We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

MMMondayMemo: What is an Airline Alliance?

Each Monday, Miles has decided to drop a tip, hint, tutorial, trick that maybe you’ve missed or haven’t heard before. If you’re an expert in this field, some of these may be things you already know, but there are a lot of beginners out there who are just getting their feet wet which is why we created the Monkey Miles Monday Memos. This week we will explain an Airline Alliance, and how this information can be beneficial to you. Without further adieu…MMMondayMemo: What is an Airline Alliance?

What is an Airline Alliance?

As defined by Wikipedia,

An Airline Alliance is an aviation industry arrangement between two or more airlines agreeing to cooperate on a substantial level. Alliances may provide marketing branding to facilitate travelers making inter-airline codeshare connections within countries. This branding may involve unified aircraft liveries of member aircraft”

There are 3 Major Airline Alliances

- One World

- SkyTeam

- Star Alliance

There are also 3 smaller Alliances:

- Vanilla

- U-Fly

- Value

Each Airline Alliance has member airlines. Here’s a look at the 3 major alliances

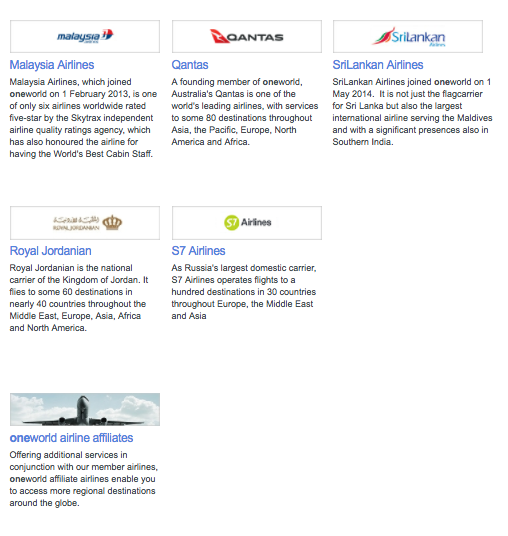

One World has 14:

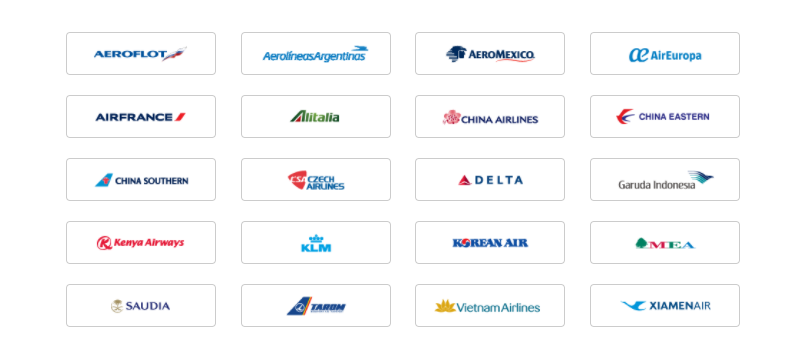

Sky Team has 20

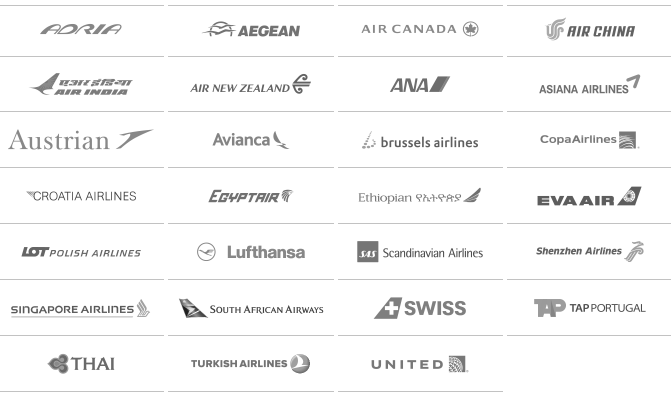

Star Alliance has 27

Why is it worth knowing about Airline Alliances?

Airline Alliances create a bevy of benefits for travelers flying on their member airlines. The biggest benefit is the ability to fly on various airlines, but still earn Elite and Redeemable miles in one central loyalty account. For instance I earned American Airlines Executive Platinum status this year and over 1/3 of my miles were earned on partner airlines.

When you achieve Elite Status with one member airline, the Alliance Partner airlines acknowledge that status as well. A few of those perks are early boarding, free checked bags, and access to partner lounges even if you aren’t flying on that airline. I was flying back from Japan on American Airlines First Class in 2015, but because they are partners I was able to visit Japan Airlines First Class Lounge. Now, because I’m One World Emerald, I can enter One World First Class lounges even when I’m flying on a coach ticket internationally. That’s pretty amazing.

Having an idea about Alliances makes it easier to use flexible currency

Flexible or Transferable currency, like Amex Membership Rewards or Chase Ultimate Rewards can be moved into airline programs. Because I knew that Singapore, United, and Lufthansa are in the same Alliance, I knew I could search on United for award space on Lufthansa, but transfer American Express Membership Rewards into their partner, Singapore, to book a Lufthansa First Class ticket when it was available. I LOVED the Porsche experience provided by Lufthansa ground services.

Noteworthy Airlines not a part of an Alliance

These airlines create partnerships outside of Alliances that create benefits similar to those airlines that are members of an Alliance. For instance, you can earn and redeem American Miles with Etihad, but Etihad isn’t a member of One World. In fact, my priority this year is achieving top tier status with Alaska Airlines which has an amazing list of partners, but isn’t part of a broader alliance.

- Alaska Airlines

- Etihad

- Emirates

- JetBlue

- Southwest

- El Al

- Virgin Australia

ICYMI Alaska is currently offering a 40% bonus on purchased miles.

I used American miles to book Etihad’s Business Studio. It still stands as one of my favorite flights.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.