This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

A little over a month ago I took advantage of the Citigold checking account offer whereby you could earn 50k Aadvantage miles by signing up for a new account. If you haven’t heard about the offer, it’s pretty fantastic. There are mixed results floating around the internet and, to this point, I’ve yet to receive my bonus miles…but here’s hoping. The offer is active through 12/31/15

If you’re interested this is the AAdvantage code: 42ERCWNQU6

- Go to Citi.com – click through to open a new Citigold account and enter that code

- It’s supposed to be targeted although there hasn’t been any restrictions disallowing anyone from signing up.

- The last page of the Gold account sign up gives you various options for funding the account

- I selected fund with a credit card so I could earn points

- I tried to fax in the docs needed, but it didn’t work. I’d suggest calling in once you’ve been emailed your account # – it’s far easier and faster.

- My experience using a Barclay Aviator card yielded points earning spend -25k Aadvantage to be exact.

- Just make sure you call Barclay ahead of time and lower your Cash Advance fees to zero. If you don’t – there is always a chance you could incur cash advance fees and they are HIGH

- I selected fund with a credit card so I could earn points

- There are a few requirements

- You must have a Citi Platinum AAdavntage card to qualify

- 50k balance in the account or incur a $30/month fee starting with the 3rd month.

- It can take 30-60 days after your meet the spend requirements for the points to populate your Aadvantage account – so you might eat $30-60 if you don’t keep the balance above 50k

- $1000 in debit card purchases in the first 60 days of account opening

- 2 bill payments in back to back months

- yes, paying off the card that you funded the account with actually qualifies as bill pay

I wanted to see what the impact on my credit would be if I allowed that balance to actually hit my statement rather than pay it off prior to statement close. In other words, because I applied and received an account, which was funded in the month of October, I could wait and allow my Aviator account to close and then make 1 payment in October, another in November paying off the balance, and fulfill the required 2 bill pays right off the bat. I could also see what the impact of adding 25k of debt to my credit score . I figured it wouldn’t be that terrible because I have a total revolving credit line across all accounts in excess of $220k, I pay everything off every month, and even adding 25k would barely put me over 11% utilization.

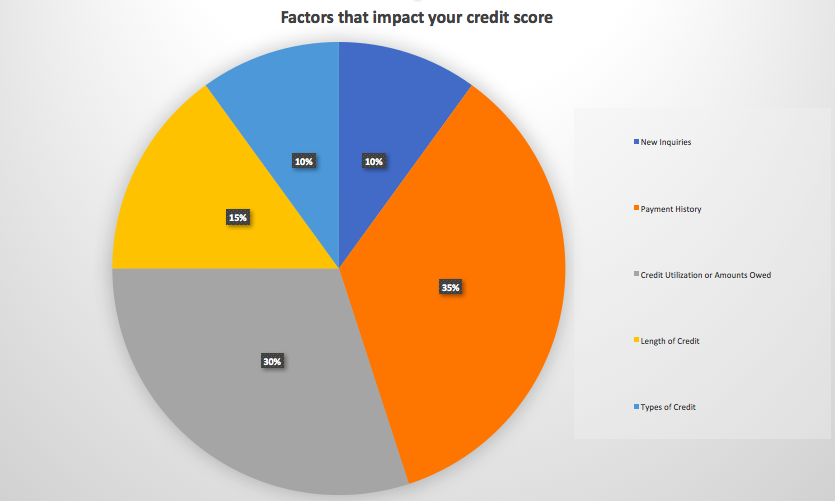

Just a quick reminder of what impacts your credit:

Amounts Owed or Utilization bears a huge impact on your credit. Utilization is how much of your credit line you’re currently using. This could be that you’ve built up a balance and are working on paying that off, or as in my case, I simply charged a large amount and didn’t pay it off before the statement hit.

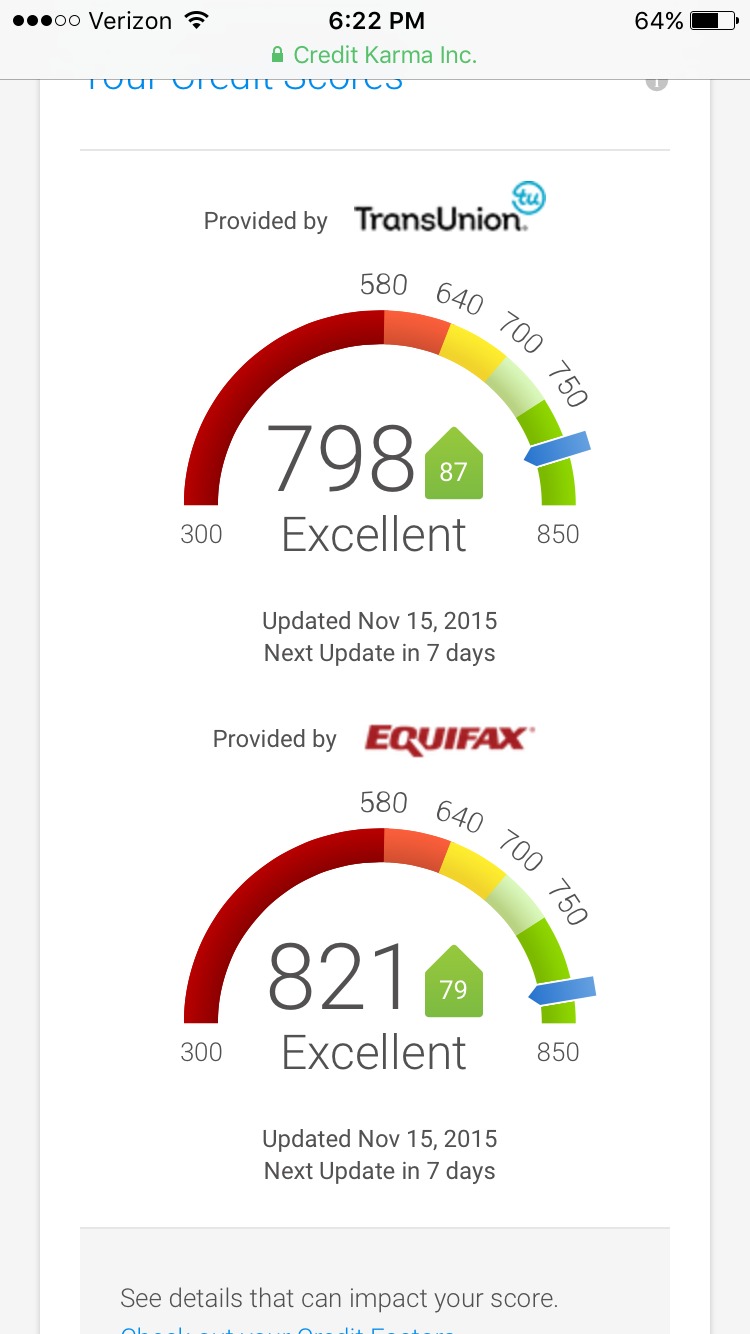

For 1 month adding 25k created…HOLY COW! A Big drop!

I use creditkarma to keep track of my score.

I had already paid the card off in full when I checked my score – this drop purely reflected the increased utilization reported to the agencies…It said it would update again on the 15th so I waited a week to see how much it would recover. It actually recovered ABOVE where it had originally fallen from.

The biggest lesson that I learned from this is how credit is actually calculated. My credit didn’t drop because my overall utilization went down – how I had suspected – but went down because of the individual bank’s reporting on utilization: that had a major impact on my credit. My overall credit line at Barclay is 32.5k – the increase to 25k, from the account funding, instituted a 77% utilization rate being reported to both Experian and Transunion. This is egregiously high and should considerably drop my credit if it represented me as a borrower…the problem was it didn’t accurately reflect my overall utilization, but just an individual bank’s utilization.

What this told me

- If you really need to have an outstanding credit score every month…pay off a big purchase before the account closes, it won’t be reported then…if it is – holy smokes it rocks your score

- Utilization reported by a bank is what impacts the score more than the overall, collective utilization

- If you need to make big purchases, put them on a business card. Those purchases don’t show up on a personal credit report.

Hope this helps!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.