We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Back in July, I wrote about a rumored update occurring in regards to hotel redemptions utilizing Marriott Vacation Club on August 1st. Seeing as though the overall Marriott Rewards/SPG integration got delayed to August 18th, I figured that the MVC would face a delay as well. Something has happened because I only see 11 hotels in the entire world that are available for MVC club point redemptions.

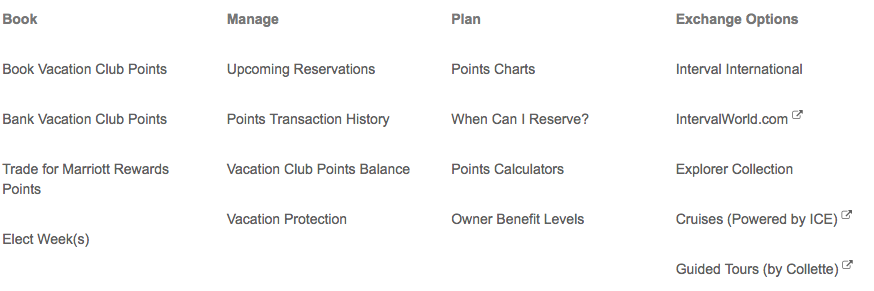

If you’re a current MVC participant you’ll see this when you go to Use Points:

One of the most valuable uses of MVC have been on Explorer Collection properties, in fact, this is the only way you can stay at a Ritz Carlton Reserve Property. Mandapa, in Ubud Bali is available via this redemption.

The 11 hotels currently named in the Explorer Collection:

Several of these have no association with Marriott at all.

- Eagle Tree Condominiums

- Ritz Carlton Golf Resort Naples

- Ritz Carlton Naples

- Ritz Carlton Kapalua, Hawaii

- Travaasa Hana

- 47 Park Street, London

- Ayana Resort Bali

- Mandapa Bali

- The Canopi – Bintan

- Ritz Carlton Jakarta

- Ritz Carlton Singapore

The list of hotels used to be extensive, I’d never counted the properties in their entirety, but I’d have guessed it around 75-100 hotels around the world whereby you could use your MVC points to stay. In fact, I thought once the programs had integrated we would actually see additional hotels added to the Explorer Collection, but apparently we are in a weird limbo stage.

I think this will be for the better.

The drop means that something is changing, we just don’t know what. While this momentary period is annoying if you’re wanting to lock down a redemption, in the long run I think it could end up being much better for MVC members.

If you’re thinking of utilizing your Marriott Vacation Club Points for hotels I’d hold off on making any plans and take some deep breaths. I highly doubt the list will stay this short in perpetuity, and I figure we will learn a lot over the next few weeks as the program settles.

Here’s to hoping some of the nicer SPG hotels get folded into the MVC Explorer Collection in the coming weeks.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.