We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I’ve carried the card in the past, and am thinking of picking it up again.

I’d mainly be doing this to pick up the bonus, but I’m also very disenchanted with AA’s elite status. I’ve written about this in the past and pivoted to Alaska earlier in the year, but this past weekend I flew a few economy legs as an Exec Plat. On two of those legs I was 12th on the upgrade list. Were they between LA and New York, Chicago, Dallas, Miami? No, between Columbus and Phoenix, and Phoenix and LA. That is nuts. While I know I’ll continue to fly AA here and there, I don’t want to credit my miles to them, but want to enjoy One World Status. What to do?

Enter British Airways.

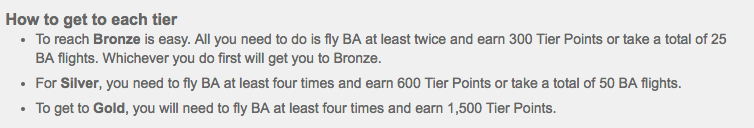

Over the past few months I’ve been looking more closely at BA’s program. Instead of EQM you earn Tier Points, and if you can get 600 Tier Points in a membership year you can qualify for BA Silver ( One World Sapphire). Qatar routinely offers amazing Business Class fares between Europe and SouthEast Asia that would pick up nearly enough Tier Points for BA Silver in one roundtrip. I’d have earned more than 600 Tier Points on the crazy Golden Ticket fares two weeks ago ( $600 roundtrip from Saigon to New York in Business).

BA Silver corresponds to One World Sapphire which means free bags, free main cabin extra, and Business Class lounge access ( this includes Admirals Club access on U.S. domestic flights.)

The catch? You must fly 4 BA segments to get British Airways Silver or Gold status. To me, this is akin to EQD. BA won’t allow you to gain status with them solely flying on partners. Fair enough. But, like many cards, BA could offer a waiver of the four flights if you hit a certain spend on the card. That would generate revenue for them by incentivizing higher spend, and would create value for customers who would otherwise hit Elite Status with BA, but can’t get in the 4 segments.

What’s the current BA Card offer and included benefits?

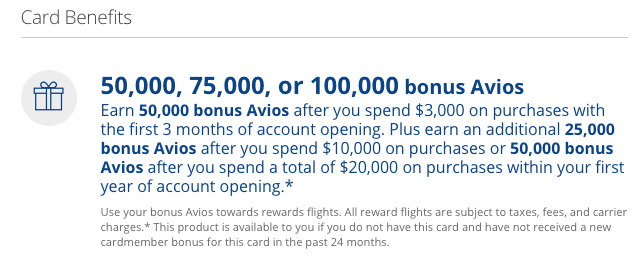

Up to 100k bonus points…

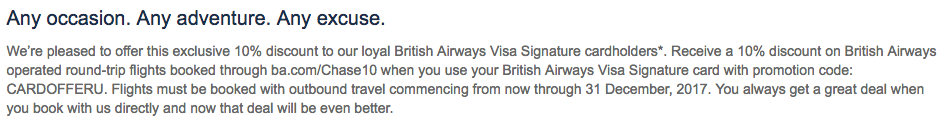

The biggest reason people kept the card in their wallet was CARDOFFERU – 10% off flights. This ends December 31st, 2017

This is a huge devaluation, and will prompt many people to drop the card. Why keep a slot in your wallet, and one from Chase, without continuing you have ongoing value?

The card also earns only 1 point per dollar. Back when I had carried it, you’d earn 1.25 points per dollar spent.

I put $20k of spend through the card when I carried it back in 2014. For that $20k spend I generated 125k Avios and got 10% back on BA flights. My folks had the card and put $30k through it in a year. They ended up utilizing the BOGO offer and flew BA First to South Africa. Even with the fees and taxes it turned out to be a great experience and deal. While the BOGO still lives on, the 1.25 Avios per dollar is dead.

British Airways also devalued their 1-650 mile flights since I had the card. Making flights that once cost 4500 Avios jump to 7500 Avios.

This is another hit to U.S. members of the program. That 4500 Avios redemption was incredible for flying from LA to SFO and I even used it to fly from IND to ORD a few years back to surprise my mom at Christmas with trip to Chicago. 6k more points roundtrip is a big increase, and one that is only imposed on flights within the U.S.A.

Imagine if the offer stayed as it is: 50k after $3k, 75k after $10k, 100k after $20k. But in addition to getting a bonus 25k points at $10k, you also got a waiver on the 4 BA flight requirement for status.

I’d pick this card up today. It’s not restricted by 5/24, has a great sign up bonus, and would make it FAR easier for me to credit partner flights to British Airways and gain status. The Irony is that I’ll fly more than 4 BA flight segments this year, but I’m crediting them all to Alaska because of MileagePlan’s insane partner earn rates.

Would you pick this card up if it added on a 4 flight waiver as a benefit? What other benefits would make the card more attractive to you?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.