We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Yep, it’s true, and something I wasn’t aware of until I did it last year. As the year was closing out, it started to become very apparent that I would be within striking distance of Alaska’s MVP Gold 75k, and I remembered a flight I took from Chicago to Shanghai on American that credited to American’s Aadvantage program. In hindsight…I wish I would have credited that flight to Alaska and began do some digging. What I found out was that it takes a little bit of effort, but you can, in fact, change the loyalty program you credited an old flight to a different one. Here’s what I did.

I phoned American Airlines

I said that I had credited a flight to their loyalty program, but was really close to getting status on Alaska, and wanted to remove credit. They said that they would reverse the flight credit and notify Alaska. The agent was very helpful and my AA account showed the removal instantly, and miles were deducted.

Now…time to ask Alaska for the miles.

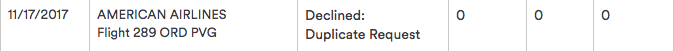

I submitted a request following Alaska’s normal protocol for missing credit. Unfortunately, Alaska never received notification from American noting the removal of the AA credit and, as a result, my first request was denied due to duplicate request.

I phoned Alaska and they said I needed to submit the request, showing the original credit and then the removal.

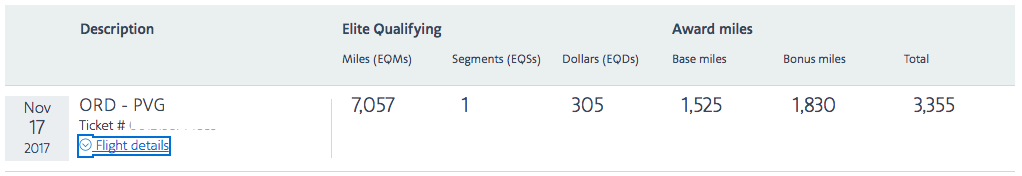

Here’s the original credit.

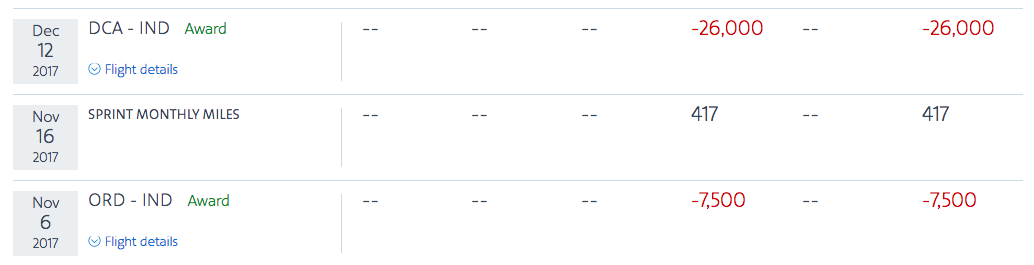

And then the statement post removal: You can see nothing on the 17th now.

After this I then needed to provide booking information to Alaska:

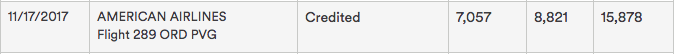

I gave them my boarding pass, original ticket receipt ( which was via American Express ). After a couple of additional emails, the flight was ultimately credited to my Alaska account.

I mean look at the difference in earning – that MVPG75 elite bonus is huge. 125% of every mile flown.

Is this something you could do all the time?

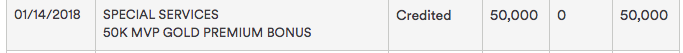

No, this is only something to do in select circumstances. I only did it because, without it, I wouldn’t have crossed the threshold and hit top tier status. In fact, I only made MVPG75 by a couple thousand EQM. Getting this one flight moved from American to Alaska not only got me Elite status, but as you can see, netted me almost 16k RDM vs 3355 when credited to American. It also meant I got those sweet 50k Alaska Miles when I requalified for MVPG75 on December 31st. It was a race to the finish line.

Those 66k miles almost paid for my Cathay First flight from HKG to ORD which set me back just 70k Alaska miles.

Seriously, get your bestie, book some Cathay First, sip some fine wine, order the fancy fish eggs, and blow your instagram. You’ll never regret it 🙂 BYAH!

There’s always something to learn, and stuff like this is why I absolutely love writing this blog, and figuring out new ways to navigate the labyrinth.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.