We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Why should you get a Chase Sapphire Preferred?

I’m a huge fan of Chase credit cards. Not only do they have excellent co-branded cards, but their bread and butter Chase Sapphire Preferred has been a part of my wallet for years now. It’s currently advertising a 100k welcome offer after spending $4k in 3 months, and it looks like that offer ends today. Let’s take a quick look at the benefits and a few reasons why I think everyone should have one in their wallet.

You can also read our full review

Straight to it: The 5 Reasons I love keeping the Chase Sapphire Preferred in my wallet

1) No foreign Transaction fees

Anywhere in the world, you don’t have to worry about paying fees. For someone like myself, this is a great benefit, and means I can rest knowing anytime I swipe, I’m not paying some silly surcharge.

2) Primary Rental Car Coverage

A lot of credit cards come with secondary rental card coverage, the Chase Sapphire Preferred offers primary and that means I can select, no thank you, when it comes to paying those hefty Collision Damage Waivers. For someone who rents A LOT, that saves me wads of cash every year.

3) Access to Ultimate Rewards transfer partners ” Makes your points more valuable “

This is where you can make your travel dreams come true by accessing partner programs and redeeming for sweet spots. Ability to merge points from Chase “cash back” cards to convert into fully transferrable Ultimate Rewards

4) 3x Bonus categories!

You’ll earn an unlimited 3x on dining + 3x on select streaming services and 3x on online grocery purchases

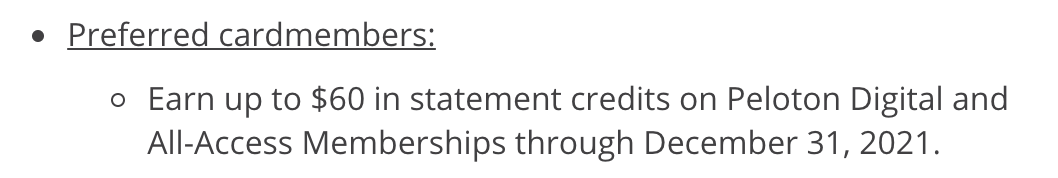

5) Peloton and DoorDash incentives

Now through the end of the year you can get $60 statement credit on Peloton Digital AND you’ll get a year of DoorDash DashPass which gives $0 delivery fees on eligible orders over $12 on DoorDash and Caviar.

Bonus Reason: Chase refer-a-friend

Chase recently upped the total amount of points that you can earn by referring people to 100k in a year. That’s a massive amount of points and completely outweighs the annual fee just by sharing the love.

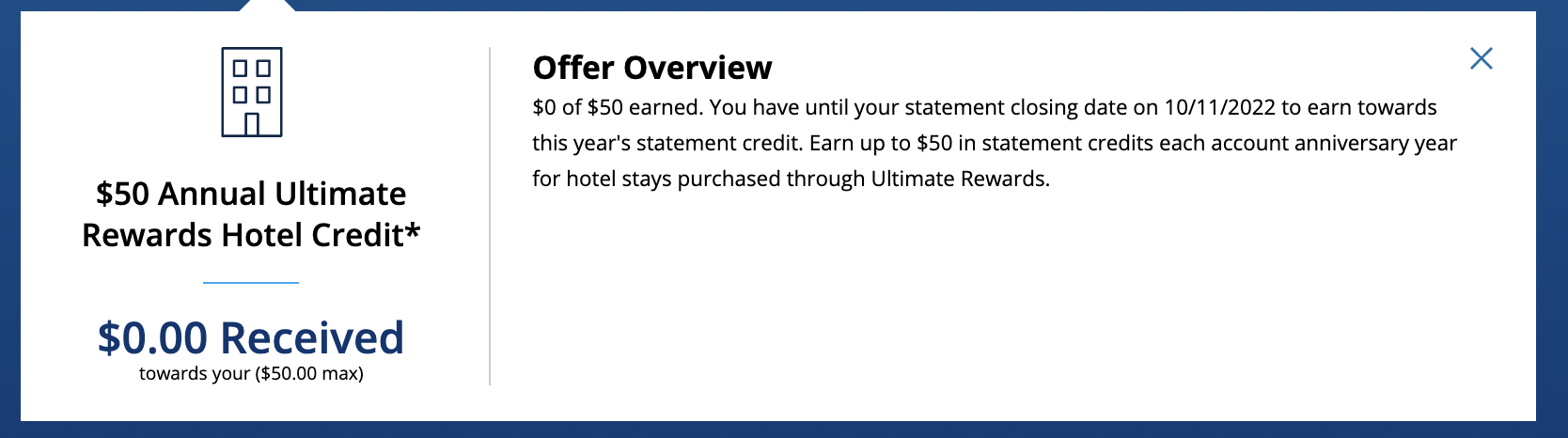

Bonus, bonus: $50 hotel credit ad 5x Chase Travel

If you spend book hotels via Ultimate Rewards/Chase Travel you’ll get a credit up to $50 a year. This begins immediately for new cardmembers, and after your first account anniversary for existing account holders.

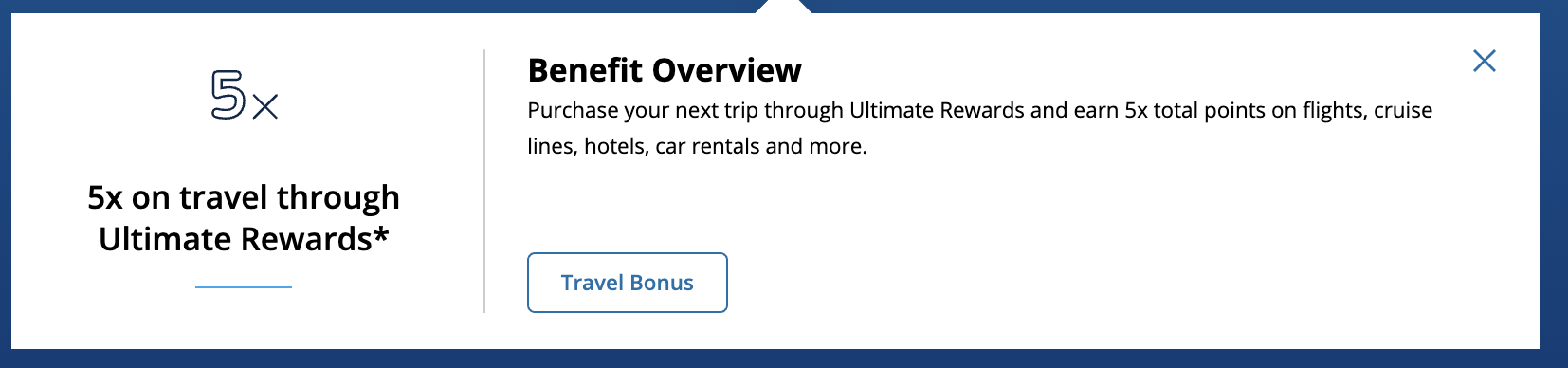

Regarding the 5x on Chase Travel…book via Chase Travel and get 5x on eligible purchases!

Don’t have one? Highest ever public offer 100k ends today

This is a great time to consider one. It comes with a great welcome offer of 100k Ultimate Rewards after $4k in purchases in 3 months

This is the best public offer we’ve seen on the card. If you’re eligible to get this card as a new cardmember and qualify for the bonus, there hasn’t been a better time to hop on it.

Who’s eligible?

Chase has some specific restrictions in place for Chase Sapphire cards, so let’s walk through them.

5/24

- If you’re opened more than 5 credit cards in the last 24 months Chase won’t approve you for this card

- Make sure you check your credit report to see how many cards are listed

1/48

- If you’ve received a sign up bonus for any Chase Sapphire card ( Preferred or Reserve ) in the past 48 months, you’ll be ineligible.

Here are some examples, but check out our Best Uses of Chase Points

Transfer to United and fly their new Polaris business class.

30k A night for the Best Hyatt in the World ( ranked by me 🙂 ) Alila Villas Uluwatu

Transfer to British Airways and use points to upgrade. Buying cheap business out of Europe and points to first a great use. This is what it’s like:

Overall:

The Chase Sapphire Preferred offers some really great benefits for a card that only costs $95 annually. It not only provides primary rental car coverage, which saves me a ton at the counter, but it also means I can merge points from my Freedom, Ink Cash, and Ink Unlimited that would otherwise only earn me cash back. It’s a fantastic way to increase the value of the points earned on those cards.

Every situation is different, but I ultimately decided to keep a Chase Sapphire Preferred en lieu of the Chase Sapphire Reserve. Do the math yourself, but the Chase Sapphire Preferred offers a lot of bang for the buck, and is squarely positioned in my wallet.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.