We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

At the beginning of the pandemic I used Instacart all the time for groceries, as did my parents. As things progressed and supermarkets started facilitating curbside pickup I stopped using Instacart all together. But…this deal kinda makes me rethink whether I should load up on a ton of stuff and trigger the credit with benefit of home delivery. Now…here is the BIG exclusion that you MUST pay attention to…. this will only be on the accounts of Amex Platinum/Business Platinum cardholders who had their card as of 11/1/2020. If you recently acquired one you won’t be eligible even if it sneaks onto your account.

Here are the 7 American Express Cards that I keep and links to their current offers and why we have them in our wallet and recommend your consideration.

- American Express Platinum

- American Express Gold

- American Express Green

- American Express Business Platinum

- American Express Business Gold

- American Express Blue Business

- American Express Blue Business Plus

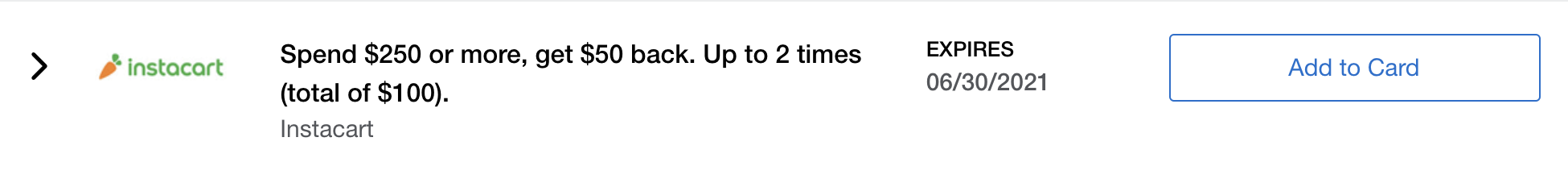

Instacart: Spend $250 and get $50 back

- Spend $250 or more on one or more transactions and get $50 back

- Limit 2x

- Must be through the Instacart app

Enrollment limited. Must first add offer to Card and then use same Card to redeem. Only U.S-issued Consumer Platinum and Consumer and Business Centurion American Express® Cards are eligible. Limit 1 enrolled Card per Card Member across all American Express offer channels. Your enrollment of an eligible American Express Card for this offer extends only to that Card. Offer valid for purchases made online at instacart.com or through the Instacart mobile app. Excludes orders placed or shipped internationally. See Instacart website for delivery availability in your market. Offer is non-transferable. Limit of 2 statement credits (total of $100 back) per Card Member. Offer is available for eligible Card Members with active accounts as of 11/1/2020. The enrolled Card account must not be cancelled or past due to receive statement credits. Any benefit earned from this offer is in addition to the rewards (i.e. Membership Rewards or cash back) earned as part of your existing Card benefits, but your ability to earn spend-based rewards for the purchase will be based on the amount after any statement credit or other discount is applied. Statement credit will appear on your billing statement within 90 days after 6/30/2021, provided that American Express receives information from Instacart about your qualifying purchase. Note that American Express may not receive information about your qualifying purchase from Instacart until all items from your qualifying purchase have been delivered by Instacart personal shoppers. Statement credit may be reversed if qualifying purchase is returned/cancelled. If American Express does not receive information that identifies your transaction as qualifying for the offer, you will not receive the statement credit. For example, your transaction will not qualify if it is not made online at Instacart.com or through the Instacart mobile app. In addition, in most cases, you may not receive the statement credit if your transaction is made with an electronic wallet or through a third party or if Instacart uses a mobile or wireless card reader to process it. By adding an offer to a Card, you agree that American Express may send you communications about the offer. INSTACART® and the Instacart carrot logo are trademarks of Maplebear Inc., d/b/a Instacart. Instacart may not be available in all zip or post codes, delivery subject to availability. See Instacart Terms of Service at https://www.instacart.com/terms for more details. POID: K1JY:0001

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.