We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Bilt Rewards Rent Day: August 2024

A couple years ago, Bilt Rewards had the bright idea to make the first of the month a bit more fun. Soooo, they launched a “RENT DAY” promo to reward Bilt Rewards members on the first of every month ( I am a senior advisor and investor in the company ).

I’ve been seriously impressed with how inventive the program has been with massive transfer bonuses, rent giveaways, and now Bilt Experiences. So far this year we’ve great transfer bonuses ( 75% to 150% )to Virgin, Flying Blue, IHG One Rewards, Aeroplan, and Alaska. Incredible

August Rent Day is offering up a free additional guest on a cruise with Virgin Voyages!

Table of Contents

VIRGIN VOYAGES TRAVEL EXPERIENCE: Go here

You need to book this experience between July 26th at 9am to August 1st, 2024 at 11:59pm PT. You need to access Virgin Voyages via the Bilt App and you’re good to go.

What do you get?

- Unlimited premium wifi

- Two (2) specialty coffees per day

- $100 bar tab credit

- Complimentary laundry

- Unlimited group workouts

- Essential drinks

- Access to entertainment and events onboard

- Access to an exclusive cocktail event

- Priority boarding at embarkation

- Dedicated support

What to do:

- Go to the Bilt App

- Request benefits in the Bilt app after making their Virgin Voyages booking.

- Members should activate the benefits by entering their name, email, and booking reference number in the Virgin Voyages Travel Experience tab of the Bilt app or website.

- How to book:

Use the Access Key: VVBILT at checkout

Caribbean:

- Mayan Sol: 08-SEPT, 03-NOV

- Fire & Sunset Soirées: 04-SEPT, 18-SEPT, 02-OCT, 11-DEC, 26-DEC

- Riviera Maya: 22-SEPT, 17-NOV, 01-DEC

- Dominican Daze: 27-SEPT, 11-OCT

- Costa Maya & Cozumel Charm: 10-NOV

- Grand Turk, Puerto Plata & Bimini: 15-NOV

- One-Way San Juan Sojourn: 30-NOV

- Pre-Holiday Caribbean Refresh: 6-DEC

- Saint (Isles) & Seas of the Caribbean: 14-DEC

Mediterranean:

- Adriatic Sea & Greek Gems: 28-JUL

- Portsmouth to Zeebrugge (& back): 27-AUG

- From England to Amsterdam (& back): 30-AUG

- A Scarlet Fright Voyage: 24-OCT

- Transatlantic Tricks & Treats: 27-OCT

- Barcelona to Civitavecchia: 03-NOV

- From Rome to Miami: 28-NOV

TRAVEL EXPERIENCE: BILT X BLADE SUMMER PARTY –

Bilt and BLADE helicopter services teamed up earlier this year and I have to say, this sounds super cool, and depending on which experience you book, you could not only end up at a cool party, but also a helicopter ride across Manhattan.

- Tickets for the Experience will be available on July 29, 2024

- starting at 12:00pm ET for Bilt Platinum Members,

- 12:10pm ET for Bilt Gold Members,

- 12:20pm ET for Bilt Silver Members

- 12:30pm ET for Bilt Blue Members.

What does it entail? Well depending on what you book:

Full experience:

This full experience will kick off August 1st at BLADE Lounge West, where you can enjoy a welcome cocktail before boarding a BLADE helicopter for a flight over the Manhattan skyline to the BLADE Lounge East. Upon landing, you’ll join other Bilt Members for a Lounge Party with a DJ on the helipad, small plates by Tao Group, and unlimited craft cocktails and beverages.

Or you could just hit up the Lounge party and skip the Heli ride. 10k points gets you a heli ride and the party…If I lived in NYC I think I’d be very tempted by this one.

Lounge Party Tickets

-

- Lounge Party Tickets to the experience can be purchased for $50 or 2,500 rewards points each.

-

- Bilt members can book a maximum of four (4) Lounge Party Tickets.

-

- Lounge Party Tickets grant access to the Experience at 8:00pm ET.

Early Access Lounge Party Tickets

-

- Early Access Lounge Party Tickets are available to Platinum and Gold Bilt account holders only.

-

- An individual Early Access Lounge Party Ticket to the Experience can be purchased for $50 or 2,500 rewards points.

-

- Bilt members can book a maximum of four (4) Early Access Lounge Party Tickets.

-

- Early Access Lounge Party Tickets grant access to the Experience at 7:00pm ET.

Lounge Party + Flight Tickets (via BLADE Helicopter)

-

- An individual Lounge Party + Flight Ticket to the Experience can be purchased for $200 or 10,000 rewards points.

-

- Bilt members can book a maximum of two (2) Lounge Party + Flight Tickets.

-

- Bilt members will be required to sign a waiver prior to booking Lounge Party + Transportation Tickets.

-

- Lounge Party + Flight Ticket holders must arrive at the BLADE Lounge West located at 12th Ave and W 30th St, New York, NY 10011 at 7:00pm ET.

-

- There are 30 total Lounge Party + Flight Tickets available.

BILT NEIGHBORHOOD DINING SERIES:

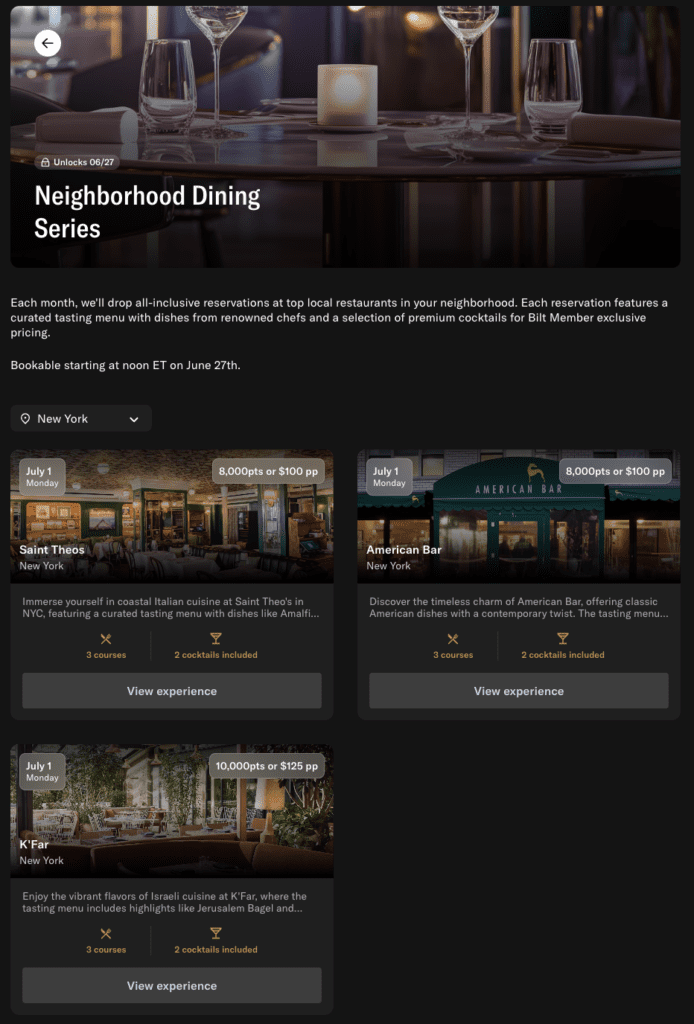

Every month, on Rent Day, Bilt offers up curated dining experiences. This month members will have 27 different restaurants to choose from across 12 different cities. These experiences are very high end, have special menus, you may hang with the chef, get specialty cocktails, etc. It’s not just a normal dining experience. Honestly, I’d do one of these just for the cash rate.

The Cost?

Book a seat for yourself and up to 4 guests starting at $75 or 6,000 Bilt points per person.

When can you book?

Available on July 29th in the Bilt app at

- 12:00pm ET for Platinum Members

- 12:10pm ET for Gold Members

- 12:20pm for Silver Members

- 12:30pm for Blue Members.

Bilt Rewards Rent Day July ( Alaska baby Alaska )

The Alaska Airlines parade is two fold

- Alaska Airlines 6 months Status Match

- Gold to MVP = One World Ruby

- Platinum to MVP Gold = One World Sapphire

- Must transfer 10k Bilt Rewards ( non bonus eligible )

- Alaska Airlines Transfer Bonus

- Transfer depends on status

- Capped at 50k Bilt Rewards

Alaska Airlines Transfer Bonus On July 1st:

| Bilt Status | Transfer Bonus |

| Bilt Platinum Members | 100% Bonus |

| Bilt Gold Members | 75% Bonus |

| Bilt Silver Members | 50% Bonus |

| Bilt Blue Members* | 25% Bonus |

One great use of Alaska Miles is to fly American to Europe – you can even avoid the high taxes and surcharges into London this way. And…it’s a great deal from the East Coast since Alaska’s award chart ( featured below ) is mileage based. It would be roughly 55k from the rest of the country.

I would highly recommend flying the 787-9 which features a great business class – review here.

I would highly recommend flying the 787-9 which features a great business class – review here.

Alaska Airlines Status Match for 6 months

One thing to note here – in order to participate in the status match you need to transfer 10k Bilt Rewards to Alaska Airlines; however, these 10k do not count in the transfer bonus.

Details:

- Must transfer 10k Bilt Rewards to Alaska Airlines

- Activate between 6/25/24 and 7/1/24

- Bilt Gold Members

- 6 months of MVP = One World Ruby Status

- Expires 12/31/24

- Bilt Platinum Members

- 6 months of MVP Gold

- Expires 12/31/24

From June 25th to July 1st, Bilt Platinum Members will be able to activate Alaska MVP Gold Status and Bilt Gold Members will be able to activate Alaska MVP Status, both with the transfer of 10,000 Bilt points to Alaska. Alaska Mileage Plan status will be good through December 31, 2024. To activate this offer, you must transfer 10,000 Bilt points to Alaska Airlines Mileage Plan from the dedicated elite status pages.

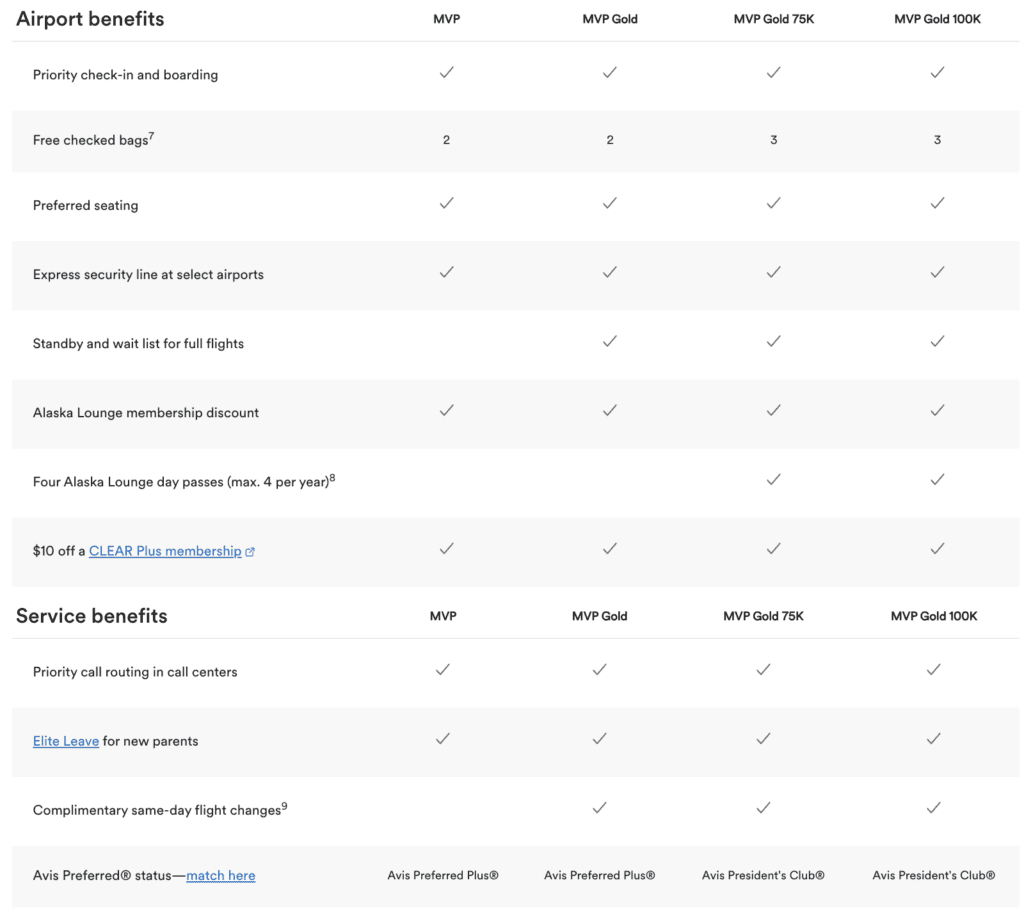

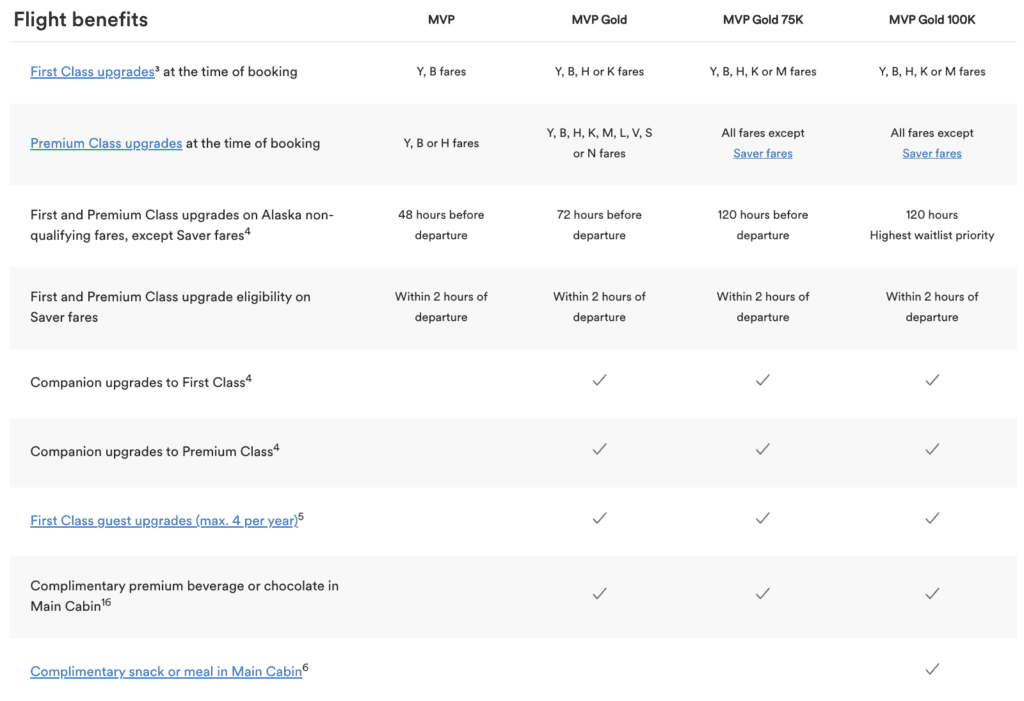

What do you get with Alaska Airlines Elite Status?

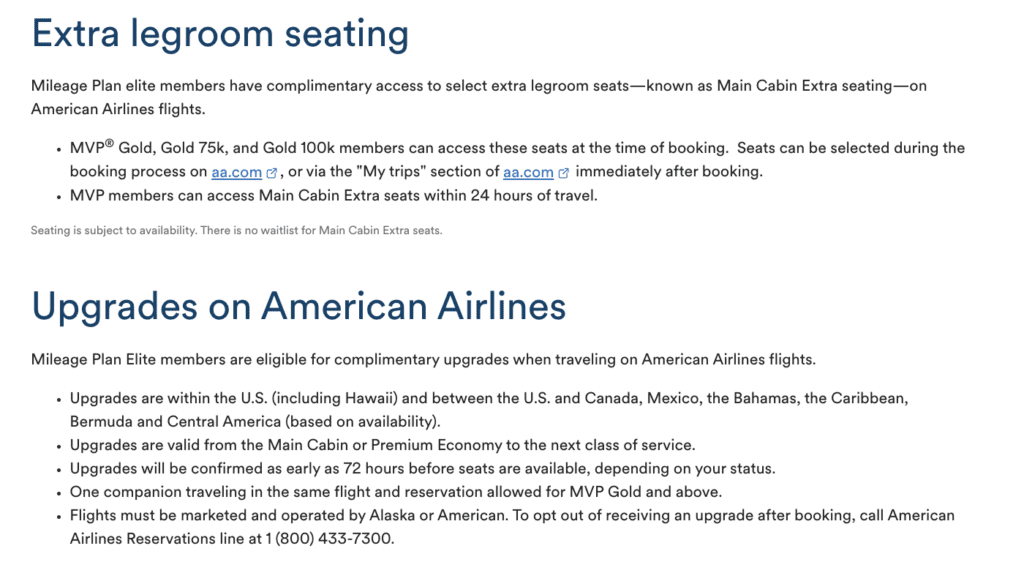

You can read all about it here but some people may think, “Zach, I don’t fly Alaska” and you don’t have to. A lot of Alaska’s benefits are going to also be on American Airlines.

American Airlines Benefits

Both MVP and MVP Gold members will have access to Main Cabin Extra seating and you’ll be on the upgrade list.

Alaska Airlines Benefits

What do you get with One World Ruby or Sapphire?

You can go here to read all about it, but if you get MVP Status you’ll have Ruby and that means you’ll be able to pick better seats when flying on American, and if you get MVP Gold, you’ll not only

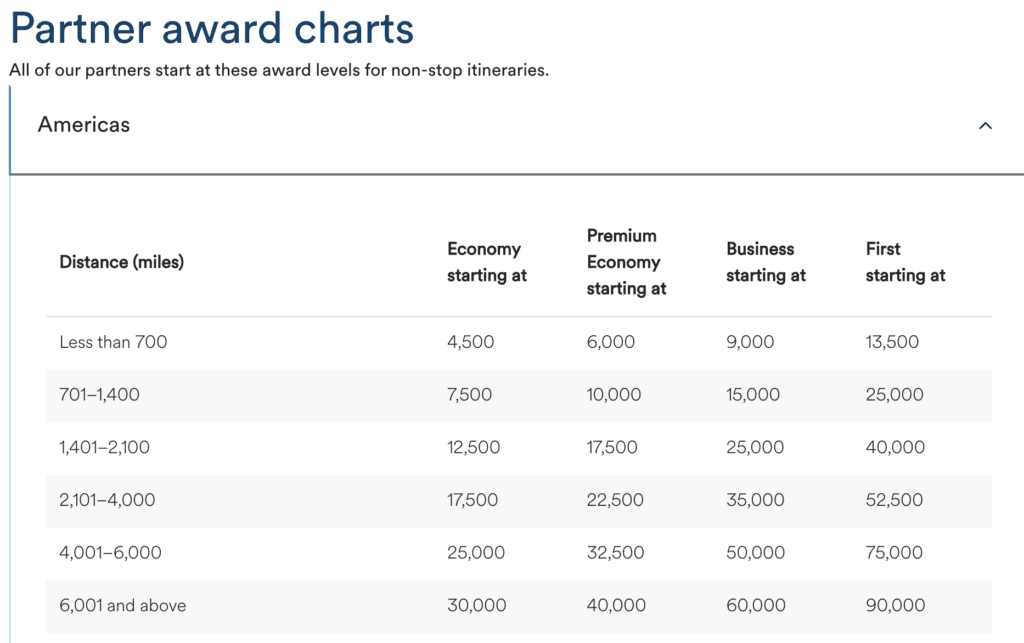

How to use the points: Alaska Airlines Award Chart

The best use of Alaska Airlines miles are on partners. Alaska is not only a part of One World ( meaning you can redeem on the Japan Airlines, Qantas, British Airways, Cathay Pacific, Qatar Airways, etc ), but they are also partners with airlines that aren’t a part of the alliance like StarLux and Aer Lingus. It’s an incredibly valuable point currency that can unlock some special experiences.

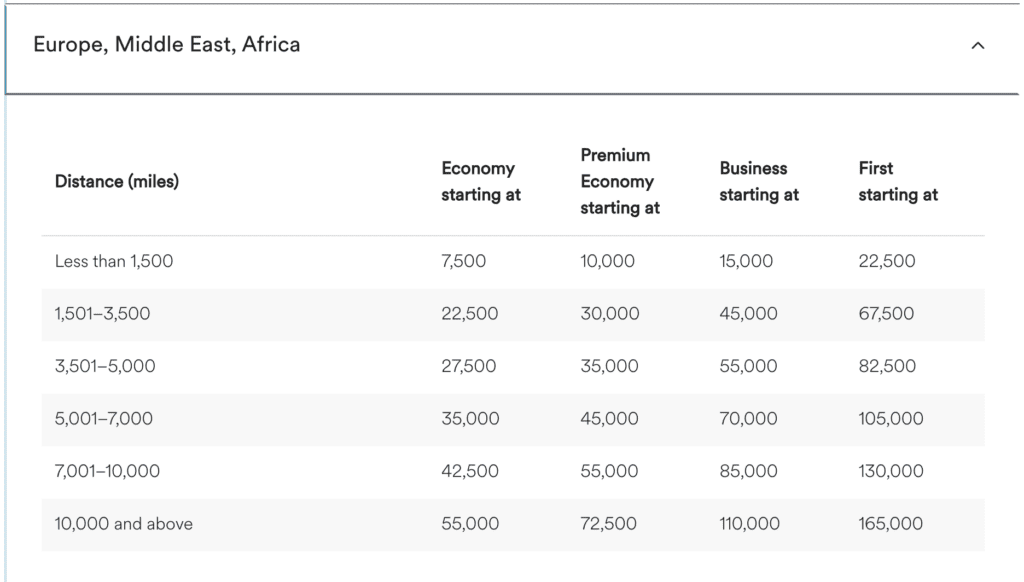

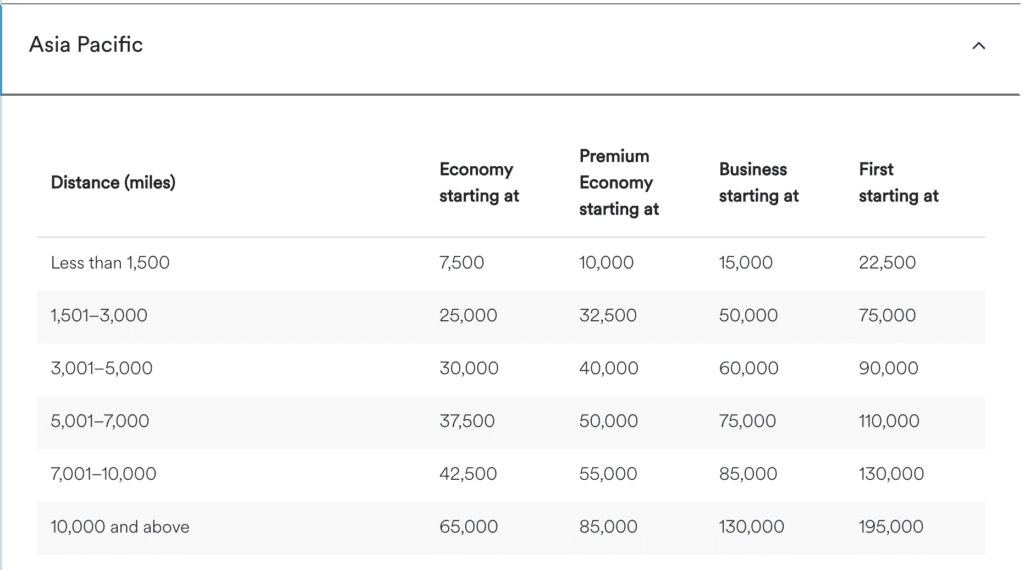

They recently updated their award chart and I thought it’d be helpful to include them below.

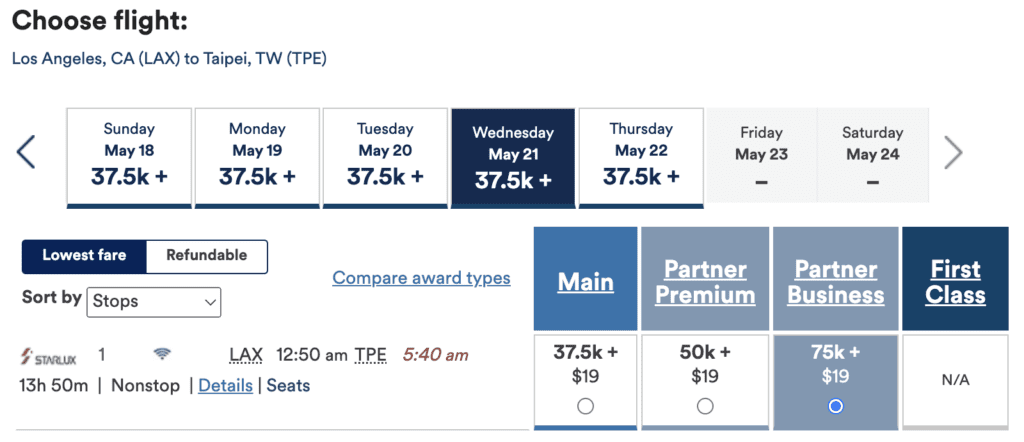

One incredible redemption is redeeming 75k Alaska Miles and $19 to fly StarLux – Taipei’s luxurious new airline. You could even book in a stopover in Taipei before continuing on into Asia. Look at their business class

Alaska Airlines Partners

Alaska Airlines Partners

Bilt Experiences:

Book a seat for yourself and your guests starting at $75 or 6,000 Bilt points per person. I would just pay cash as these are quite expensive places and I like to transfer my Bilt Rewards for max value.

Booking is available on June 27th in the Bilt app

- 12:00 ET for Platinum Members,

- 12:10 ET for Gold Members,

- 12:20 for Silver Members,

- 12:30 for Blue Members

Cities included

- NYC,

- Chicago,

- Miami,

- Los Angeles,

- Brooklyn,

- Boston,

- Philadelphia,

- Dallas,

- Austin,

- Houston,

- Washington DC.

Exclusive to July, among 18 total restaurants, this will include Omakase Experiences at Sushi Bar in 4 cities. These experiences will feature a curated tasting menu alongside Brooklyn Peltz Beckham’s premium grade Japanese sake, “WESAKE.”

Bilt Rewards Game Show ‘RENT FREE’

It’s a fun game to play, super easy and straight forward. This month it features chef, author, YouTuber, influencer, Brooklyn Peltz Beckham to play the game

Each month, we ask 1,000 Bilt Members some juicy hypothetical questions.You’ll team up with our celebrity guest to guess the three most popular responses to each question. The more you both get right, the better your chances of winning.Submit your guesses before 3pm ET on July 1st, and then come back after 4pm ET to see if you’ve won and claim your prize.

What are some past Bilt Rent Day promos?

- November 2022

- United status trial and challenge

- December 2022:

- 100% transfer bonuses to IHG

- January 2023

- Bonus points with Trivia

- February 2023

- 100% transfer bonus to Hawaiian

- March 2023

- Points worth 50% more with Amazon

- April 2023

- Hyatt Trial Status and Challenge,

- Explorist and pathway to Globalist in 20 nights

- Hyatt Trial Status and Challenge,

- May 2023

- 100% transfer bonus to Flying Blue

- June 2023

- 100k Bilt Rewards prize, R/T Virgin Upper Class and Emirate Biz tix

- July 2023

- $10 to $20 Lyft Credits ( $10 for all Bilt Rewards members and $20 for Bilt Rewards credit cardholders )

- August 2023

- 75% to 150% transfer bonus to Virgin Atlantic/Virgin Red

- 75% standard

- 100% silver

- 125% gold

- 150% platinum

- 75% to 150% transfer bonus to Virgin Atlantic/Virgin Red

- September 2023

- One rider in each SoulCycle class will get a month’s rent – up to $2500

- All Rent Day Riders are eligible

- You can book your bike, starting today!

- 10 bikes are available per class

- One rider in each SoulCycle class will get a month’s rent – up to $2500

- October 2023

- 5x on Sports Tickets

- Use points to book NFL Suites and Tickets

- November 2023

- 75% to 150% transfer bonus to Emirates SkyWards

- 75% standard

- 100% silver

- 125% gold

- 150% platinum

- 75% to 150% transfer bonus to Emirates SkyWards

- December 2023

- 2x shopping

- 10x Bilt Dining

- January 2024

- 75% to 150% transfer bonus to Virgin, Air France/KLM Flying Blue, and IHG One Rewards

- 75% standard

- 100% silver

- 125% gold

- 150% platinum

- 75% to 150% transfer bonus to Virgin, Air France/KLM Flying Blue, and IHG One Rewards

- February 2024

- 75% to 150% transfer bonus to Air Canada, Aeroplan

- 75% standard

- 100% silver

- 125% gold

- 150% platinum

- 50% more value with Amazon

- $5 Lyft Credit

- 75% to 150% transfer bonus to Air Canada, Aeroplan

- March 2024

- NCAA Sweet 16 tournament

- Connect your Bilt Rewards to a partner and get 1k point up to 2 partners.

- NCAA Sweet 16 tournament

- April 2024

- Buy One Get One Fitness Classes

- May 2024

- Use Points on Rent, get 100% back to use in Home Collection

- June 2024

- 5x or 10x on Bilt Dining

- July 2024

- Alaska Airlines Status Match

- Gold = MVP

- Platinum = MVP Gold

- Alaska Airlines Transfer Bonus – capped at 50k

- 25% standard

- 50% silver

- 75% gold

- 100% platinum

- Alaska Airlines Status Match

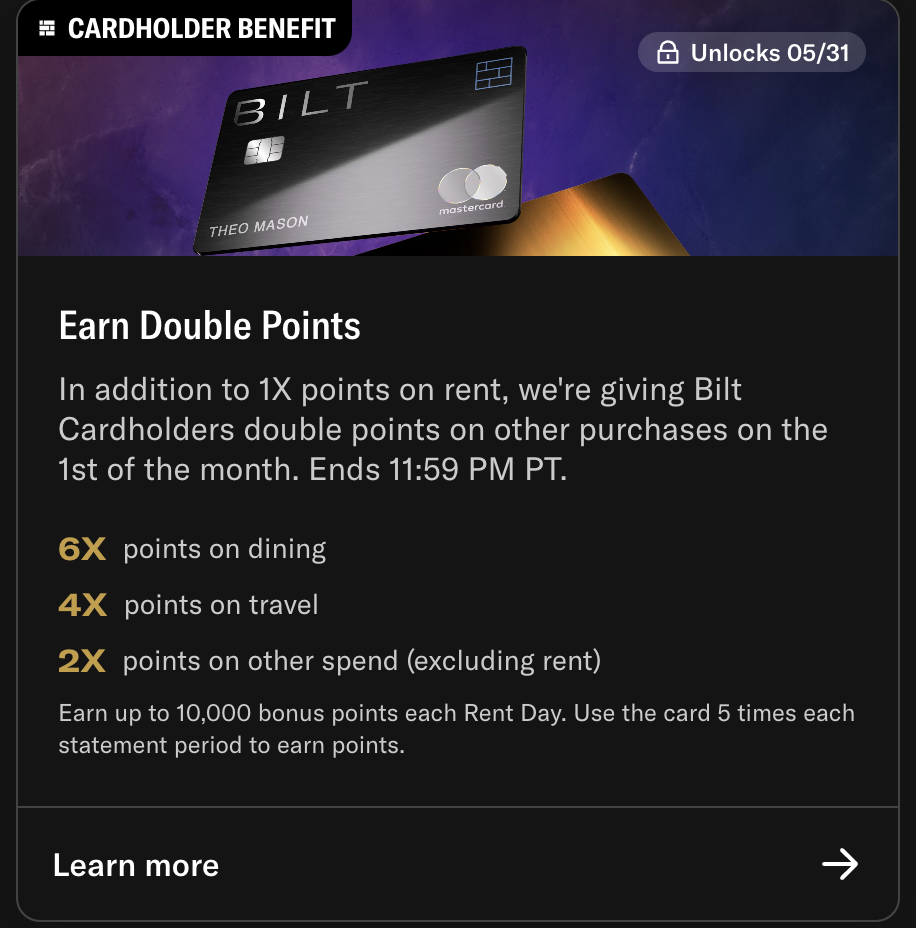

DOUBLE POINTS ON ALL NON-RENT PURCHASES

Don’t forget you need to use the card 5x in a month to get your points. Here’s how you can earn:

- DINING: 6x points (regularly 3x points)

- This applies to Restaurants in the Bilt Dining program as well – so you’d earn 11x

- TRAVEL: 4x points (regularly 2x points)

- ALL OTHER SPEND excluding rent: 2x points (regularly 1x points)

Play Point Quest to earn points

- log in to the Bilt Rewards app on the first

- Answer 5 questions and earn 50 points instantly for each correct answer

- If you get all 5 correct, you will be given a 6th question for another 100 Bilt points

Soul Cycle

- Bilt Members can book complimentary bikes at every SoulCycle x Bilt Rent Day Ride on the 1st of each month at studios across the country.

- Book directly in the Bilt App to book one of 10 complimentary bikes that are available per class, on a first-come, first-served basis.

Rent Giveaway

I mentioned this up above, but if you solve a phrase and you submit the correct answer you’ll be entered in a contest to win up to $2500 in free rent!

Tell me more about the Bilt Mastercard®?

You can earn on points rent without the transaction fee by using the Bilt Mastercard® as long as you make 5 non-rent transaction in a statement period ( up to 100k points per year ).

You can pay rent via two different ways

- The first, using their app to pay rent within their Bilt Alliance network. They have partnerships with over 2 million properties across the country. If your building is a part of it, it’s super easy and streamlined.

But the 2nd way is a gamechanger.

- You can use their no annual fee Bilt Mastercard® to pay your rent and earn points. The card even earns 2x on travel and 3x on dining with no annual fee. I’m not talking just within the alliance, but literally any landlord, anywhere in the United States.

My landlord doesn’t accept credit card.

If they don’t accept credit card…

- Bilt will mail your landlord a check.

- They even set it up so that you can use the Bilt Mastercard® to pay via ACH, Venmo, or PayPal

If you pay rent…it’s a complete no brainer.

Overall

Bilt Rewards Rent Day is an exceptional time to spend on your credit card if you have one, but also take advantage of all the promotions they offer.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.