We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Upgrade Amex Green to Amex Gold

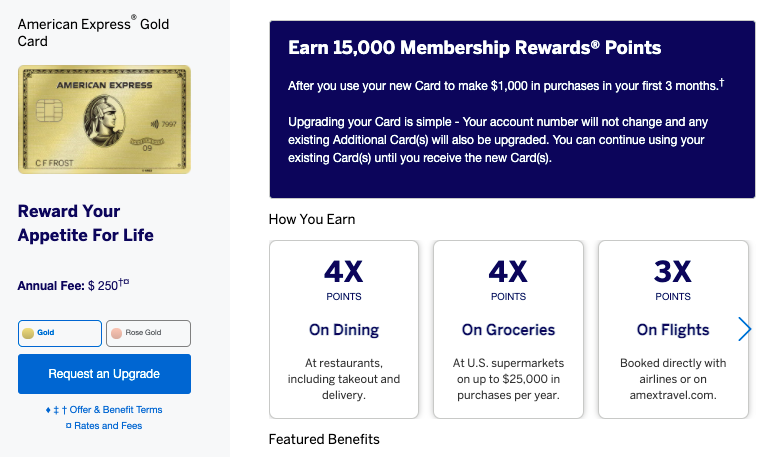

I’d recently written about a targeted Amex Platinum upgrade offer. It was 25k Membership Rewards after $2k spend in 3 months + 10x on US Gas and US Supermarkets ( as a point of comparison some people are getting 75k upgrade offers). It hit both my Amex Green and Amex Gold. Now…I have another upgrade offer that specifically hit my Amex Green: Upgrade to Amex Gold and receive 15k Membership Rewards after spending $1k in 3 months. Let’s break those offers down, and why I may take them both.

Amex Gold is one of my favorite cards and I highly recommend it…this would allow me to keep it while streamlining my wallet via double upgrades.

My Amex Green account has this listed in its Amex Offers

Upgrade Amex Green to Amex Gold and earn 15k Membership Rewards after $1k spend in 3 months

Is this the best ever?

It appears some people have received 40k Membership Rewards to upgrade to Amex Gold after spending $2k in 3 months in the past.

Where my head is at with it all

- Upgrade to Platinum received 25k Membership Rewards after $2k spend + 10x categories

- Upgrade to Gold receive 15K after $1k spend

I currently hold the following personal cards: Amex Green, Amex Gold, and Amex Platinum. My Platinum was originally the Mercedes Benz version of the card that ultimately converted into a standard Amex Platinum a few years back. As a result, I’ve never been able to refer off of that card, and even though I’ve tried to resolve this many times with Amex it just never works.

I’m now presented with the option of upgrading both cards, spending $3k in 3 months, earning 40k Membership Rewards and cancelling my existing Amex Platinum. I’d not only earn 40k Membership Rewards, but I’d earn 10x on US Gas and Supermarkets for the next 6 months up to $15k. That is amazing earning potential.

This would open up a spot in my wallet – I could either re-add an Amex Green without a bonus, but with the ability to refer and earn 55k points a year, or throw in an Everyday Preferred card which would be great to have and also earn referral bonuses. I could also add in something from Marriott or Hilton. Honestly, the options are quite intriguing and I’m leaning towards pulling the trigger

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.