We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Sapphire Preferred® Card Review

Yes, the Chase Sapphire Preferred® Card is one of the 25+ credit cards I currently carry, and I’d not only highly recommend it for beginners, but experts as well.

It serves as a cornerstone card that not only provides cardmembers with very solid benefits, but also one that you can build a Chase portfolio of cards around. I often recommend pairing the Chase Sapphire Preferred® with a Chase Freedom Flex® or Chase Freedom Unlimited® in order to unlock the higher point earn rates and complimentary benefits. Don’t worry…I get into that below.

Table of Contents

A brief history on the Chase Sapphire Preferred® Card

The backbone of Chase’s entire Ultimate Reward centered credit card program started a decade ago, in 2009, with the Chase Sapphire and Chase Sapphire Preferred. It set out to target the top 15% of all households, and the rest is history.

The program’s expansion to an entire portfolio means options have increasingly gotten richer and more valuable for cardholders since its debut. Fascinated with history? The original bonus on the Sapphire was 10k after first purchase, and the Sapphire Preferred offered 15k bonus points after making $1k in 3 months. Times have changed, and not only has the program gotten richer, so have the welcomes offers. I suggest you read our entire break down of the Chase system to give you better clarity.

What are the Chase Sapphire Preferred® Card Benefits?

My entire Chase portfolio of cards started with this card, and even though I kept a Chase Sapphire Reserve for a little while, I opted to downgrade it back to a Chase Sapphire Preferred because it worked best for my situation.

- 5x on all travel purchased through Chase Travel℠

- 3x on dining, including eligible delivery services for takeout & dining out

- 3x on select streaming services

- 3x on online grocery purchases

- (excluding Target, Walmart and wholesale clubs)

- $50 Annual Chase Travel Hotel Credit via Chase Travel℠

- The begins immediately for new cardmembers and after your account anniversary for existing cardmembers

- 2x on all other travel

- 10% Anniversary Bonus

- Every year you keep the card, your total spend will yield a 10% points bonus. If you spend $10k in a year, you’ll get 1k bonus points

- Chase Sapphire Preferred continues to redeem at 1.25c in the Chase Travel℠ and the slew of other benefits remain in tact including Auto Rental Collision Damage Waiver ( primary ), purchase protections, etc.

- Points are transferrable to 14 Ultimate Rewards partners

- Redeem in Chase Travel℠ for 1.25 cents per point

- No foreign transaction fees

- Suite of Travel and Purchase Coverage

- Auto Rental Collision Damage Waiver is my favorite

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024

- $95 Annual Fee

I used Chase Ultimate Rewards earned from my Chase Sapphire Preferred® to fly Singapore Suites with my family on my Mom’s Around the World surprise birthday trip!

What are the bonus categories on the Chase Sapphire Preferred® Card?

Travel:

- 5x on all travel purchased through Chase Travel℠

- 2x on all other travel

Dining

- 3x on dining, including eligible delivery services for takeout & dining out

Streaming Services

- 3x on select streaming services

Online Groceries

- 3x on online grocery purchases

What are the transfer partners of the Chase Sapphire Preferred® Card?

What kind of credit score do you need for Chase Sapphire Preferred® Card?

It’s our opinion that you should be good to go as long as you’re over 720 – nothing is published on this though.

Is this the best offer we’ve offer seen?

Last year we did see offers as high as 100k, and we recently had an 80k Offer.

What is the Annual fee of the Chase Sapphire Preferred® Card?

The annual fee is $95 and is not waived for the first year.

What are the sign up rules for the Chase Sapphire Preferred® Card?

5/24

- Almost all of Chase’s cards are a part of their 5/24 rule. This means that you can not sign up if you have opened more than 5 credit cards in the last 24 months.

1/48

- Specific to the Chase Sapphire Preferred and Reserve, you can not receive a welcome bonus if you have received one on either the Chase Sapphire Preferred or Chase Sapphire Reserve.

Only one Chase Sapphire Premium product

- If you currently hold a Chase Sapphire Preferred or Reserve you cannot sign up for the card. Those who currently hold both can be grandfathered into holding both, but if you only have one, you’re restricted from another.

Should I get a Chase Sapphire Preferred® or a Chase Sapphire Reserve®?

Every situation is different and I’d recommend you read how we to decided to forego a Chase Sapphire Reserve® for the Chase Sapphire Preferred®.

I ultimately gave up my Chase Sapphire Reserve because it wasn’t worth the added cost since many of those “premium benefits” I get from other cards. If you hold a Chase Freedom Unlimited® or Chase Freedom Flex® you can combine your points, and those cards earn 3x dining, 3x pharmacies, and 5x Chase Travel℠. Those match some of the category bonuses on Chase Sapphire Reserve® except both of those cards carry no annual fee. I found it to make more sense for me to carry a Chase Sapphire Preferred + a Chase Freedom than it did to keep a Chase Sapphire Reserve.

What is Chase Sapphire Preferred® Customer Service like?

You’ll enjoy a premium level of customer service on the phone at 1-800-493-3319 and I’ve typically gotten a rep on the phone in under 30 seconds.

Earn more points with Chase Refer a Friend

Referrals are an incredible way to add to your Ultimate Rewards balance. Currently Chase offers 15k points per approved referral, up to 75k a year.

You can go here for our Chase Refer a Friend master thread

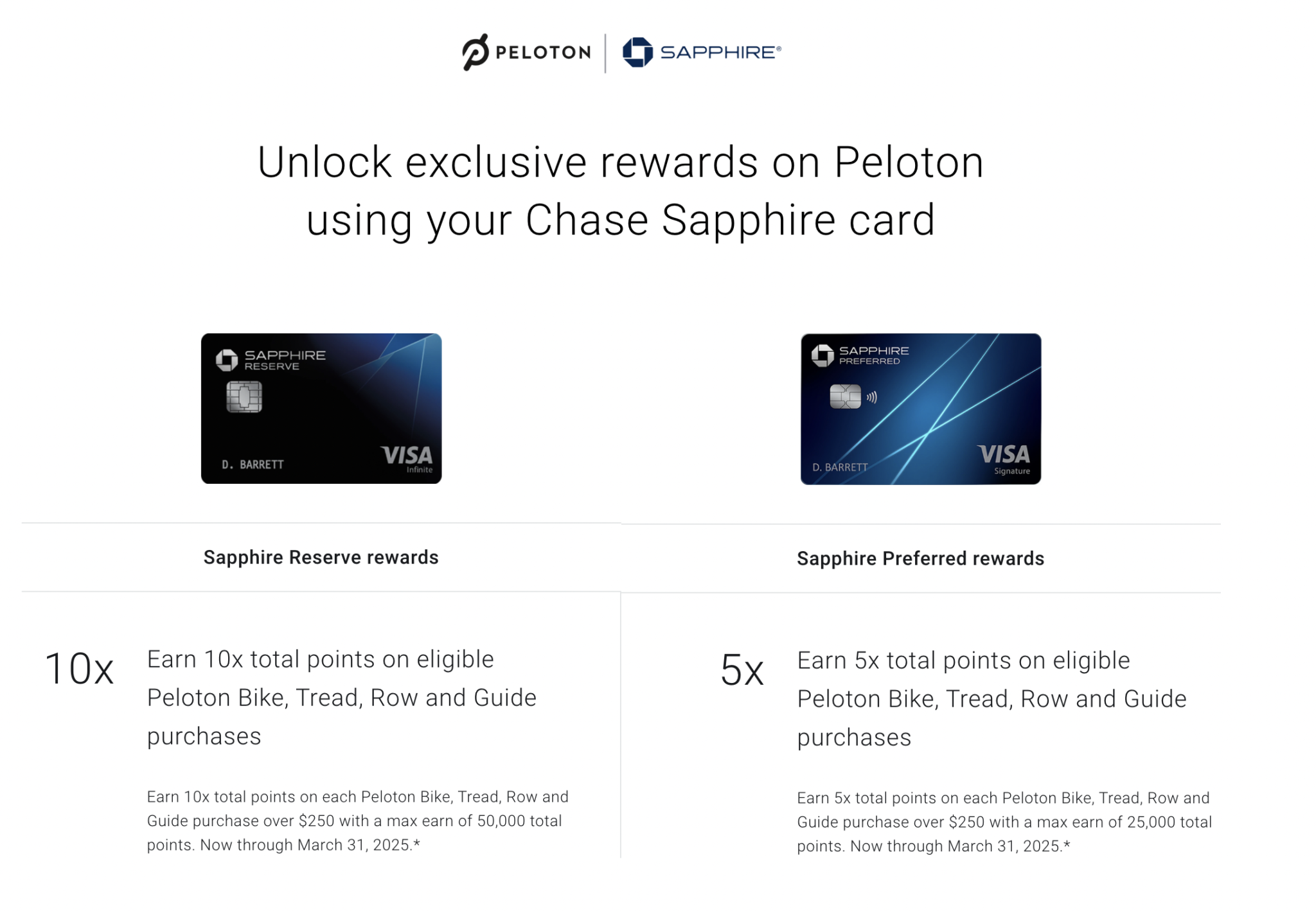

How do Peloton benefits work?

You go here to link your account and register it…voila you’re good to go

- Chase Sapphire Reserve cardmembers will get 10x total points on Peloton equipment and accessory purchases over $250 through March 2025, with a max earn of 50,000 points. Stay tuned for details on additional, exclusive in-studio opportunities for cardmembers!

- Chase Sapphire Preferred cardmembers will get 5x total points on Peloton equipment and accessory purchases over $250 through March 2025, with a max earn of 25,000 points.

How does the 10% anniversary bonus work?

Simple. If you spend $10k in a year, you’ll get 1k points. The biggest thing to remember is you’re not getting 10% on the points you earn, but rather an extra 10% on the dollars you spend.

How does the $50 hotel credit work?

If you spend book hotels via Chase Travel℠ you’ll get a credit up to $50 a year. This begins immediately for new cardmembers, and after your first account anniversary for existing account holders.

How to use Chase Sapphire Preferred® in tandem with other Chase Products for max ‘earnage’

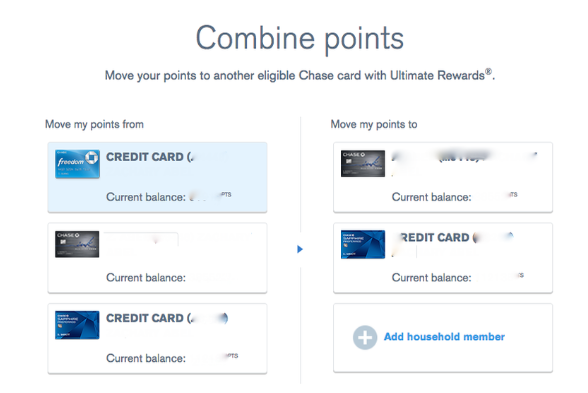

Chase allows you to transfer Ultimate Rewards between accounts. This is fantastic because Chase offers other credit cards that earn more points per dollar on certain categories, but often times those cards don’t earn Premium Ultimate Rewards. You can then transfer them into your Chase Sapphire Preferred account, and voila, they are converted into Premium Ultimate Rewards which can then be transferred into partner programs. You can easily move them between household accounts as well!

If you had a Chase Freedom Flex® or Chase Freedom Unlimited and a Chase Sapphire Preferred®…

- 5x on all purchases with Chase Travel℠ purchases via Chase Sapphire Preferred® Chase Freedom Flex® or Chase Freedom Unlimited®

- 5x on rotating category bonuses with Chase Freedom Flex®

- 3x on dining via Chase Sapphire Preferred® Chase Freedom Flex® or Chase Freedom Unlimited®

- 3x on pharmacy via Chase Freedom Flex® or Chase Freedom Unlimited®

- 3x on Select Streaming

- 3x on online groceries ( excluding Target, Walmart and wholesale clubs )

- 2x on travel outside of Chase Travel℠ with the Chase Sapphire Preferred®

- 1.5x on every purchase with Chase Freedom Unlimited®

- Primary Rental car coverage with Chase Sapphire Preferred®

- Access to transfer partners with Chase Sapphire Preferred®

When you pair two or three of these cards together you can see how your ability to earn points increases, but keeping the Chase Sapphire Preferred® means you have access to the valuable transfer partners we so frequently write about.

What are some of the best uses of Chase Ultimate Rewards?

Every person is different, and you need to establish your travel goals to fully flesh out what makes the most sense for you. My travel goals are to see as many places as I can, travel in the best possible way, and stay in the most luxurious places on the planet. This means I’m looking to maximize the value of every single point, and I hardly ever redeem through Chase’s own travel center, and instead, transfer to partners.

Check out Virgin’s new Upper Class aboard the A350.

We transferred Ultimate Rewards over and flew it for 47.5k points and $600

You can fly Air France Business Class for 50k

I booked a roundtrip Business Class ticket on Iberia using just 68k points.

You can read our review here

Or transfer to Hyatt and stay in entry level to truly aspirational world class properties.

We used Hyatt points to stay in a wide array of properties, but none have been quite like the Alila Villas Uluwatu which we consider to be the best Hyatt in the world.

Recap

If you’re just getting into unlocking the potential of points and miles, the Chase Sapphire Preferred® is an outstanding place to start. It earns great points, has a relatively low annual fee, and you can start to build more Chase cards around it to optimize and utilize their Ultimate Rewards program to its fullest potential.

If you’re a seasoned pro when it comes to points and miles, and you qualify for this offer, you’ll be enjoying the highest public welcome offer we’ve ever seen. Great time to strike.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.