

-

Buying points is cheaper than paying a cash rate

- Many times it’s far cheaper to just buy points for a hotel night or flight than it is to pay out of pocket. Usually when you use points you’ll end up with far greater flexibility than paid fares as well. For instance, AA allows you to change the date of your award ticket as many times as you want as long as there is award availability on the day you want to change it to.

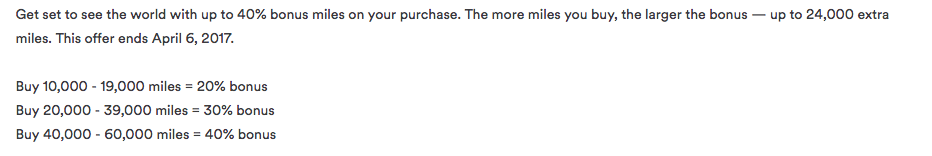

- Let’s look at the current Alaska Airlines 40% promotion on purchased points.

- We can see that 84k points would cost $1773.75 or $0.021 per point.

- A one way business class ticket on Cathay Pacific from Chicago to Bangkok booked with Alaska Miles costs 50k points. Or $1055 if you were to use this promo to buy the points for the ticket. You’d also be able to bake in a stopover in Hong Kong if you wanted because Alaska allows stopovers on their award tickets. Last minute tickets in coach are often times more expensive than this, and biz tickets are regularly several thousand.

Cathay Biz This is also true of hotels. I recently showed an example of how buying points for $0.00575 with the recent IHG 100% bonus promotion would be far cheaper than paying for it outright. I used the Intercontinental Cleveland as an example.

These are 3 of the biggest reasons I have purchased points or would recommend considering the practice.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.