We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Stephen, over at Frequent Miler, shared a great tip on getting a referral to populate again once it had disappeared. This could not have been better timed since both my Amex Platinum and Amex Gold stopped populating referrals late last year. After using Stephen’s tip, sure enough, I was able to generate Amex referrals once again. So…what’s the tip?

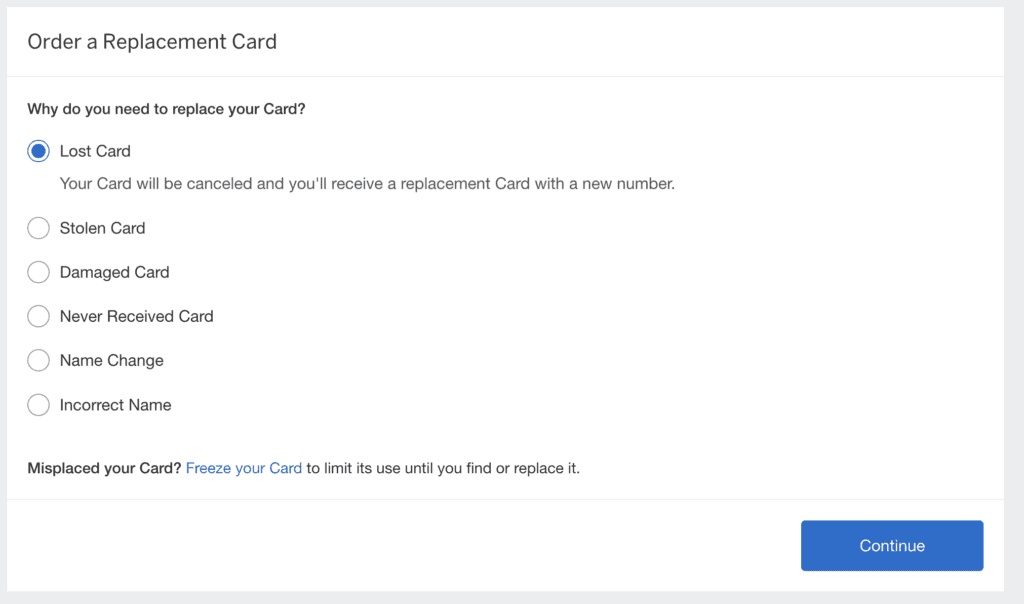

Lose your card to get Amex Referrals

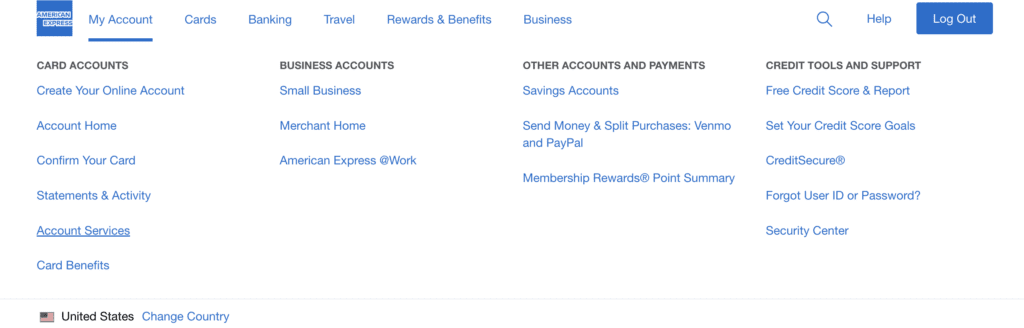

Yep…you just request a new card. Apparently, if you lose your card, the system will reboot on the back end and give you the ability to refer people again.

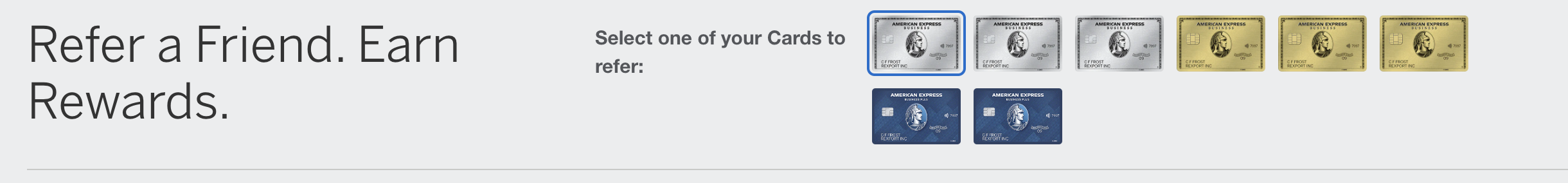

All of a sudden you can refer again

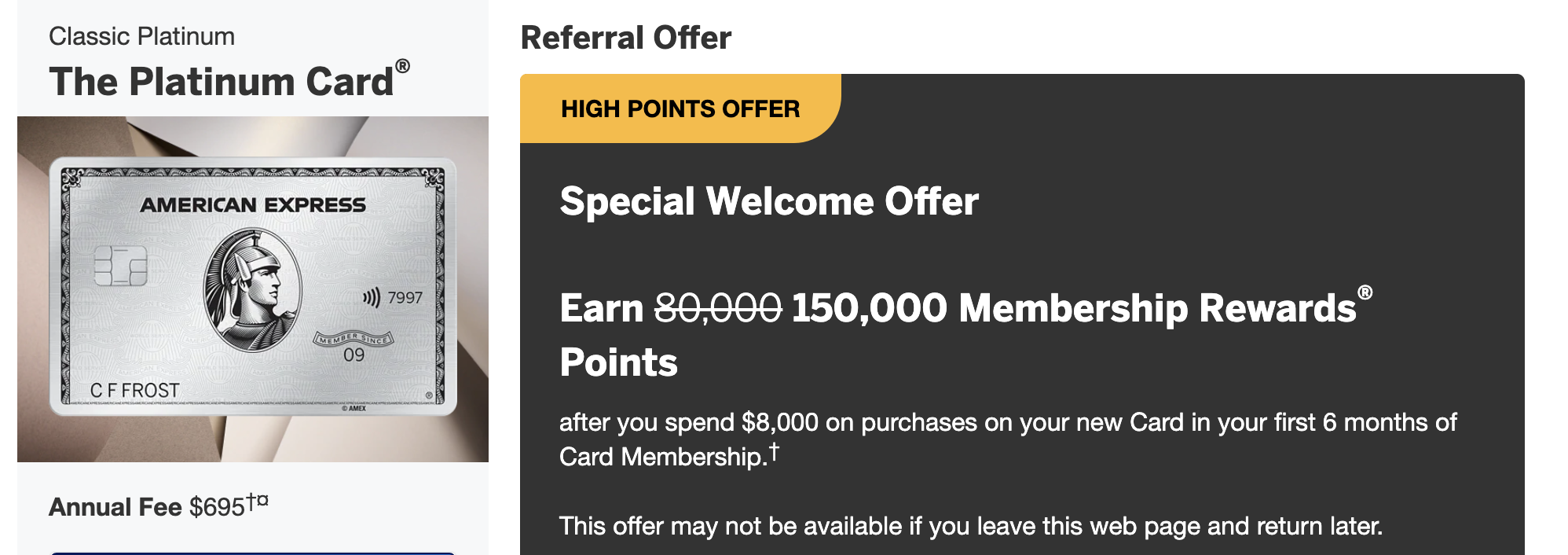

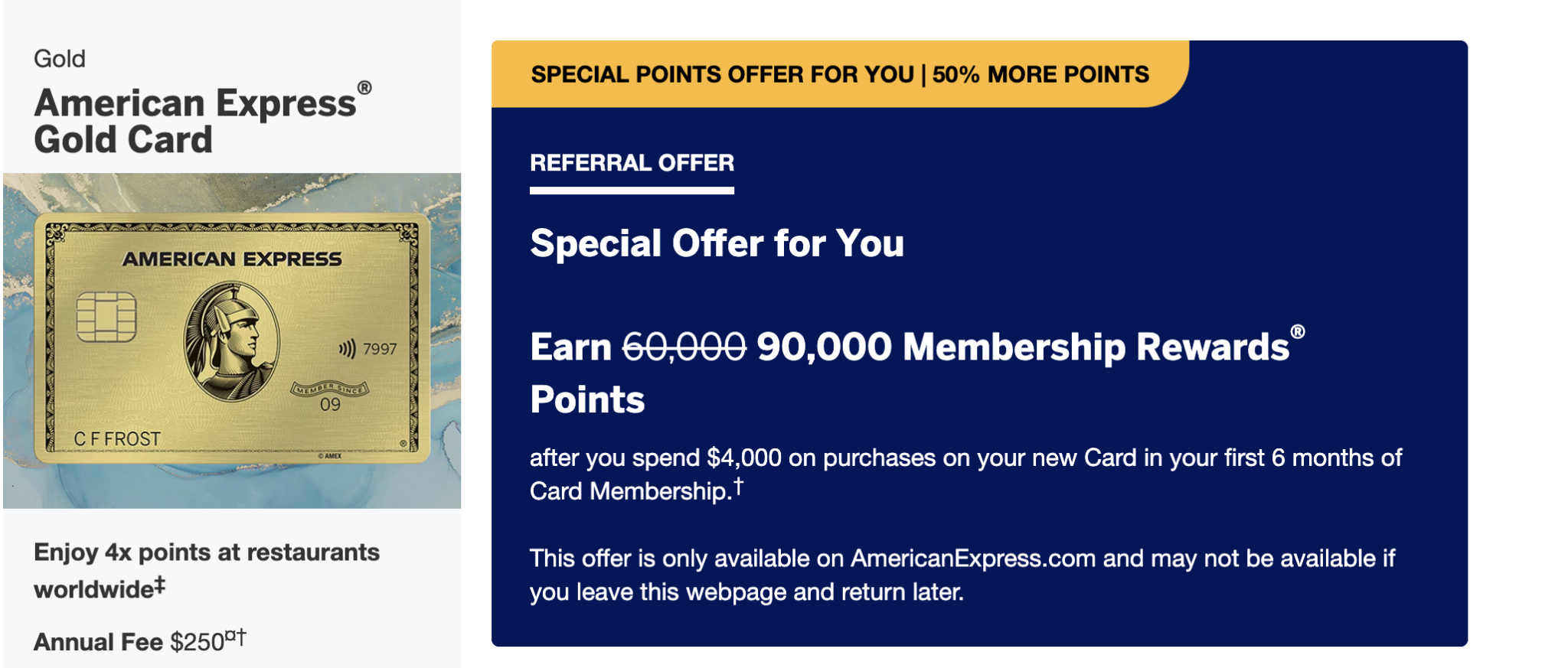

As soon as I reported my cards lost, I was able to refer. Note that you’d still need to open without cookies to see the higher offers

Platinum 150k offer $8k spend in 6 months – ( open private/incognito )

Gold 90k offer after $4k spend in 6 months my referral link ( open private/ incognito )

The problem…It looks like these referral codes disappear quickly

Last year, I did this and my Platinum card delivered within 48 hours, and my Gold card has yet to arrive, and the referral links aren’t showing up anymore. That doesn’t mean they don’t work, but rather, if you don’t copy and paste them somewhere while they are active, you’ll lose them once again. Luckily, I was prepared for this and copied my codes down before the option to refer disappeared.

If you look…my personal Platinum and Gold are gone

Recap

You can “lose” your card, request a new one, and once that account is generated, your ability to refer will be reinstated. But…make sure you copy and paste that code somewhere because it’s likely to disappear quite quickly.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.