We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

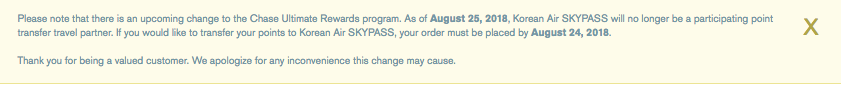

There’s no getting around the fact that this is a big loss to Chase’s Ultimate Rewards program. Korean Air consistently releases a lot of award space to Asia, and maintains some really solid sweet spots in its redemption chart. 80k roundtrip business class to Europe, 80k First Class from the states to Korea, and 45k miles roundtrip in business to Hawaii on Delta. All of those are fantastic deals. But, as you can see in the screencap below, the partnership between Chase and Korean Airlines is ending on the 25th of August, and your transfer/orders need to be placed by August 24, 2018.

Should you make a speculative transfer?

A few things to consider

- Points don’t expire for 10 years.

- Korean eliminated holds ( although maybe they’ll come back after losing Chase? )

- Booking awards for other people isn’t easy, and can only be done for immediate family members ( and this must be confirmed with documentation)

I’m weighing this decision as I write. I’d love to try out Korean’s new First Class which features doors and looks uber nice, and Korea is high on my list of destinations I’d like to visit in the couple of years. In fact, it’s on a short list of destinations I’d like to visit this November when my friend Dave and I take a buddy trip. For that reason only, I’m considering moving 100k Ultimate Rewards over, but haven’t made a final decision.

If you’re thinking of using Korean to facilitate roundtrips to Hawaii on Delta or roundtrips to Europe in business at the 45k, 80k respectively, these are not easy awards to find and lock down. That’s just an FYI. Not impossible, but requires quite a bit of planning.

Widget not in any sidebars

Who would I like to see replace Korean Airlines?

Korean Air represented a great option for Asian travel. Yes, there were other sweet spots mentioned above, but being able to find readily available space to Asia in some great cabins, at great rates, was a huge perk of accumulating Ultimate Rewards. Here’s who I’d like to see Ultimate Rewards add.

Asiana.

I know this has very small odds of actually happening, but it has been a 1:1 partner of SPG for years, so why not? Asiana releases a ton of award space on their metal, and they have some of the best redemption sweet spots of any airline in the sky. Lufthansa first class for 50k anyone?

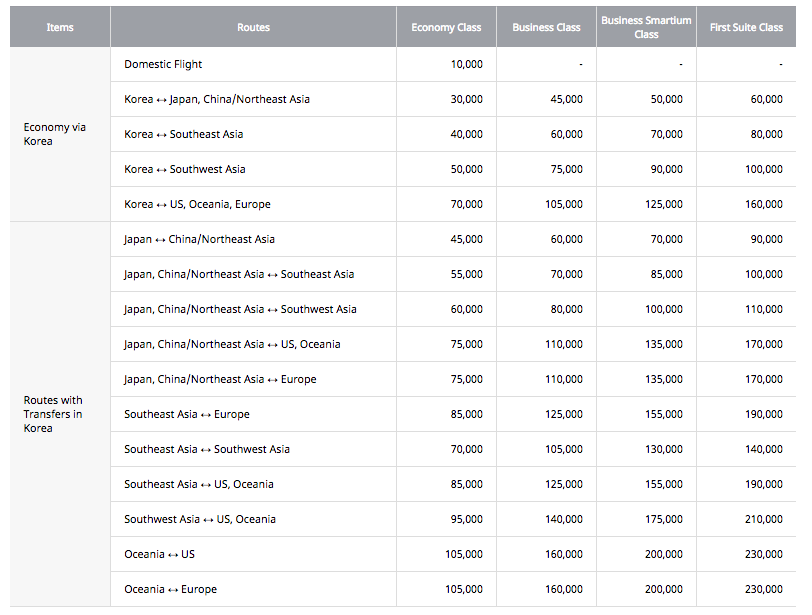

They are also a Korean carrier so it would be advantageous to Korean tourism to maintain a solid partnership with a large bank like Chase. The biggest hiccup is Asiana currently has a credit card offered with Bank of America, but then again AA is partnered with both Citi and Barclay. Take a look at their award charts

Avianca.

Avianca recently partnered with Citi as a transfer partner, and regularly puts their miles on sale so it would represent a great shore up opportunity. It’s also been known to have advanced access to Lufthansa First Class flights that both United and Singapore didn’t have access to when Lufthansa made them available to partners earlier in the year. They have great sweet spots for domestic travel on United, attractive redemptions on business and first to Europe ( 63k/87k ), and business/first to Asia ( 88k/111k for anywhere in Asia or 78k/102k to North Asia).

Not a bad way to fly for just 63k points.

Widget not in any sidebars

Etihad or Emirates – perhaps both?

The ability to shore up accounts from multiple transferrable currencies is uber attractive. Etihad is a partner of both Citi and Amex, while Emirates is an Amex partner. The vast majority of my award booking clients who hold Chase cards also keep Amex in their wallet. The ability to transfer from both partners to a single currency stretches the life and opportunity of your base currencies and would be welcomed.

I love that Etihad has reasonable rates on their own metal, but attractive rates AA domestically, and amazing rates on AA business and first class internationally. 50k to Asia in outstanding.

Emirates is just plane fun ( 😉 ) and their 5th freedom routes between New York and Milan/Athens are outstanding ways to experience the best Emirates has to offer for just 85k points and get to Europe. The taxes and fees are tough to swallow, but all that Dom will take the edge off.

We keep hearing news of financial woes from the UAE airliners so the opportunity to monetize, I would think, should be welcomed.

Lastly, Lufthansa Miles and More

For no other reason than advanced access to Lufthansa First Class inventory.

What do you think? Who would you like to see?

For savvy travelers, the biggest win, by far, would be nabbing Asiana. Their program isn’t that well known, the site isn’t exactly user friendly, and I’d guess the general Ultimate Reward user wouldn’t really look to them as a first choice for redemption. But for the savvier users, or those utilizing award booking services, it would be an incredible add to the program, one that potentially represents more value than did Korean.

Widget not in any sidebars

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.