We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Cathay Pacific is the latest partner airline to be bookable on AA’s website. No doubt this is great news for those looking to make booking easier ( who isn’t, right?), but AA’s bookability has gotten shockingly better over a relatively short timeframe. A US Carrier doing something to add value? Something doesn’t quite add up here.

I’d argue that this isn’t a gift horse, but rather a trojan one indeed.

Over the past 12 months, we’ve seen Japan Airlines, Air Tahiti Nui, Royal Jordanian, Qatar Airways, Etihad, etc become online booking options, and while that’s great news for those looking to streamline booking and see more options with greater ease, I’d argue that long term – it’s not the best news. Why?

More availability online = less need for reps

We’ve had access to these awards in the past, and that favored the savvy, but it also meant reps needed to be involved for booking, and that leads to more transparency because they reference rules and reasons for why something works or doesn’t work routing wise.

AA has some great routing rules, and reps, albeit it may take a call or three, willing to make those routing rules work for you. I can attest that the more status you carry the easier it is to get those tickets issued, but regardless, you can get reps to manually piece together tickets for you. Now, unless you’re elite and get those fees waived as a perk, you’ll be paying phone booking fees on itineraries that they would have waived them for, and also, ones that you could manually build.

With more availability online, the less need there will be for reps, and ultimately I’d guess if AA could remove reps from the award redemption equation they would. At least as much as they have from revenue ticketing – it’s enormous cost savings I’d assume, plus they can more easily devalue miles.

AA is moving towards dynamic pricing for awards.

We’ve seen data points on this and know that, certainly on AA’s on metal, award redemptions won’t be based off a fixed chart, but rather will heavily fluctuate. In fact, charts won’t exist externally, maybe they still will behind closed doors, but without leaks, nothing will be transparent.

I can’t imagine AA is improving their online booking capabilities to hire more agents, but rather to minimize overhead and diminish call center staff. More tickets booked online means less need for agents to book them.

Try calling United or Delta and request that they piece together an itinerary you built that abides by routing rules but their online engine isn’t pricing. Good. Luck.

More miles will get used for less redemptive value. Again, there are no charts

AA is moving towards the exact model laid out by Delta, then followed by United, and it isn’t going to increase the value of your Aadvantage miles. My guess is that it’s going to lock redemptions to whatever is available online. And, that my friends, will be another major devaluation in Aadvantage.

If you see award space available online, but it doesn’t price correctly online, Delta basically says…what you see is what you get. United pretty much does the same. AA, will soon, follow in those footsteps is my guess. That means, even if you see 2 segments available for redemption on one ticket, if you can’t book them together online and instead need to book them as two individually priced segments, you’re likely to just have to deal. To those who aren’t savvy, which is overwhelmingly most people, they’ll just pay the higher cost because they never knew that they could book lower, nor should be able to.

AA will continue to whittle down their accounts payable on points for a far less value of redemption, which helps bottom line, but also erodes consumer value and trust.

Without charts that we can even point to, who knows how AA will price segments in the future, but the more partners that are available online means they can just point to their search engine and say…that’s what it is, so that’s what you pay.

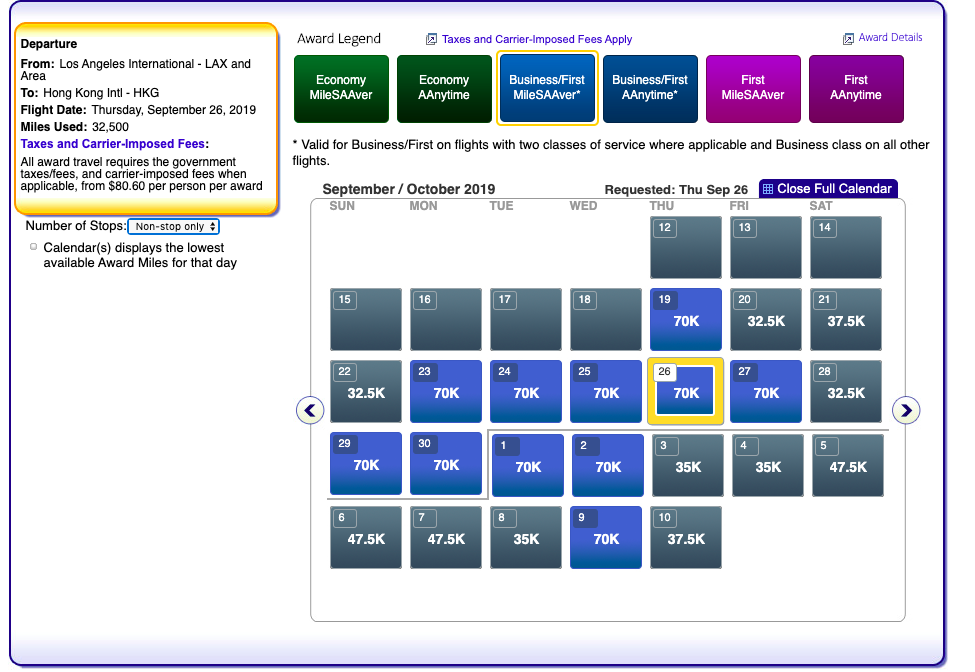

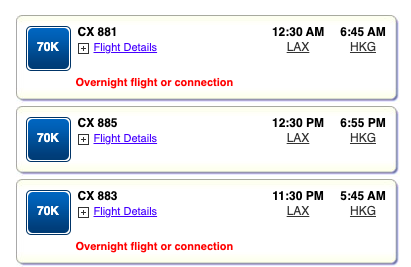

Man…just in 2014, a measly 5 years ago, you got 8 System Wide Upgrades as Exec Plat, one way first class to anywhere in Asia was just 67.5k miles, and the program was based off miles flown, not revenue. Crazy how much this program has been gutted. But hey…you can book this online now which is pretty cool 😉

cathay first class

cathay first class

Am I off base? What are your thoughts?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.