We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Sapphire Reserve® Full Review

The Chase Sapphire Reserve® comes with a bevy of benefits, travel credits, and increased earn rates. But…is it worth it compared to having the Chase Sapphire Preferred®?

In the past few years we have seen an onslaught of super premium card offerings from Chase, Amex, Citi, and Capital One. I still contend the Capital One Venture X is the most straight forward super premium card for most people because it’s so simple to see the value proposition, but the Chase Sapphire Reserve® comes with a ton of benefits that could make it a very good value proposition to you if you utilize them.

Table of Contents

What are Chase Sapphire Reserve® benefits?

- $550 Annual Fee

- $300 Annual Travel Credit

- Each anniversary Year

- 3x on dining

- Earn rates via Chase Travel℠

- Earn 5x total points on flights

- 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠

- Bonuses starts after the first $300 is spent on travel purchases annually.

- Redeem rates via Chase Travel℠

- Redeem points at 1.5c valuation in the Chase Travel℠ portal

- Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Chase Sapphire lounge access

- Priority Pass membership

- $100 application fee credit every four years for

- Global Entry,

- NEXUS,

- or TSA PreCheck(R)

- Free DashPass (DoorDash and Caviar) for one year

- activate by December 31, 2024.

- No Fx fees

- Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

I use Chase Ultimate Rewards to transfer to Hyatt to stay at incredible places like the Alila Villas Uluwatu in Bali

Do you qualify for the Chase Sapphire Reserve® ?

First things first…Chase has quite stringent sign up rules for their Sapphire Products in general which includes their flagship Chase Sapphire Reserve® . Let’s break those down.

What kind of credit score do you need for Chase Sapphire Reserve®?

It’s our opinion that you should be good to go as long as you’re over 720 – nothing is published on this though.

What are the sign up rules for the Chase Sapphire Reserve®?

5/24

- Almost all of Chase’s cards are a part of their 5/24 rule. This means that you can not sign up if you have opened more than 5 credit cards in the last 24 months.

1/48

- Specific to the Chase Sapphire Preferred® and Reserve, you can not receive a welcome bonus if you have received one on either the Chase Sapphire Preferred or Chase Sapphire Reserve® .

Only one Chase Sapphire Premium product

- If you currently hold a Chase Sapphire Preferred or Reserve you cannot sign up for the card. Those who currently hold both can be grandfathered into holding both, but if you only have one, you’re restricted from another.

Is this the best offer we’ve offer seen on the Chase Sapphire Reserve® ?

6 years ago we did see offers as high as 100k – see our best offer spreadsheet for more data

What is the Annual fee of the Chase Sapphire Reserve®?

The annual fee is $550 and is not waived for the first year.

$300 Annual Travel Credit

This an annual travel credit that is issued per anniversary year is credited toward any travel purchase you make on the card. This differs from other card issuers who stipulate that purchases must be in a portal. The Chase Sapphire Reserve® does not. Here is how Chase defines travel

Merchants in the travel category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages

Rent a Tesla and use your Chase Sapphire Reserve® …you’ll trigger your $300 travel credit

Chase Sapphire Reserve® Earn Rates

The Chase Sapphire Reserve® earns 1x on every single purchase, but earns increased earn rates on select categores:

3x Travel and Dining

TheChase Sapphire Reserve® Earns 3x on travel and dining including pickup and select delivery services with a cap.

Here’s how Chase defines travel:

Merchants in the travel category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages

Chase Travel℠ earn rates

When you book travel via the Ultimate Reward travel portal you will earn at the following rates

- 10x Hotels and Car Rentals

- 5x Flights

Redeeming Chase Ultimate Rewards with the Chase Sapphire Reserve®

The Chase Sapphire Reserve® offers a couple different redemptions options when it comes to travel:

- Use your points at 1.5c per point with Chase Travel℠

- Transfer them to partners

Redeeming for 1.5c in Chase Travel℠

Personally, I think the best usage Is typically transferring them into partners, but every once in a while there is the opportunity ( like discount business class flights, 5 star hotels that don’t have point programs, etc ) where redeeming for 1.5c makes a lot of sense and cheaper than transferring.

- You typically will earn elite benefits when booking flights

- You won’t earn elite benefits when booking hotels or car rentals

Stay in 5 star boutique properties with the Chase Sapphire Reserve® like The Soho in London by redeeming points for 1.5c

Transferring points

Chase offers some of the richest points in the business with a great list of both domestic and international partners. With partners like Hyatt, United, Southwest, Marriott, and IHG I believe they have some of the easiest to redeem points.

I have used Chase Ultimate Rewards to fly in some of the world’s best first class products as well as stay in incredible 5 star hotels via transferring points like Emirates First Class

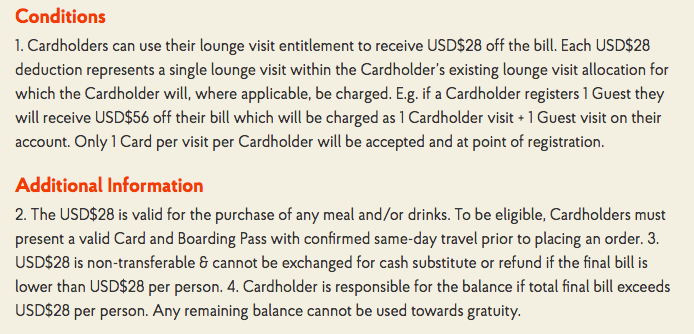

Lounge Access

The greatest perk of the Chase Sapphire Reserve® lounge access is the priority pass with restaurant access which gives the cardmember + 2 guests access to lounges but also $28 per person

|

|

Other Benefits

DoorDash

- Free DashPass through 12/31/24

- Or minimum of a 1 year

- If DashPass is activated between 1/1/24 and 12/31/24 you’ll have one year from activation

- Sapphire Reserve and JP Morgan Reserve cardmembers get $5k a month in DoorDash credits

- Up to $15 can be accrued before a $5 credit expires

- Up to 7 Authorized Users can receive the credit each month

Lyft Pink All Access + 10x

Through March of 2025, you’ll earn 10x on Lyft rides

Lyft Pink All Access

Lyft Pink All Access

- Free for 2 years, worth $199 a year

- activate by 12/31/24

- 50% the 3rd year

- Other benefits

- Free Priority Pickup upgrades to get picked up faster

- Member-exclusive pricing including 10% off all Lux rides

- Cancellation forgiveness, cancel up to 3 times per month for free

- In-app roadside assistance for your own car, free up to 4 times a year

- Free SIXT car rental upgrades

- Free, unlimited 45-min classic bike rides

- Free unlimited ebike and scooter unlocks

- Discounted ebike and scooter rates

- 3 bike or scooter guest passes per year

Chase Sapphire Reserve® Travel Protections

| Primary rental car coverage, up to $75k, some exclusions |

Trip Cancellation

|

Trip Delay

|

Baggage delay

|

Lost Baggage

|

Emergency Medical

|

Purchase Protection

|

Overall

The Chase Sapphire Reserve® is a super premium card that comes with an incredible amount of benefits and when you factor in this new increased welcome offer, I think you can justify getting it over the Chase Sapphire Preferred® for at least the first year.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.