We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Marriott unveiled their peak/off peak award charts this weekend. I think most of us were expecting to see large periods of time blocked off as peak or off peak, but that isn’t at all what Marriott introduced. Instead, Marriott introduced a calendar that is far more dynamic than anything named Peak/Off Peak across the industry. For instance, when it’s rainy season in Mexico, the prevailing thought would have been to see Marriott price the entire season as “Off-Peak,” and when it’s spring break and hotels are jam packed, you’d see “Peak.” This isn’t at all what Marriott has designed.

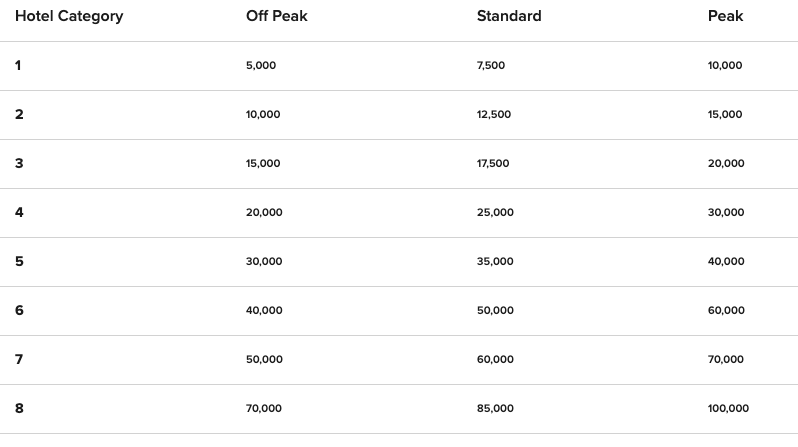

As a reminder, here is the Peak/Off Peak Calendar

Marriott introduced a Demand based Peak/Off Peak redemption calendar. And it isn’t stagnant.

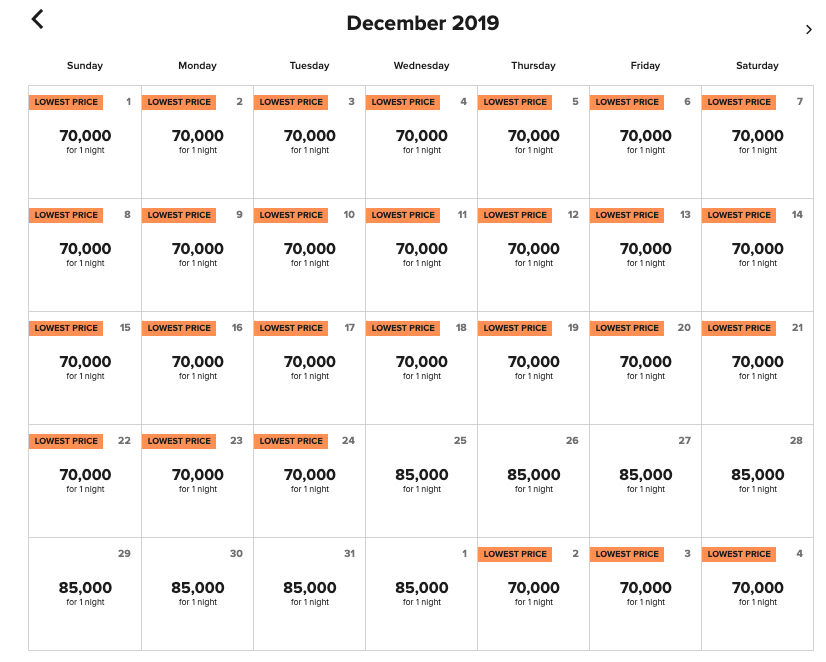

That’s right. If the hotel is in super high demand, and occupancy rates are super high, you’ll see award pricing reflect with Peak pricing in effect. If demand is really low, you’ll see Off Peak. You can see this pretty clearly in this screen cap of the St Regis Rome in December. 85k is a standard rate, and 70k is a Off Peak rate. Every single day is priced differently.

This calendar isn’t fixed either, since it’s completely based on demand and as rooms are booked the prices will change accordingly. Or, if rooms are cancelled, the hotel may drop from Peak to Standard, or even Off Peak.

Changes to 5th night Free.

The program has changed. You’ll now get the lowest of the 5 nights free when redeeming points. If 4 nights are priced at Peak and one, let’s say the 3rd of your 5 night stay, is priced at Off Peak. That 3rd night will be free, not the true 5th night.

Changes to Marriott’s Point Advance program

If you’re unfamiliar, Marriott has a program whereby you can book a hotel without having the points in your account, and they will advance you points against your future point accrual. Now, since award nights fluctuate, your point advance isn’t fixed. Let’s say you book a 5 night stay at the St Regis Rome with every single night being Off Peak. If your 5th night pops up to 85k before your stay, you’re advance will be repriced to reflect the award night popping up in price.

Additionally, you can only have, at max, 3 advance point reservations at a time.

The biggest issue to me is transparency

Does each and every hotel has their own criteria that determines whether a hotel is priced at Peak or Off Peak? Does it depend on the number of base rooms available, suites, etc? Another aspect to consider when pricing is done this way it opens room hogging with fake bookings. It isn’t hard to imagine that someone will have two Marriott accounts. One with their real status and another fake one. They could use the fake one to make a multi-room booking thus forcing pricing on the hotel to Peak, then when they’ve either acquired the points they need, or made their mind up on location, cancel the multi-room booking, thus dropping the pricing to Standard or Off Peak. People have been known to do this will full fare first class tickets with no intention of booking, but rather to increase their chances of upgrading at the last minute after they cancel the fake booking. Airlines cracked down on this with IP and credit card cross referencing, etc, but at the end of the day, that takes a lot of IT power, and is Marriott ready for that given its issues with IT leading up to this? I doubt it.

Overall

In a lot of ways I actually like this pricing scheme compared to having large blocks of time that are allocated to Peak or Off Peak. While it means that pricing is going to be far more unpredictable, if you know you want to travel far in advance, you have the opportunity of locking up hotel rooms in desirable locations when everyone also wants to travel for Standard or Off Peak pricing. I remember staying at the JW Marriott in Rio last November, and the hotel was practically empty. We would have saved quite a few points had this pricing structure been in effect.

Alternatively, Marriott hasn’t disclosed, at all, the basis for determining what constitutes a hotel justifying Peak/Off Peak pricing. I’m sure someone load up nights and see if they can force the system to change and thus giving us a basis. In fact, I’ll probably try and do this when contemplating a booking just to see how many rooms are actually pricing at Off Peak/Standard, etc.

If you ever get the opportunity to stay at the St Regis New York during Off Peak pricing…I’d highly suggest it. An incredible hotel, service, and special treat for any NYC trip.

If you want to see Videos, more information, etc – head on over to the Marriott landing page for Peak/OffPeak

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.