We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Use Starwood Platinum to receive complimentary United Silver status

As I mentioned yesterday in my post detailing how an American Express Platinum card can get you Marriott Rewards Gold Elite status, this new Marriott/Starwood merger has opened up a land of transitive property BALLERNESS. Today, we will show how you can use Starwood Platinum to receive complimentary United Silver status by matching your status within the Marriott brands.

Starwood Platinum matches to Marriott Rewards Platinum Elite

Why is this important? Because… Marriott Platinum Elite is the highest category within the Marriott brand, but Platinum isn’t the highest within SPG ( SPG Ambassador after 100 nights). You can actually attain SPG Platinum with just 25 stays/50nights vs Marriott’s Platinum requires a fixed 75 nights. That is a HUGE difference. So it’s a lot easier to become an SPG Plat if you frequent SPG hotels.

Once you’ve matched to Marriott Platinum you can get United Silver :

This is a great way to get SOME sort of status within United. In fact, it makes mattress running for SPG Platinum a worthy consideration. You’ll not only be earning Platinum status within SPG and Marriott, but also Silver with United.

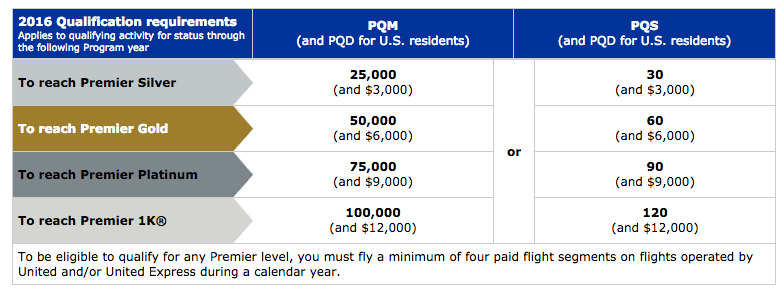

What does it normally take to get to United Silver?

Here is the data straight from United.com:

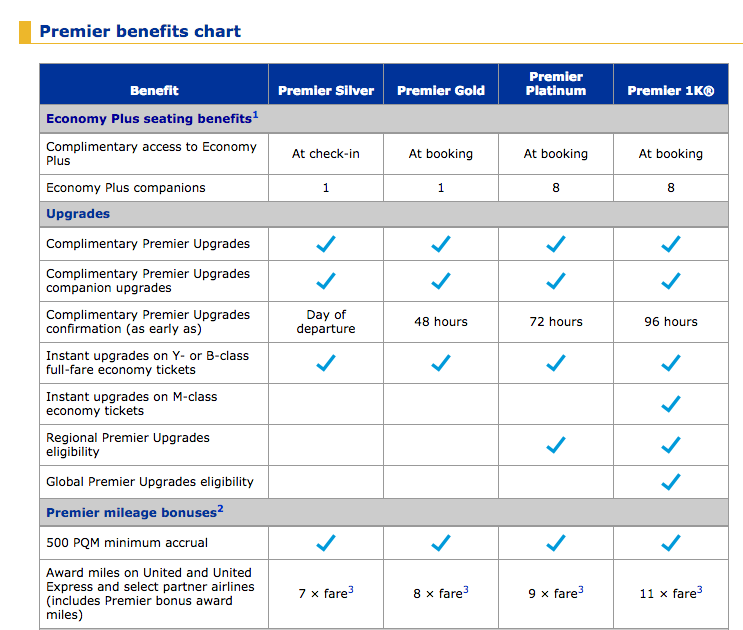

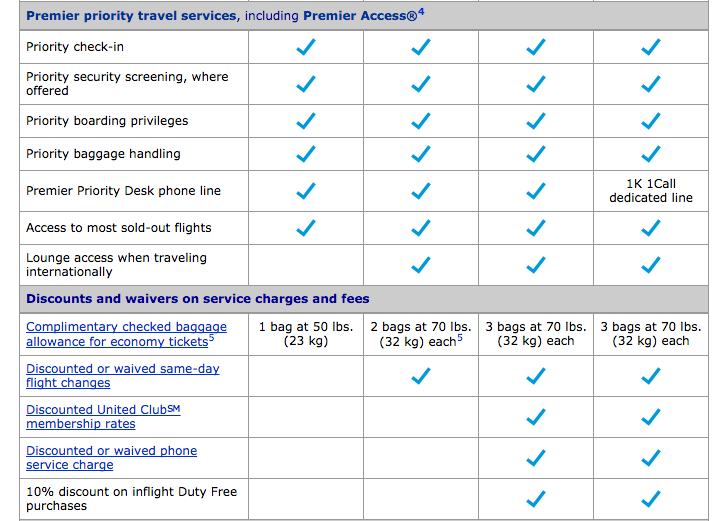

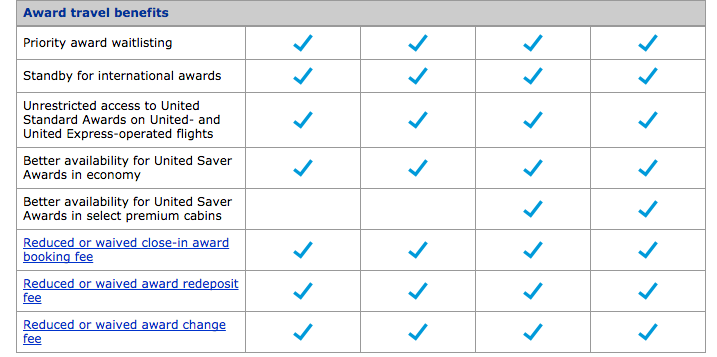

What are the benefits of United Silver?

The most valuable, in my opinion:

- Complimentary Economy Plus

- Premier Upgrades

- 7x fare earning

- Free Bag

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.