We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Bilt Mastercard® Full Review

The Bilt Mastercard® is a phenomenal resource for those who’d like to earn something back on one of their biggest expenses: Rent ( up to 100k points per year ).

Bilt Points aren’t just any points – these bad boys will transfer to United, American, and Alaska Airlines as well as Hyatt, IHG, Marriott, Turkish, British Airways, Iberia, and Aer Lingus. The list of transfer partners is fantastic, and in early 2022, I became a Bilt Rewards Senior Advisor and the program has continued to impress and impress.

But, you don’t have to have the credit card to earn points via Bilt Rewards, so let’s dig into the program from soup to nuts.

Table of Contents

How do you earn points with Bilt Rewards?

You can earn Bilt Rewards via multiple avenues, one being paying rent, up to 100k points per year, via the Bilt Rewards Alliance, paying rent via the Bilt Mastercard®, along with many other ways as well.

Pay your rent via the Bilt Rewards App as an alliance partner

- The first, using their app to pay rent within their Bilt Alliance network. They have partnerships with over 2 million properties across the country. If your building is a part of it, it’s super easy and streamlined. You would simply onboard via the property owner’s rent portal, or via Bilt’s app. You could then have you rent processed and you’d earn points on your rent to the tune of 250 points per month.

How does paying rent with Bilt Mastercard® work?

This is a gamechanger.

You can use their no annual fee Bilt Mastercard® to pay your rent and earn points without paying any transaction fees as long as you use the card 5 times each statement period. I’m not talking just within the alliance, but literally any landlord, anywhere in the United States, and setting up your account is super easy.

Before you ask…I know what you’re going to say: My landlord doesn’t accept credit card.

Easy peasy! If they don’t accept credit card…

- Bilt will mail your landlord a check.

- They even set it up so that you can use the Bilt Mastercard® to pay via ACH, Venmo, or PayPal

How does the Bilt Mastercard® earn points?

The biggest caveat is that you have to make 5 transactions each statement period to earn points…

As long as you do that, you’ll earn your points on rent and at the following rates without any annual fee

- $0 Annual fee See terms

- Earn Structure:

- 1x on rent (up to 100,000 points in a calendar year) and other purchases

- 2x on travel

- booked direct with airlines, hotels, cruises or car rentals

- 3x on dining

- Use the card 5 times each statement period to earn points

- Learn More about the product features, terms, and conditions

- Transfer points 1:1 to over a dozen partners, including American, United, and Hyatt

- Redeem points toward Rent, Mortgage Downpayment, Amazon, etc

- Redeem at 1.25c in the Bilt Rewards Travel Center (powered by Expedia)

- Features and Benefits

- Cellular Telephone Protection

- Up to $800 of cell phone protection per claim, subject to a $25 deductible.

- Auto Rental Collision Damage Waiver

- Cellular Telephone Protection

- If you’d like to read the Guide to Benefits you can do so here

How many points can I earn every year on rent? 100k

Bilt quietly increased their their yearly max from 50k to 100k in April of 2023 – you can see it noted below

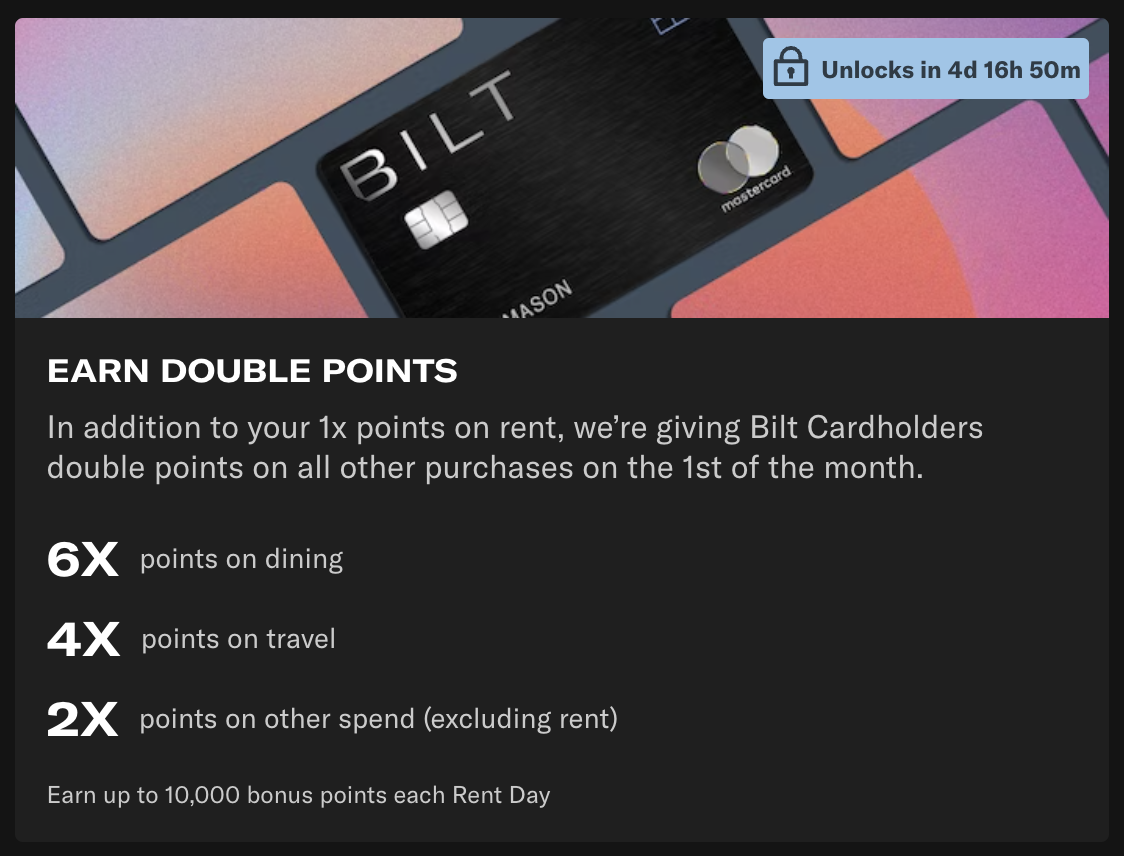

Bilt Rewards ‘Rent Day’: Earn double points on every category except rent

Each month, on the 1st, Bilt Rewards will double all of the points you earn that day. So the normal 3x dining, 2x travel, and 1x on other purchases, becomes 6x, 4x, and 2x, respectively. This doesn’t include rent and does max out a 10k Bilt Points each rent day, but if you’re planning a fancy dinner or to book plane tickets/hotels, this is a great way to earn more points.

Soul Cycle

Soul Cycle

- Bilt Members can book complimentary bikes at every SoulCycle x Bilt Rent Day Ride on the 1st of each month at studios across the country.

- Book directly in the Bilt App to book one of 10 complimentary bikes that are available per class, on a first-come, first-served basis.

Bilt Dining earns an additional 5x on points

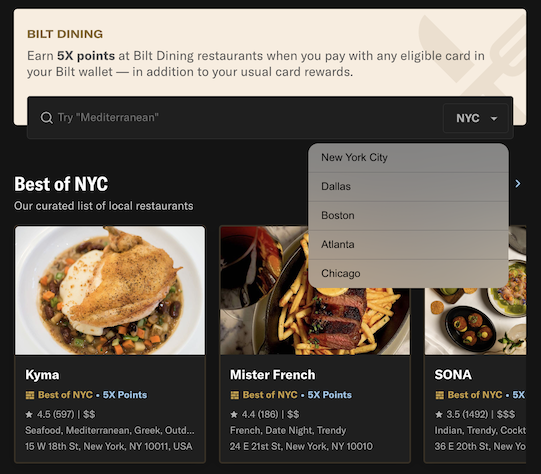

In April of 2023, Bilt introduced a Dining Program that earns additional rewards and access to exclusive benefits at Bilt Neighborhood Dining restaurants if you eat at restaurants participating in the program.

This works in a similar way to any other dining portal, except you’re earning additional Bilt Rewards instead of AA, United, Alaska, etc.

You can pay with any debit or credit card linked in your Bilt app, but if you currently have the Bilt Mastercard®, it’ll be automatically added. Everything works behind the scenes, so you don’t pay with the app, you just use your credit card as you normally would, and you’ll receive your additional points in 7 or so days.

This is incredible and if you have the Bilt Mastercard® you’ll earn your additional dining points on top of the standard 3x (which is 6x on Rent Days). It’s first rollout was in NYC, Boston, Dallas, Atlanta, and Chicago – when you select a city, as shown below, you’ll see a bunch of restaurants that are included.

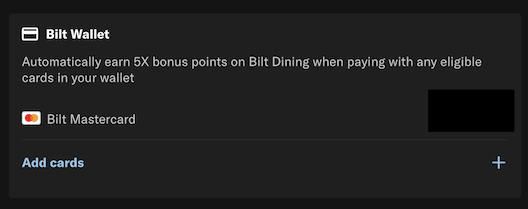

How do I load my card?

Under the Wallet tab in the Bilt Rewards App, you’ll find your Bilt Mastercard® already loaded. If you don’t have the card, you can load any American Express®, Mastercard®, or Visa® credit or debit card. Then when you use them at a participating restaurant, you’ll earn your credit card points + additional Bilt points. It’s that simple.

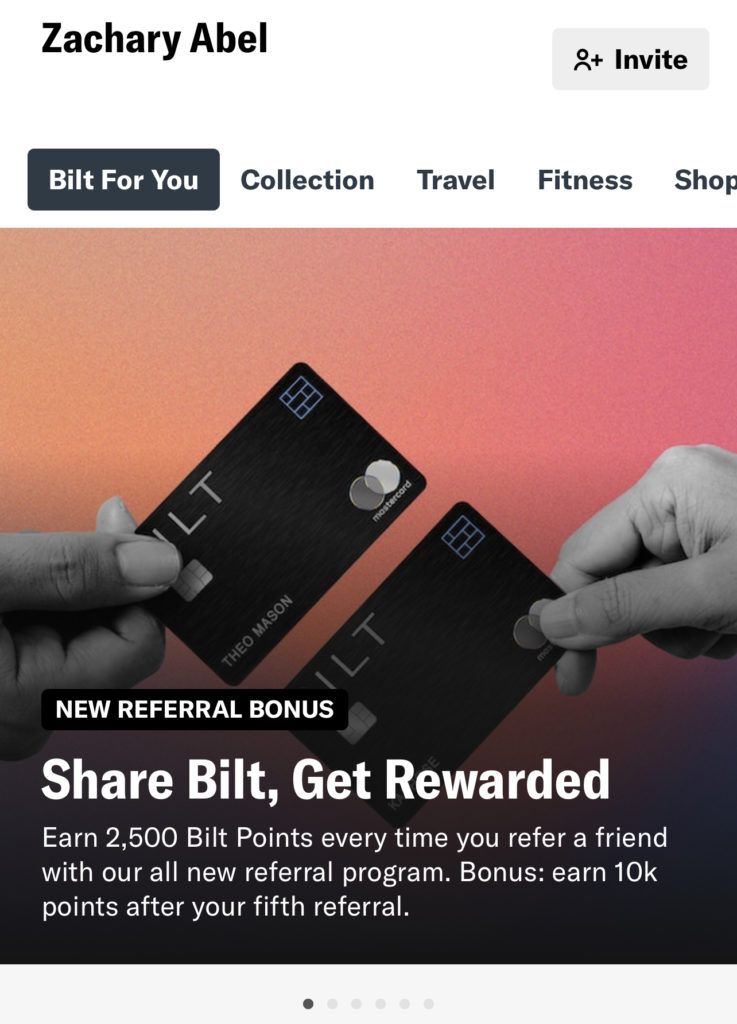

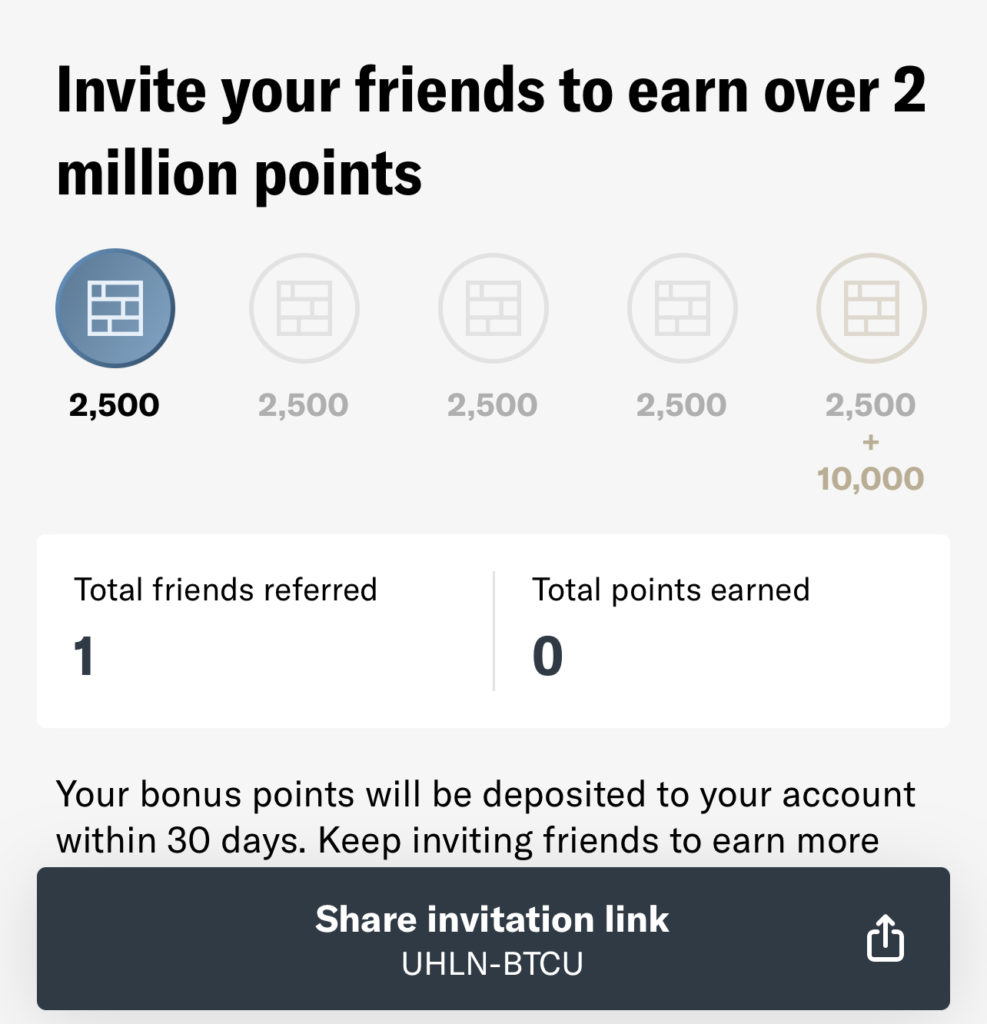

Bilt Rewards Referral program – you don’t need the Bilt Mastercard® to refer

As long as you have a Bilt Rewards account, you don’t need the credit card to refer people to the credit, you can refer bonuses. It’s pretty easy: just go to Invite in the top right corner of the homepage on the app, create a link, and you can refer. Just note that you will receive a 1099 on the points you earn.

- 2500 per referral

- 10k bonus after 5 referrals

- Capped at 225k ( 50 referrals )

- This had been 2,025,000, or 450 referrals, up until 2/1/24

What my referral looks like:

Additional benefits of the Bilt Mastercard®:

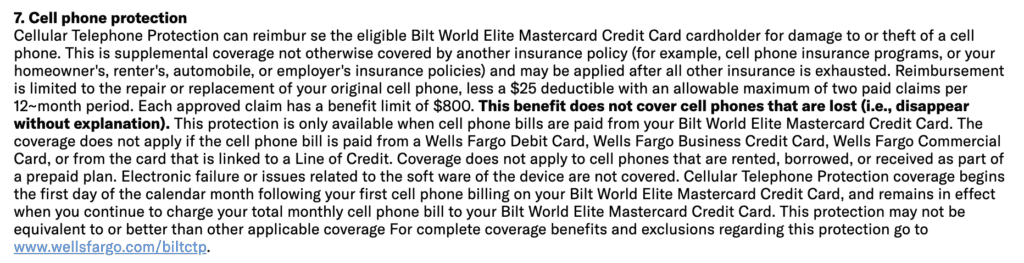

Cellular Telephone Protection

- Up to $800 of cell phone protection against damage or theft. Subject to a $25 deductible

- 2 claims in any 12 month rolling period

- doesn’t cover phones that are lost, I.e. disappear without explanation

- bill must be paid by the Bilt Mastercard®

Auto Rental Collision Damage Waiver

- Pay for rental transactions with an eligible card and receive reimbursement of up to $50,000 if covered damage to or theft of your eligible rental vehicle occurs

- Go here to see exclusions and more details

Earn more points with BILT Status via interest on points

BILT established 3 tiers of status that is based off of how many points you earn in a year, or you can earn it via spend. Additionally, you’ll earn interest in the form of points, based on your point balance. This is akin to the Chase Sapphire Preferred® giving out a 10% bonus on points earned each year, but this is based on your total balance and will yield a rate akin to the national savings rate. A very nominal rate of return, but something is better than nothing.

Bilt status also given members a higher transfer bonus on big Bilt Rent Day transfer bonuses

- 75% blue

- 1000 Bilt = 1750 partner points

- 100% silver

- 1000 Bilt = 2000 partner points

- 125% gold

- 1000 Bilt = 2250 partner points

- 150% platinum

- 1000 Bilt = 2500 partner points

How can I use my Bilt Rewards?

There are multiple ways you can actually redeem your Bilt Rewards, but my favorite is transferring them to partners. Bilt has an incredible list of transfer partners and is the only program with both American and United as 1:1 transfer partners. Add in Hyatt and Bilt Rewards are arguably one of the most valuable point currencies out there.

Bilt Rewards 16 Transfer Partners – Only program with 1:1 transfer with American and United

BILT has a great list of transfer partners, and the IHG addition is nice, but honestly I’d never transfer to IHG from BILT. The partners like American or Hyatt are FAR, FAR, more valuable especially with IHG points often being on sale for 1/2 a penny a point.

Note that in March of 2024 they added Alaska Airlines

You can also redeem for 1.25c in the Bilt Rewards Travel Portal powered by Expedia

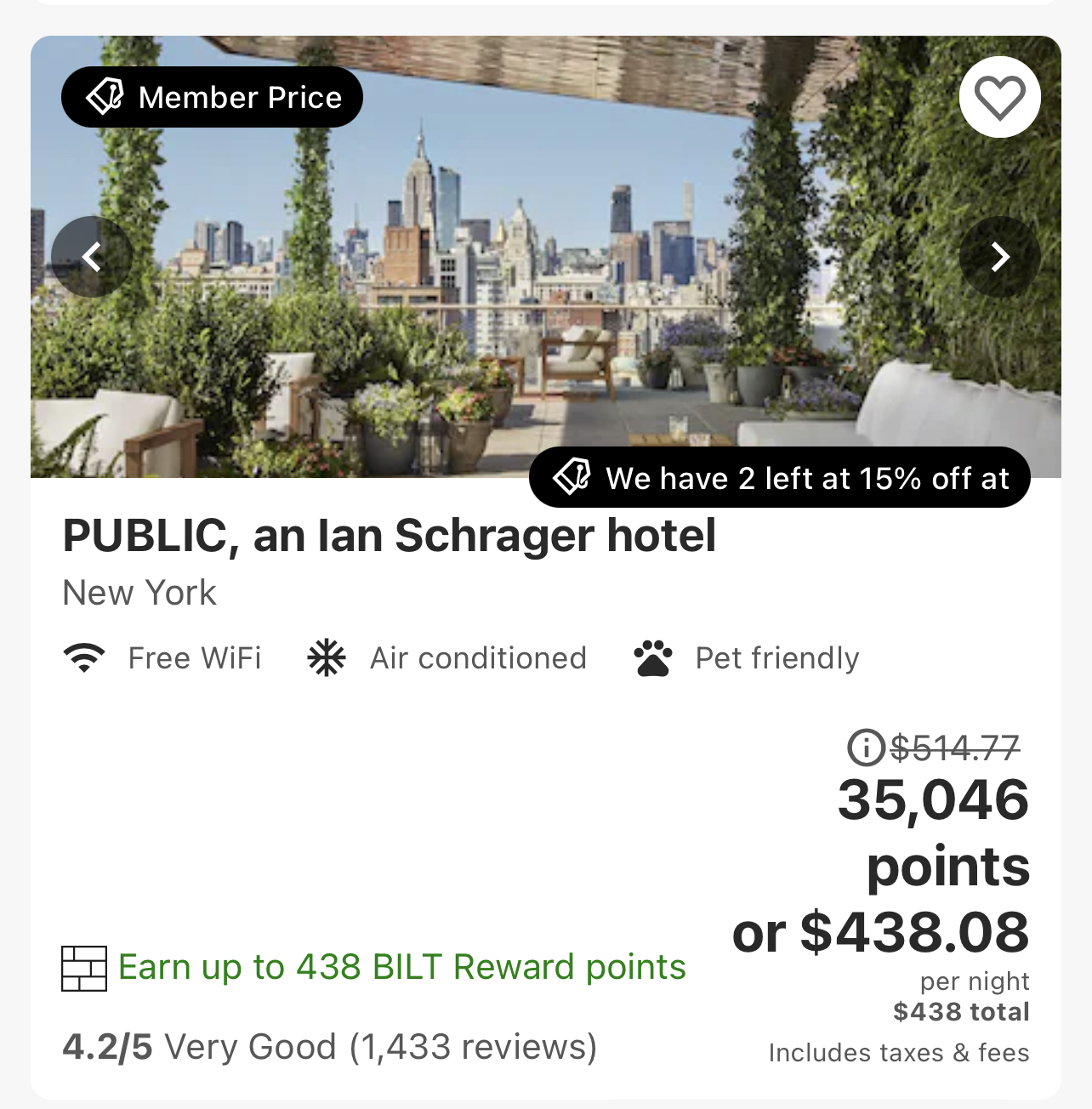

If you don’t want to transfer them to their transfer partners, you can redeem at 1.25c in the Bilt Rewards Travel Portal, powered by Expedia.

- Airlines

- Hotels

- Cruises

- Theme Parks

A quick example

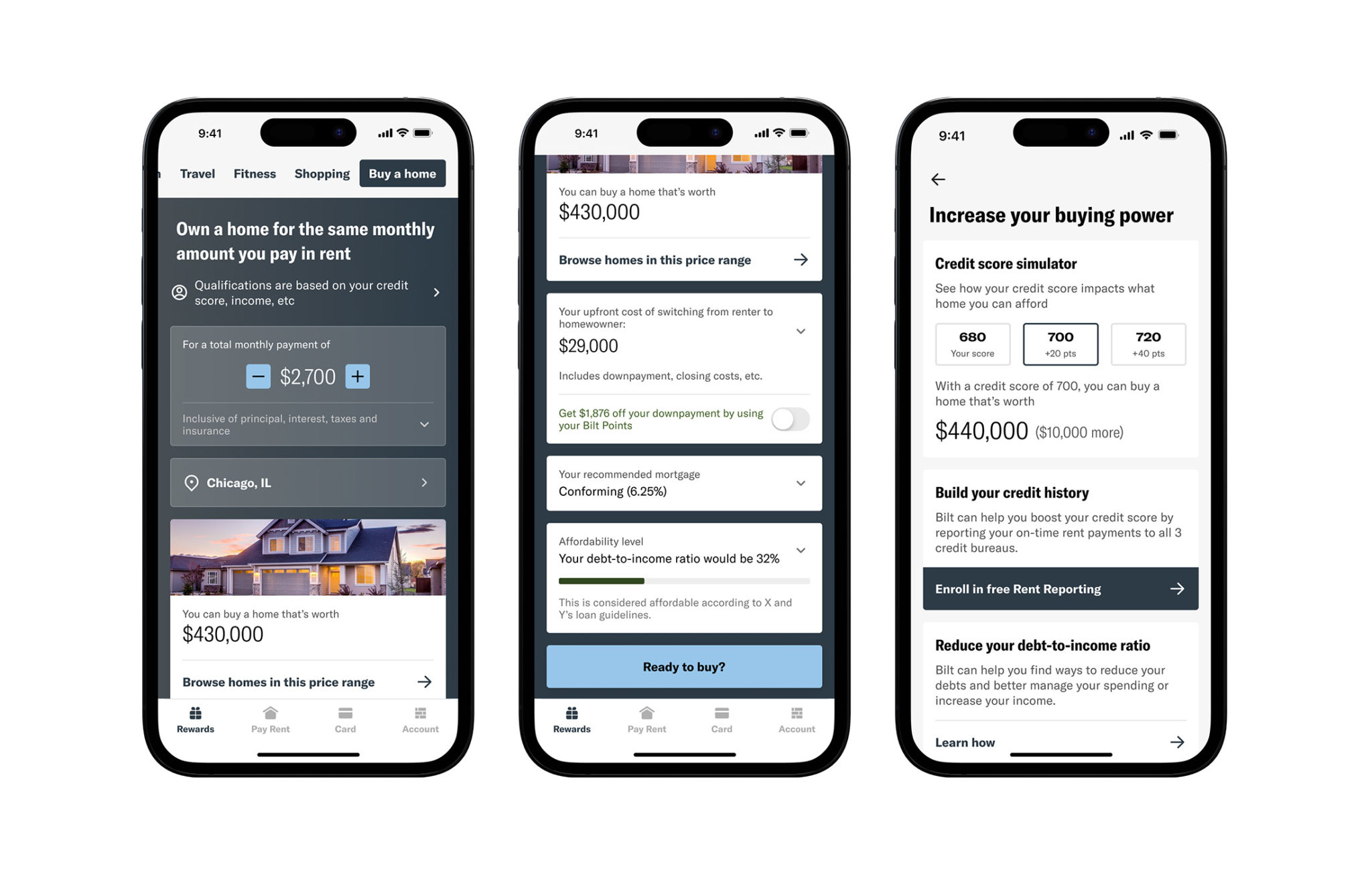

Redeem on a mortgage with Bilt Homes:

See what you could afford mortgage wise + use points for a down payment

Bilt Homes takes a member’s monthly rent payment and instantly shows them homes they can own for an equal monthly mortgage payment. The feature automatically factors in real-time interest rates, taxes, income, credit profile, and other personal data to determine mortgage qualification. Members can then use their Bilt points to help cover any downpayment and closing costs required to switch from renting to home ownership.

Redeem toward statement credits

Personally, this is not an option I would use, but you can pay off your statement balance at $0.055 per point.

Redeem toward Rent

This is similar to the statement credit payment, not something I’d do, and you only get $0.055 per point.

Bilt’s Homeownership Concierge (Gold, Platinum)

This is a service that Gold and Platinum members can use when redeeming Bilt Rewards toward a downpayment. A concierge will walk people through the process.

What are some great ways to use Bilt Rewards?

Bilt Rewards has a fantastic list of transfer partners that you can access whether you have the credit card or not. Let’s take a look at a few of them.

Hyatt

I’ve used points to stay at the feature image the Alila Villas Uluwatu for 30k points per night. It’s base room is a large villa with a private pool overlooking the cliffs of Bali. I mean can we say aspirational?

British Airways Avios

As I mentioned, you can link your account to Qatar Airways Avios. By doing this, your BA Avios populate in both your BA account and your Qatar Airways account and you can take advantage of some better pricing. For instance, you can book most routes from the US through Doha to the Maldives for just 85k Avios. That’s an outrageously good deal – a little tip for finding award avail is to look 10 months into the future, or within a couple weeks of departure for a last minute trip

United

Fly business class from the US to Europe or South America for 60k miles. You could make that if you maxed out your rent and renewed your lease. Pretty awesome.

American Airlines

One of the suite spots of AA is flying to Japan. You can fly in business class for 60k and first class for 85k. Japan Airlines has a phenomenal first class that would be well worth a redemption. Just don’t do this…but you can read our review.

If you rent…this is a complete no brainer.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.