We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

American Express® Gold Card Referral Offers

Information about this card has been collected independently by Monkey Miles. Card issuer is not responsible for the information or accuracy.

The American Express® Gold Card, hits the nail on its head. It earns 4x on restaurants ( up to $50k/year, then 1x ) , 4x on U.S. Supermarkets ( up to $25k/year, then 1x ) You can read about all the details in this post, but if you’re in the market for a slam dunk of a card…this is it.

American Express® Gold Card Referral Link

- some people see better offers opening a private or incognito window since your browser may store prior offers

- If the offer in the main body of the post isn’t working or showing a different offer, please check the comments.

Here’s how it works with our site and referrals: do not spam post or I’ll block your referral

First off, this is meant to help everyone. So, if you’re posting your referral a dozen times a day, week, month, and trying to manipulate the comment section, I’m going block your referral for abuse. No ifs ands or buts – if I see you’re doing it, or you’re flagged by another use, I’ll just block you from ever posting. Let’s not ruin a good thing.

We earn commission when you use our links via our partner Cardratings or CreditCards.com and are really grateful when you do, but we also publish other deals that may be attractive to you. Referrals, are one of those other deals, and is a way we can give back to you for supporting us since you earn a referral bonus when someone uses your link.

We want to give you an opportunity to earn some valuable points as well, and so this is how we go about doing it.

- We add our own referrals first

- Because we use a ton of points every year and publish reviews of the flight and hotels we take, but we quickly max out

- We add those of friends and family to load up their accounts

- Once those are maxed out

- We then import your links from the comments section below to help you out.

- We usually leave those up for a few weeks and cycle through them, or when we get an email notifying us that someone’s account has maxes out

You can also leave referrals for

- The Platinum Card® from American Express

- American Express® Gold Card

- The Business Platinum Card® from American Express

- American Express® Green Card

- American Express® Business Gold Card

- Hilton Honors American Express Aspire Card

- Blue Business® Plus Credit Card

- The American Express Blue Business Cash™ Card

- Amex EveryDay® Preferred

*I would note that you get more action when the referral is correlated to the article.

If you’re interested – some are getting 100k but I can’t seem to populate that:

Here’s a list of Amex Gold Benefits:

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide,

- on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets,

- on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- Get the American Express® Gold Card in either the Gold, Rose Gold or Limited-Edition White Gold metal design.

- White Gold design is only available while supplies last.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month

- Automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $84 Dunkin’ Credit: With the $84 Dunkin’ Credit,

- You can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at Dunkin’ locations.

- $100 Resy Credit:

- Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That’s up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit:

- Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. (Enrollment required.)

- The Hotel Collection

- receive a $100 credit to use towards eligible charges, which may include food and beverage, spa, or other on-property charges with every booking of two nights or more through AmexTravel.com. Credit use varies by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

- See Rates & Fees

What’s the best ever for Amex Gold?

There have been a wide range of offers, but 90k + $200 is the highest I’ve ever seen.

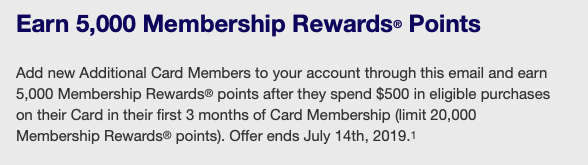

Targeted Authorized User bonuses started populating roughly 6 months into card-membership

If you were targeted like I was, this would potentially add on an additional 20k points simply by adding people to your account. Go here to read all the details – you are responsible for your authorized users and there are rules so read them carefully. Great thing is that you earn the points and the category bonus spend. If your mother or son dines out…you get the 4x points. BYAH!

Want the big bro to Amex Gold? Some are getting 150k+ referrals from Amex Platinum

Go to this article to read all about it, and YMMV, but worth a shot.

What can 90k Amex points get you?

Yes you can fly on Emirates First Class with all the gold accents and flowing champagne your heart desires. Emirates prices these first class flights at 85k between the States and Europe. BYAH!

Another insane example? You can fly the new Singapore Suites from Singapore to Delhi for just 53k points.

Feel free to leave your own referrals if you’d like. FYI – periodically I’ll grab someone’s and stick it in the main links above which will earn you points pretty quickly.

History of the referral bonuses:

- 90k welcome offer after $6k spend in Dec 2023

- 90k welcome offer + $200 March 2023

- 90k welcome offers are back in September

- 90k welcome offers in March 2022 with 20% back on worldwide restaurants, up to $250, in first 12 months of card membership given as a statement credit

- 75k welcome offers in July 2021

- 60k Welcome Offer populating again June 2021

- Up to 75k Welcome Offers March 2021

- 60k Offer debuts in August of 2020

- 50k offers populating consistently again ( 07/31/19)

- You can now get the Rose Gold version of the card again. 6/6/2019. Expired.

- Some are getting 50k offers again

3/30/195/16/19 - 50k up until January of 2019 when offer dropped to 40k

- January 2019 to 3/30/19 – 40k and then some starting to get 50k.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.