We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

One transfer partner of American Express that is often overlooked is ANA. It offers outstanding value from a points perspective, but because of the taxes and fees assessed, it rarely makes a “best use” list. Suddenly, this situation changes a bit when you take into account the savings you’d make point wise, and then the added points earned off a targeted offer like this one.

In my situation, the Amex Offer I received was to spend $1k and get 25k Membership Rewards. This doesn’t have been in association with a point redemption, ( you could just be purchasing an ANA ticket ) and there are several terms and conditions. Mainly…it needs to be on ANA metal in order to qualify and originating in the US. Well…funny enough, ANA has some fantastic options that fulfill the terms and conditions.

Here are the 10 American Express Cards that I keep and links to their current offers and why we have them in our wallet and recommend your consideration.

- American Express Platinum

- American Express Gold

- American Express Green ( I no longer hold this card, but referrals are open if you want to leave yours )

- American Express Business Platinum x3

- American Express Business Gold x3

- American Express Blue Business Plus x2

Let’s take a look at this stellar deal – Spend $1k on ANA and get 25k Membership Rewards

- On “Airfare Purchases”

- Airfare, Fare Upgrades, Seat Selection Fees, Baggage Fees

- Must spend $1k by 3/10/24

- Must originate in the US or territories

- Must be in US Dollars

- Must be on ANA metal

- Must book via

- www.fly-ana.com

- US website

- US ANA app

- US Reservation telephone

- Doesn’t have any language that I can find that excludes taxes and fees on award tickets. If you see this, or experience the exclusion, let me know as it heavily devalues the promo.

Full Terms and Conditions:

ENROLLMENT/ELIGIBLE CARDS: Enrollment limited. Must first add offer to Card and then use same Card to redeem. Only U.S.-issued American Express® Cards that are enrolled in the Membership Rewards® program at the time of purchase are eligible. Limit 1 enrolled Card per Card Member across all American Express offer channels. Your enrollment of an eligible American Express Card for this offer extends only to that Card. Your enrollment does not extend to any other Cards that may be linked to the same Membership Rewards program account (such as Additional Cards). Offer is non-transferable. QUALIFYING PURCHASES: Offer valid for purchases made directly with All Nippon Airways through U.S. website fly-ana.com, All Nippon Airways U.S. App, and U.S. reservation telephone line: 1-800-235-9262. Flights must originate in the U.S., including U.S. territories. Offer valid only for purchases where All Nippon Airways is the merchant of record, such as airfare, fare upgrades, seat selection fees and baggage fees. Excludes the following: (i) in-flight purchases of WiFi, entertainment, or phone service, (ii) standalone hotel bookings and car rentals, (iii) purchases through third parties or affiliated agents, (iv) code share flights or ANA flights operated by partner airlines, (v) duty free shopping and orders, (vi) travel insurance/trip protection, Mobile Rental Service, and Bid My Price. Valid only on purchases made in US dollars. You may not receive additional Membership Rewards points if we receive inaccurate information or are otherwise unable to identify your purchase as qualifying for the offer. For example, you may not receive the Membership Rewards points if (a) the merchant uses a third-party to sell their products or services; or (b) the merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or (c) you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet. Purchases may fall outside of the offer period in some cases due to a delay in merchants submitting transactions to us or if the purchase date differs from the date you made the transaction (for example, the purchase date for online orders may be the shipping date). Additional points will be credited to your Membership Rewards program account within 90 days after 3/10/2024, provided that American Express receives information from the merchant about your qualifying purchase. Note that American Express may not receive information about your qualifying purchase until all items/services from your qualifying purchase have been shipped/provided by merchant. We may not credit additional Membership Rewards points to, or we may take away additional Membership Rewards points that have been credited to, your program account if the qualifying purchase is returned/canceled. If American Express does not receive information that identifies your purchase as qualifying for the offer, you will not receive the additional Membership Rewards points. EARNING POINTS: Limit 1 enrolled Card per American Express Card online account. Limit of 25,000 additional Membership Rewards points per Card Member. The enrolled Card account must be active, not be past due, canceled or have a returned payment outstanding to receive the additional Membership Rewards points. Any additional points you receive through this offer are in addition to the points you would normally receive for purchases charged to your Card, but the number of additional points you receive will be based on the purchase price after any credit or other discount is applied. When we calculate the additional points benefit for Amex EveryDay® Card products, points awarded under this offer will not be included. Terms and conditions for the Membership Rewards program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice. The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo. Amex Offers are available for varying and limited periods of time and are dynamic and personalized. If you navigate away from the Amex Offers page, you may see different offers when you return. By adding an offer to a Card, you agree that American Express may send you communications about the offer. Bonus ID: B8K5 POID: K733:0001

Best ways to use ANA Miles – Transfer partner of Amex

Protip – If you use ANA miles on the following airlines you can avoid high surcharges.

- Air Canada

- Avianca

- Copa

- United

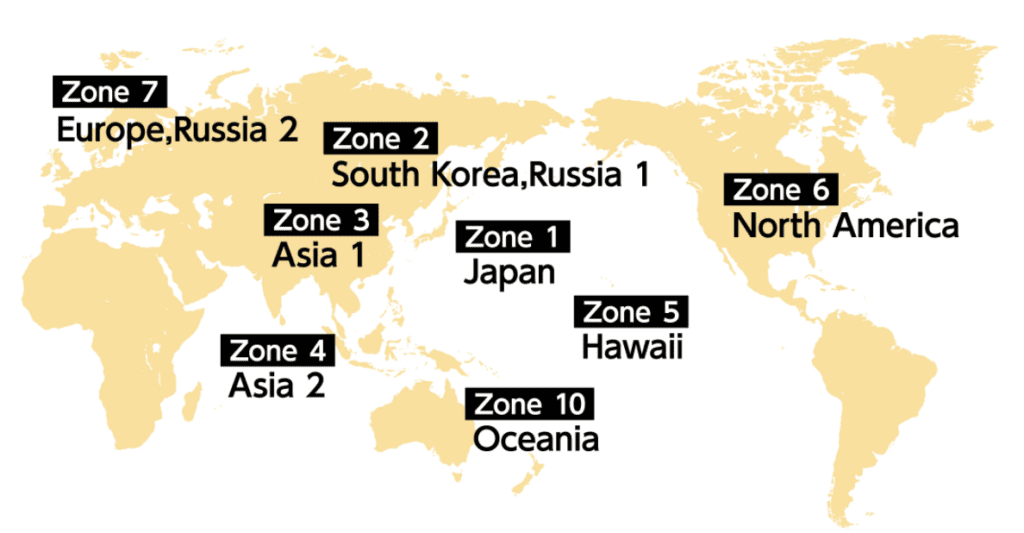

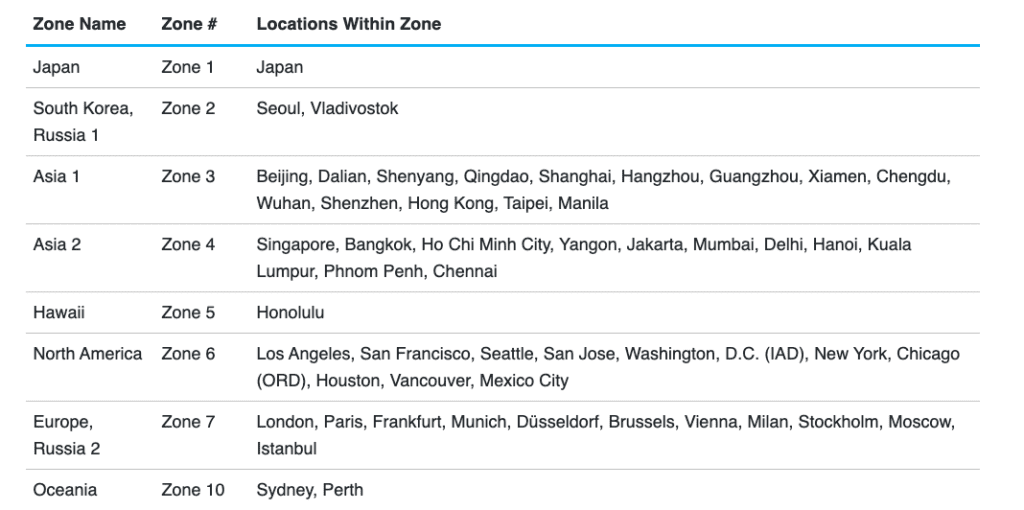

Here is how ANA divides the world like this:

Examples to Japan + Asia that are pretty stellar – r/t biz from 75k

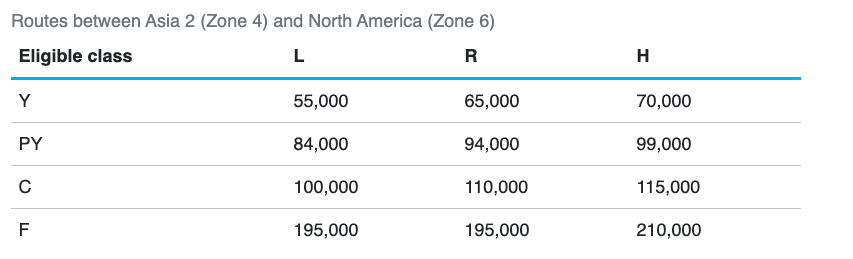

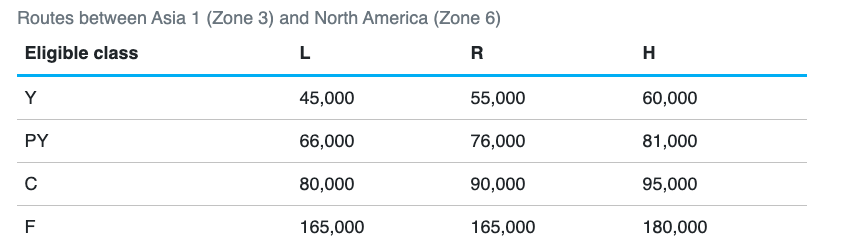

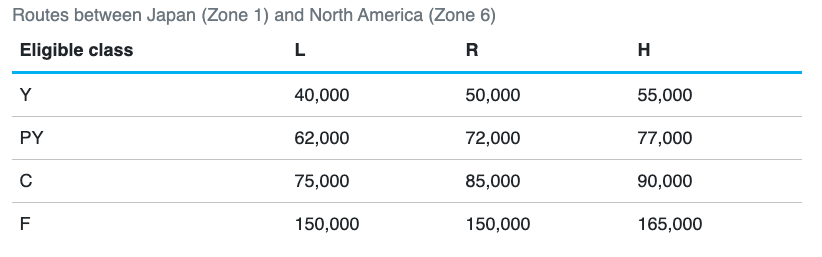

As you can see in the charts below, which divide the year into low, standard, and high seasons – you can land some incredible roundtrip business and first class deals.

- 85k Business Class Standard roundtrip from North America to Japan

- As low as 75k in low season

- 110k Business standard roundtrip from North America to Asia 2 ( Southeast Asian countries: Singapore, Vietnam, Thailand, Indonesia, etc )

- As low as 100k

You can fly roundtrip to Japan in The Room for just 75k points in low season. That is absolutely incredible.

Example: Roundtrip US to Europe in business class for just 88k miles.

You could fly in Lufthansa Business Class over and Ethiopian Business Class back and pay just 88k miles. You could also pay $500+ each way…so is it worth it?

Fancy a trip around the world?

You could fly in business class ALL THE WAY around by redeeming ANA miles. You could do an amazing trip on some of the best Star Alliance airlines in the world for 170k in business class. Just make sure you keep an eye on those taxes and fees.

I would highly recommend incorporating EVA if you can. Their business class is pretty much a first class experience.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.