We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Buy Marriott Points

We have seen all sorts of deals this year when it comes to buying points throughout the pandemic. Marriott has a deal, which if used strategically, could be quite advantageous for future travel. I’m a big fan of purchasing any kind of point as long as you have a redemption in mind, and can save money by doing so. With that said, Marriott has put forth a very good offer until November 8th which increases the normal total from 100k to 150k Marriott Points.

Remember that Marriott uses dynamic pricing so rates will heavily fluctuate from night to night.

In the past we’ve seen a 30% discount as well as a 40 to 50% bonus so keep that in mind when assessing the value of this offer.

Buy Marriott points with a 40% bonus

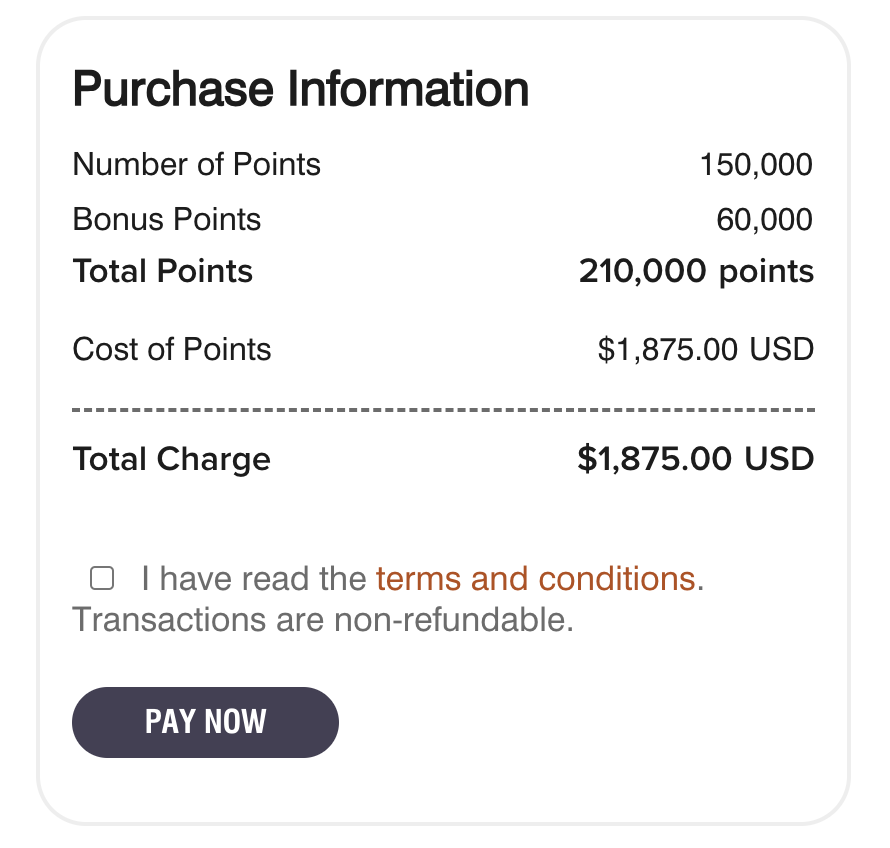

Normally I’m not a huge advocate of purchasing Marriott points because they traditionally limit the maximum per year to just 50k. Besides shoring up for an award night, there isn’t a lot of potential for arbitrage. Earlier this year, Marriott increased that max to 100k not including any bonus. With this offer, you could accumulate 210k Marriott Bonvoy points for $1875, or a $0.00893 a point.

What’s the cheapest price am I paying per point: $0.00893 per point

This opens up a lot of potential in my mind to seize some great opportunities on high priced properties around the world. Particularly when you hit them during off peak and the point pricing is low comparative to the cash value.

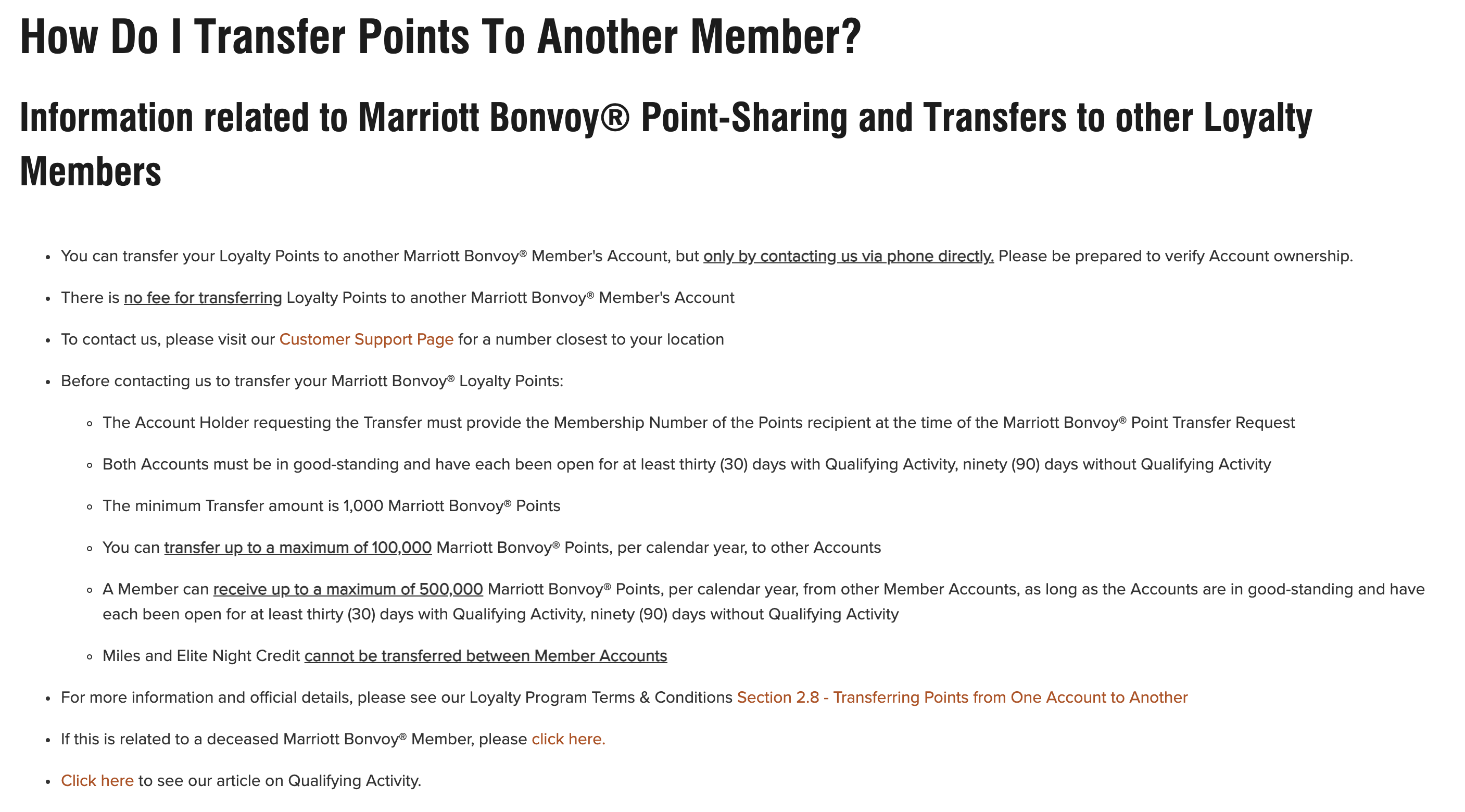

You can transfer between Marriott accounts

You can read all about it here, but this is the long and short

- If your account has activity in it…it has to be at least 30 days old to send or receive

- If there is no activity it has to be at least 90 days old

- You can TRANSFER a max of 100k points

- you can RECEIVE a max of 500k points

Where could this make sense?

An African Safari

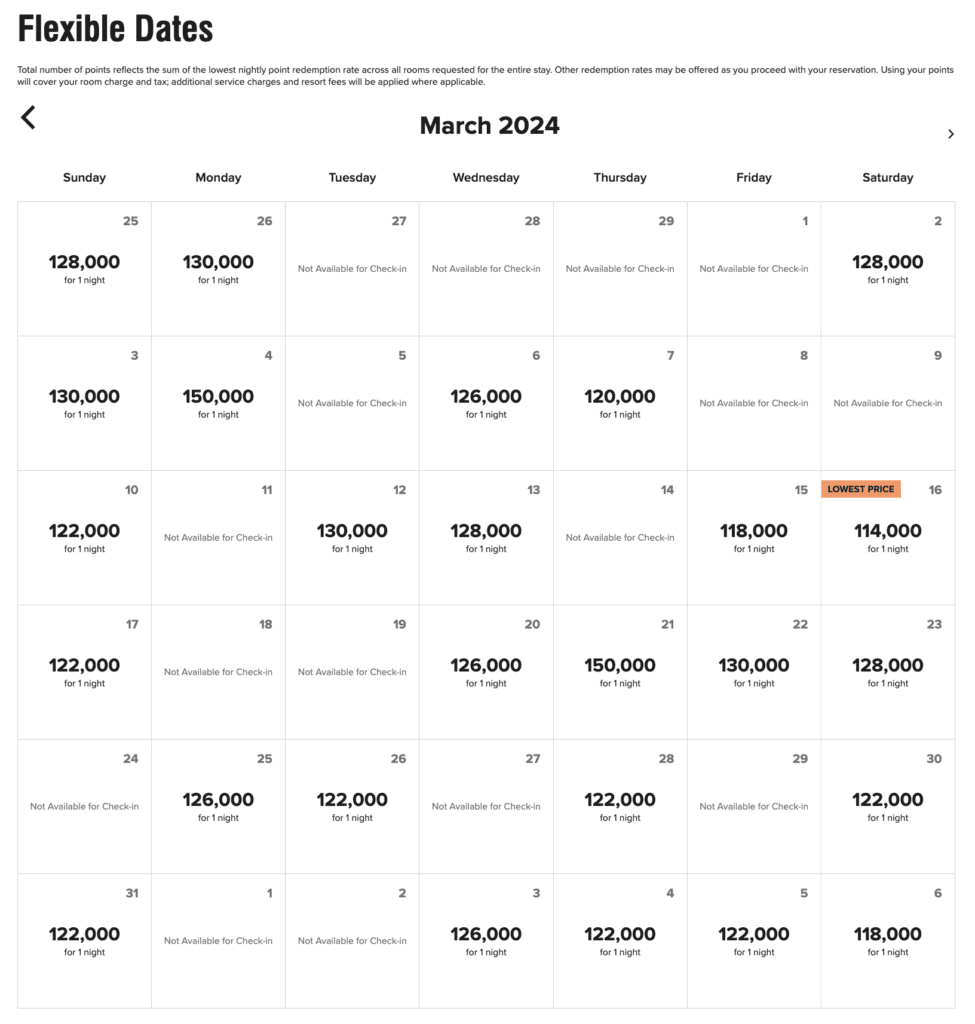

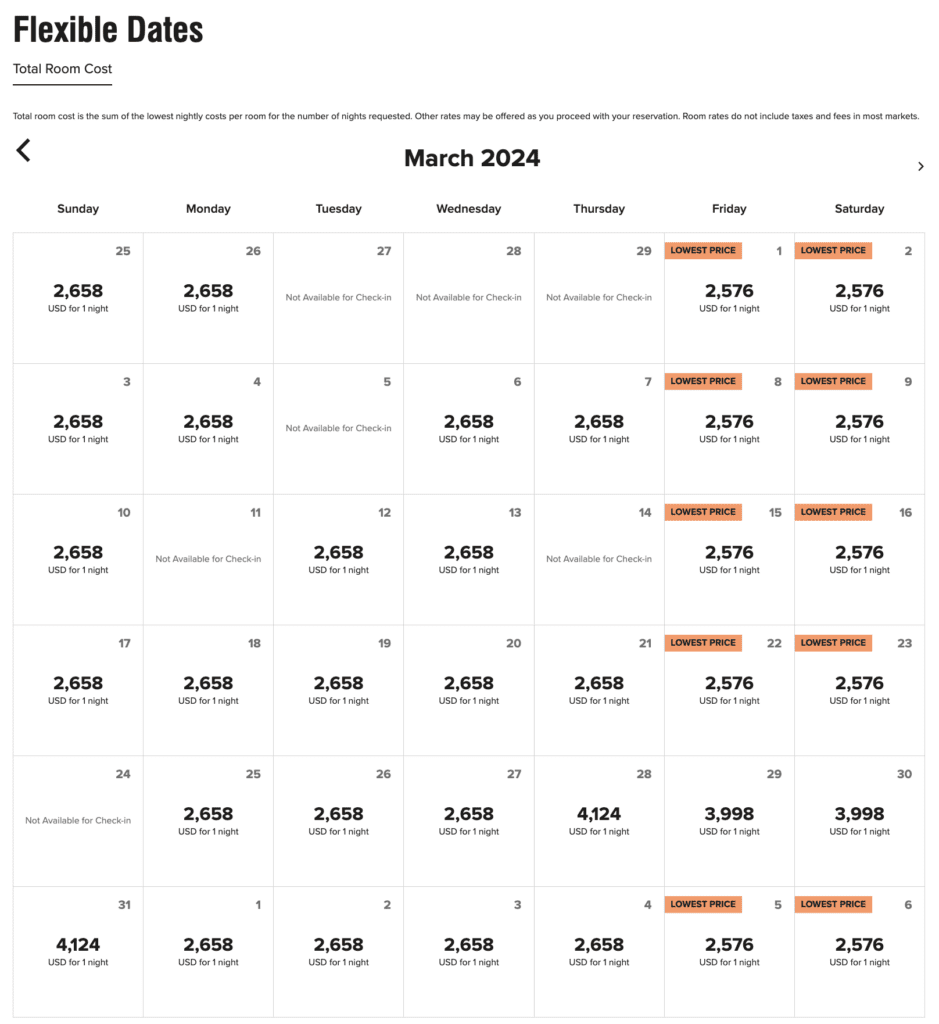

I just returned from an incredible stay at the JW Marriott Masai Mara where my buddy and I used between 106k and 112k points per night. The cash rate was nearly $3000 per night, so that is an incredible deal if you were able to buy points to make this redemption possible. We did it for 3 nights and while we could have definitely stayed longer, we felt it was plenty of time and even managed to squeeze

Here is March 2024 in calendar modes

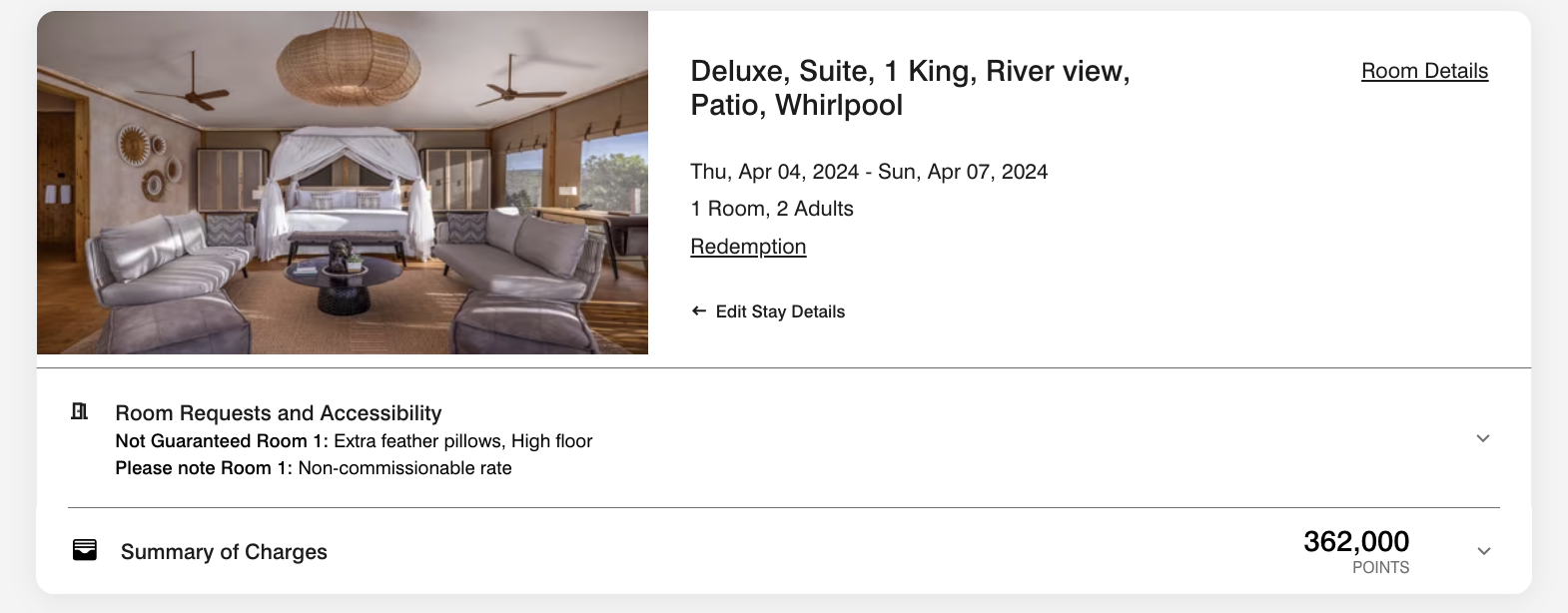

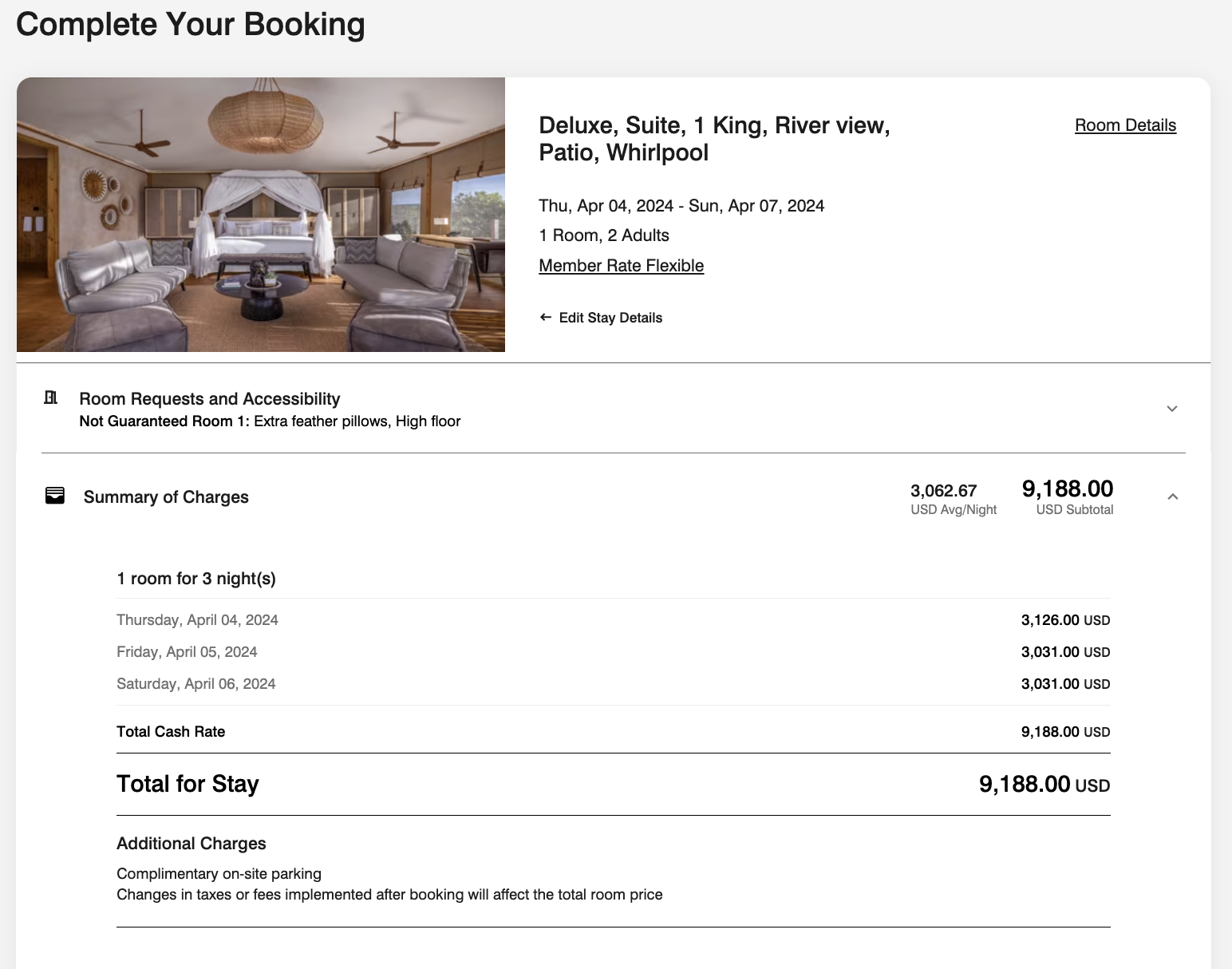

If we look at the 3 nights starting April 4th. It’s around 120k per night, a big higher than what we paid, but you’re getting $9k of value out of them.

If you wanted to buy those points you’d need to do it in a couple of different accounts, maxing one deal with 210k, and then adding in the other 150k from two other accounts. In aggregate, you’d spend $3250 for a 3 night safari vs $9100. Pretty darn good deal.

Couple of things to remember

- You need to have had a Marriott account for 30 days with activity

- If you have no activity…90 days

- It can take up to 7 days for the points to populate…

Overall

Certainly you need to crunch the numbers and make sure it works FOR YOU. But if you have that special redemption in mind this could be a way to make it work for much, much less.

Go here to Buy

Go here to Buy

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.