We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

This is just about as good as it gets for AA miles.

American Airlines puts their miles on sale just about every month. In fact, I can’t recall a month this year when they didn’t put them on sale. But now, they’ve put their sale miles on sale for Thanksgiving weekend and you’ve got a couple more days to take aadvantage of this sale inside of a sale. Personally, I wish that they would have done one more sale, and done a sale inside a sale inside a sale, and done a little co-brand with Chris Nolan’s Inception. A boy and his monkey can only wish… Let’s take a look at how you can drop almost $5k on American miles at roughly 1.77 cents a pop.

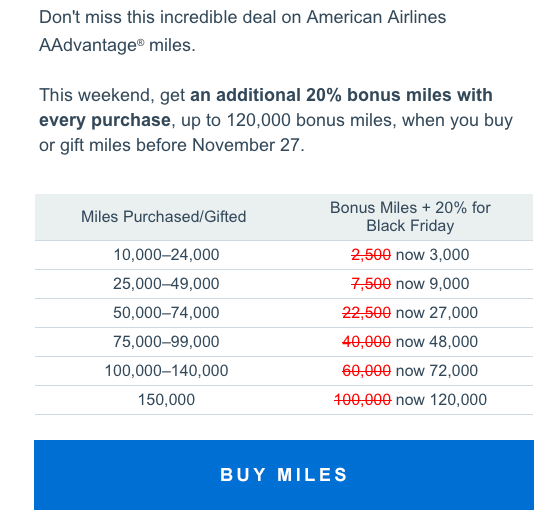

The sale is a sale inside a sale – netting an additional 20% bonus

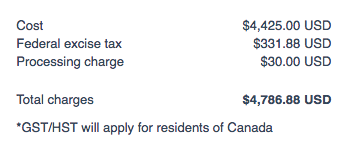

270k miles would cost you $4,786.88…1.77 cents per mile.

This provides some great opportunities to buy business class tickets: Assuming you can find avail.

US —-> Europe is 57,500 —–> $1019

US—–> Japan & Asia 1 is 60k —–> $1,063

US—–> Asia2 is 70k —–> $1,241

If you have a co-branded AA card that gives you 10% back it yields even better value

( Barclay Aviator Red, Citi Platinums, Citi Exec )

US —-> Europe is 57,500 —–> $1019 $917

US—–> Japan & Asia 1 is 60k —–> $1,063 $956

US—–> Asia2 is 70k —–> $1,241 $1117

Gary Leff has written an article where he illustrates a tax rule that allows you to get the taxes back on miles redeemed for foreign carriers. That would reduce the price per mile to 1.65 cents.

Assuming you have a co-branded card and haven’t exhausted the 10k annual maximum refund, you could fly Cathay Pacific business class for $1039 each way from the States to anywhere in Asia. That’s a great deal.

Interested? Go Here.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.