This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Bilt Rewards Full Review

(I am a Bilt Advisor and Investor )

First off.. you don’t need to have a Bilt Credit Card to earn Bilt Points. You can join, free of charge, add your exisiting credit cards into the app and begin earning Bilt Points when you use those cards at Bilt Partners. We will get into that more down below, but let’s get into the new card offerings first.

Bilt 2.0 is in full effect and we have the official details on the cards below. There are three of them: Blue, Obsidian, and Palladium. Every single one of them earns 4% Bilt Cash alongside, and in addition to, earning Bilt Points. They all give you the ability to pay your rent or mortgage, but if you want to earn Bilt Points on that transaction, you’ll need to use your Bilt Cash to do so…$30 per 1000 points. Let’s dig into each card, but personally, I think the Bilt Palladium Card is the no brainer of the bunch with uncapped 2x Bilt Points, 4% Bilt Cash, and $600 of easy to use annual credits. It’s also the only one that is currently offering a 50k Bilt Points Bonus and Gold Status.

Table of Contents

3 Bilt Credit Cards

Earning points on Rent/Mortage has two options

Option 1: Bilt Cash

Each of these cards come with 4% back in Bilt Cash. If you spend $1000 in a month, you’d earn $30 and that could earn you 1000 points on $1000 of rent. It’s a sliding scale and you can use all or none of your Bilt Cash to earn points on housing

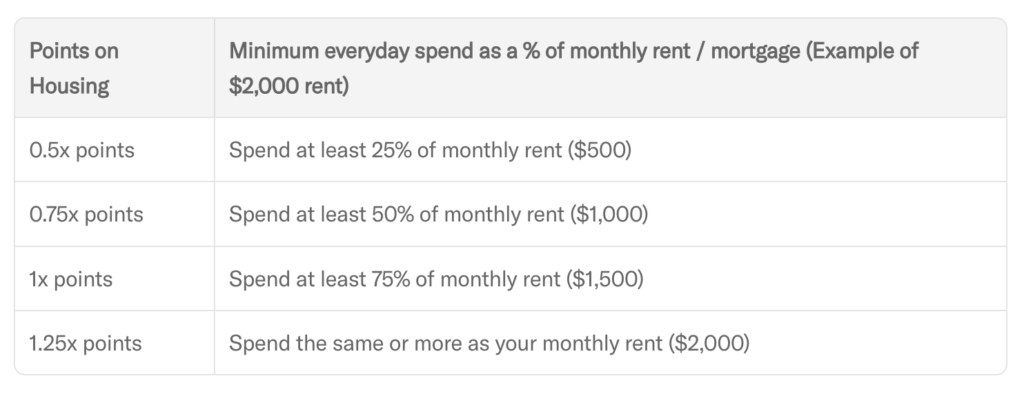

Option 2: Earn points via this table

If you’re doing the math…it’s basically the same thing; however, it’s broken into fixed ranges and no Bilt Cash is earned. If you don’t want to do Math… this could be an easy fix for you. If you don’t mind a little math, Option 1 is a lot more flexible.

Your rent/mortgage is pulled via ACH and does not use your credit line

Some people will love this, some will hate it because they can’t float their rent. One of the big complaints of Bilt 1.0 from those who used this feature is that rent took up a ton of of their credit line, and if they didn’t pay it off before their statement close, they had a very high utilization rate. So, Bilt now pulls your Rent and Mortgage via ACH. It’s then your choice how you want to use your Bilt Cash… earn points on housing or on other Bilt partners.

Places that you won’t earn points on spend – tax payments? Gift Cards? Hmmmm.

Wait I won’t earn points on quarterly Tax payments or purchases on Ebay, etc?!

As the details continue to roll out but here are places that you will not earn points on spend – i’m not sure exactly how this will be enforced especially on things like Gift Cards purchased directly with an airline or hotel or even those purchased at a grocery store. The Obsidian offers a choice to earn 3x at grocery stores with a cap of $25k. Would they not extend points if I bought a gift card at Christmas for my cousin alongside my groceries?

Most of this list is pretty typical though, you’re not going to earn points with any major issuer on money orders, wire transfer, cash advances, etc. But categories like taxes and marketplaces aren’t something that is typically singled out.

Time will tell, but there are quite a few unknowns and is this list definitive?! What will be added or subtracted?

- Tax Payment

- Ebay

- Facebook Marketplace

- Gift Cards

- Crypto purchases

- person to person like Venmo, PayPal, CashApp, Zelle

- Cash Advances,

- Travelers Checks

- Money Orders

- Wire Transfers

- Pre-paid cards

- Lottery Tickets

- Gambling chips, race track wagers

- Check that access account

“Eligible Purchases” or “Purchases” means transactions for goods or services made with your Bilt Card, minus returns, refunds, or credits. Purchases that do not earn Bilt Points or Bilt Cash: Balance transfers, Special Transfers, cash advances, travelers checks, money orders, wire transfers or similar cash-like transactions, prepaid cards, gift cards, person-to-person payments (such as Venmo, PayPal, Cash App, or Zelle), tax payments, online resale marketplaces (such as eBay or Facebook Marketplace), cryptocurrency or other digital currency purchases, fees or interest posted to your Account (including annual fees, late fees, and returned payment fees), lottery tickets, casino gaming chips, race track wagers or similar betting transactions, and checks that access your Account”

Hotel Cash needs to be 2 nights

The Palladium card comes with $400 a year in Bilt Travel. Part of terms requires a two night stay to use one of the $200 semi annual credits.

What the heck is Bilt Cash?

All 3 of these cards earn 4% back on purchases in the form of Bilt Cash. But what exactly is it?

What is it?

Bilt Cash replaces the Milestone rewards that were earned after certain thresholds of Bilt Point accrual in a calendar year. Instead, you’ll just earn a flat $50 of Bilt Cash after every 25k Bilt Points you earn, regardless of how you earn them. You’ll also earn 4% Bilt Cash on each of these cards. You can use that to offset rent/mortgage transaction fees at the rate of $3 per 100 Bilt Points.

How can I use it?

Two ways to earn Bilt Cash

- $50 every 25k Bilt Points that qualify for Elite Status

- This excludes sign up bonus points, Rakuten, etc

- 4% Bilt Cash on purchases with every Bilt Card

$25 of Bilt Cash is worth a $25 redemption on qualifying Bilt Partners shown below as well as getting a boost for Bilt’s Rent Day to the next status level for a bonus, accelerating your points earned on the Bilt credit cards, and offsetting rent/mortgages at the rate of $3 per 100 points.

| Category | Benefit Description | Monthly Credit | Annual Maximum |

|---|---|---|---|

| DINING & GROCERIES | $1,180 | ||

| Restaurant/Grocery Delivery | GrubHub delivery credit (available 3/1/26) | $10 | $120 |

| Home Delivery | Bilt 15-min delivery via Gopuff | $5 | $60 |

| Gopuff FAM Membership | Free delivery & discounted groceries (available 3/1/26) | — | $100 |

| Restaurant Partners | Select Bilt Dining partners via Mobile Checkout | Up to $25 | $300 |

| Dining Experiences | Exclusive Bilt dining experiences (available 3/1/26) | Up to $50 | $600 |

| TRAVEL & TRANSPORTATION | Up to $3,010 | ||

| Hotel Credit | Bilt Travel Portal (2-night minimum) | $50-$100* | Up to $1,200* |

| Lyft Rideshare | Lyft ride credits | $10 | $120 |

| Blacklane Rides | Premium car service | — | Up to $150* |

| BLADE Flights | Airport flights (available 3/1/26) | — | $700 |

| Priority Pass Guests | Extra guest fees (Palladium only) | Up to $70 | $840 |

| Parking | Participating Bilt locations (available 3/1/26) | $5 | $60 |

| HEALTH & FITNESS | $600 | ||

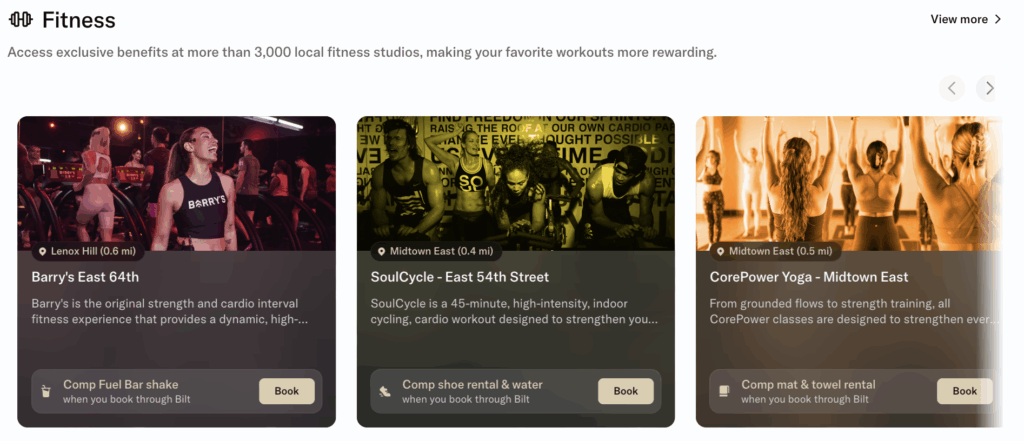

| Fitness Classes | Group classes (SoulCycle, Barry’s, etc.) | Up to $40 | $480 |

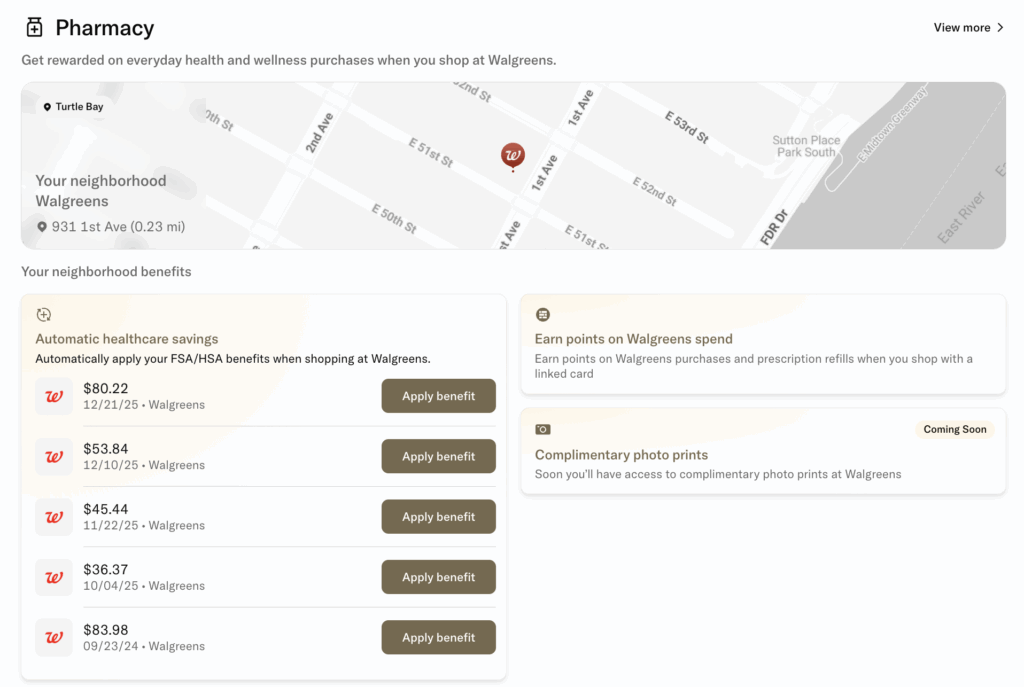

| Walgreens | Pharmacy/wellness credit | $10 | $120 |

| ENTERTAINMENT & OTHER | $720 | ||

| Comedy Experiences | Exclusive Bilt comedy shows (available 3/1/26) | Up to $50 | $600 |

| Design Collection | Bilt Design Collection purchases | $10 | $120 |

| BONUS POINTS | |||

| Point Accelerator | +1X on $5,000 spend (up to 5x/year) | — | 5 activations |

| Transfer Bonus Upgrade | Upgrade to next tier transfer bonus | — | Variable cost |

| Rent/Mortgage Points | Unlock 1X points on housing payments | — | $3 per 100 points |

| Home Away Benefits | Unlock luxury hotel benefits (Blue/Silver) | — | $95 one-time |

Does it expire?

Yes, at the end of every year. $100 would rollover.

Do I still earn Bilt Points

Yes… this is an additional reward currency alongside Bilt Points, not a replacement.

Are there maximums I can use

Yes there are, but we’re unclear when and how that will firm up as the program comes into action. Stay Tuned, but yes, there will be as I understand it.

Ways to earn Bilt Points without having a Bilt Credit Card

You can earn Bilt Rewards via multiple avenues…via the Bilt Rewards Alliance, using a Bilt Credit Card, but you can also join Bilt Rewards and load your existing credit cards and earn Bilt Points when you make purchases with partners.

Load your any credit card into the app to begin earning on Bilt Partners

You simply add your existing credit cards to Bilt Wallet and seamlessly earn Bilt Points when you use that card at Bilt partners

Ways to earn Bilt Points without having their credit card

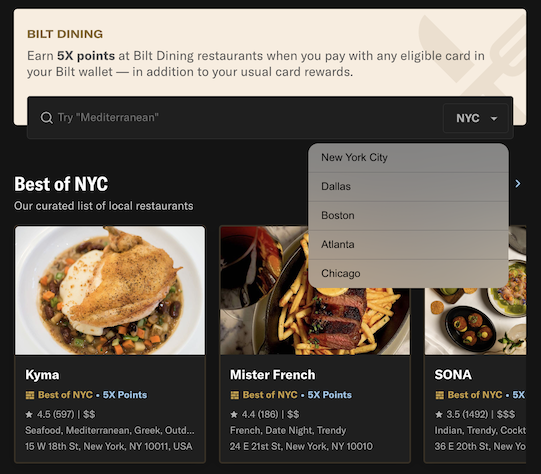

Bilt Dining earns an additional 5x on points

In April of 2023, Bilt introduced a Dining Program that earns additional rewards and access to exclusive benefits at Bilt Neighborhood Dining restaurants if you eat at restaurants participating in the program.

This works in a similar way to any other dining portal, except you’re earning additional Bilt Rewards instead of AA, United, Alaska, etc.

You can pay with any debit or credit card linked in your Bilt app, but if you currently have a Bilt Credit Card, it’ll be automatically added. Everything works behind the scenes, so you don’t pay with the app, you just use your credit card as you normally would, and you’ll receive your additional points in 7 or so days.

Rakuten – easy way to stack loads and loads of Bilt Points

You can link your Bilt account with Rakuten and start earning Bilt Points on every single purchase you make online via Rakuten. First create an account – you can get $50 back on a $50 purchase when you use my referral.

Once you have a Rakuten account, link your Bilt account to Rakuten here

Once you’ve set that up, go to account settings and choose Bilt.

Why should you select Bilt Points instead of Cashback

- One…you don’t need a credit card vs Amex where you do. Anyone can sign up for Bilt Rewards. In order to earn Amex points via Rakuten you need to have a Membership Rewards earning credit card.

- I value Bilt points at over 2 cents. You can directly transfer them to Hyatt and Alaska as well as over 20 other partners shown below, but those two are the best hotel and airline points around.

- This means instead of earning 8% cashback on every dollar I spend via the portal, I’d be earning 8x Bilt Points. If I spend a $100 and earn 800 Bilt Points, I’m earning points worth $16+ or more than double the cashback rate.

- Not everyone values points like I do, but I almost always redeem my points for a higher than 2 cent valuation. On the low side, I can redeem my points in Bilt Travel in Amex Travel for 1.25 cents – so regardless, I feel comfortable I will extract value in excess of a penny.

Pay your rent via the Bilt Rewards App as an alliance partner

- The first, using their app to pay rent within their Bilt Alliance network. They have partnerships with over 2 million properties across the country. If your building is a part of it, it’s super easy and streamlined. You would simply onboard via the property owner’s rent portal, or via Bilt’s app. You could then have you rent processed and you’d earn points on your rent to the tune of 250 points per month.

Lyft

Link your account, pay with whatever card, and earn Bilt Points

Fitness

Pharmacy

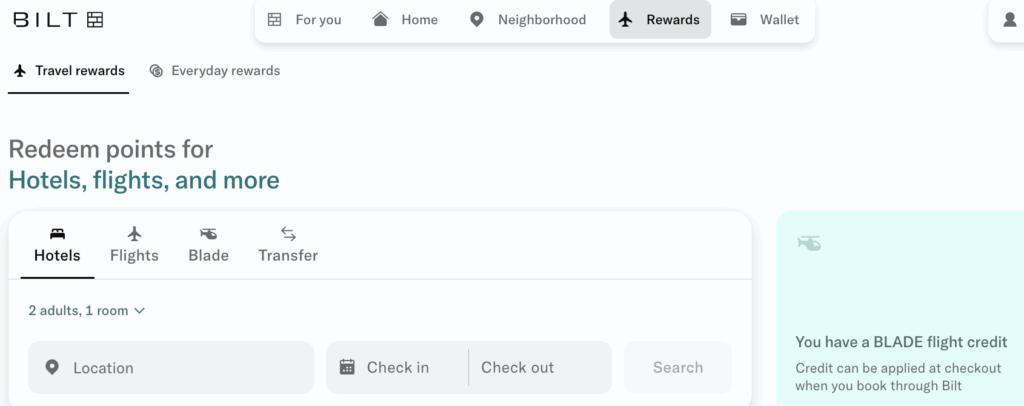

How can I use my Bilt Rewards?

There are multiple ways you can actually redeem your Bilt Rewards, but my favorite is transferring them to partners. Bilt has an incredible list of transfer partners and is the only program with both American and United as 1:1 transfer partners. Add in Hyatt and Bilt Rewards are arguably one of the most valuable point currencies out there.

Bilt Rewards Transfer Partners – Only program with 1:1 transfer with Alaska, United, and 5 Major Hotel Brands

BILT has a great list of transfer partners, and the IHG addition is nice, but honestly I’d never transfer to IHG from BILT. The partners like Alaska or Hyatt are FAR, FAR, more valuable especially with IHG points often being on sale for 1/2 a penny a point.

You can earn 2x Bilt Points with any card in Bilt Travel and redeem for 1.25c in the Bilt Rewards Travel Portal – direct hotel and airline bookings

Earning:

If you book via Bilt Travel, with any card, you’ll earn 2x Bilt Points. Meaning, if you want to book a United flight in Bilt Travel with your Capital One Venture X, you’d earn 2x Bilt Points, 2x Cap1 Points, and United points – as well as be able to use all your United elite benefits.

Redeeming

If you don’t want to transfer your Bilt Points to their transfer partners, you can redeem at 1.25c in the Bilt Travel Portal. This was custom built so that when you book via Bilt, most of the time your reservation counts as a direct booking with the hotel or airline. What does that mean? You’ll earn your elite nights, upgrade certificates, hotel and airline points, and will deal directly with the hotel or airline to resolve any issues or update your reservation.

- Airlines

- Hotels

You can see that Bilt tells you when you’ll earn hotel points, elite status, etc.

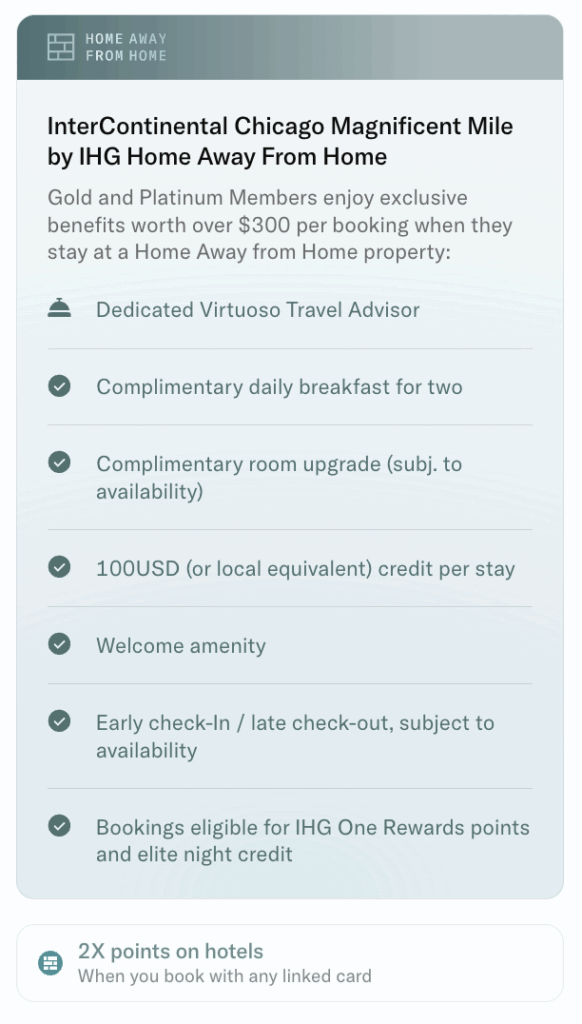

Home Away From Home premium hotel bookings – available to all Gold and Platinum members.

Home Away From Home premium hotel bookings – available to all Gold and Platinum members.

You’ll have a personal Virtuoso advisor and get a bunch of benefits when you book one of these properties. Yes, you can use your Bilt Cash here, as well as the $200 semi annual Bilt Hotel Credit that comes with the Palladium card.

What are some great ways to use Bilt Rewards?

Bilt Rewards has a fantastic list of transfer partners that you can access whether you have the credit card or not. Let’s take a look at a few of them.

Hyatt

I’ve used points to stay at a ton of Hyatt hotels and one that Is always my favorite Is Alila Villas Uluwatu for 30k points per night. It’s base room is a large villa with a private pool overlooking the cliffs of Bali. I mean can we say aspirational?

British Airways/Iberia/Aer Lingus/Qatar Avios

As I mentioned, you can link your account to Qatar Airways Avios. By doing this, your BA Avios populate in both your BA account and your Qatar Airways account and you can take advantage of some better pricing. For instance, you can book most routes from the US through Doha to the Maldives for just 85k Avios. That’s an outrageously good deal – a little tip for finding award avail is to look 10 months into the future, or within a couple weeks of departure for a last minute trip

United

Fly business class from the US to Europe or South America for 60k miles. You could make that if you maxed out your rent and renewed your lease. Pretty awesome.

Alaska Airlines

One of the suite spots of Alaska is flying on American Airlines. You can fly in business class to Europe starting at 45k miles. I’ve done this several times and it blow my mind.

FlyingBlue

I’ve used the poitns program of KLM and Air France to fly not only those airlines, but also Delta. In fact, one of my favorite ways to use FlyingBlue is domestically in economy for short flights between hubs ( Atlanta to Indianapolis for instance ). I’ve also had great luck using FlyingBLue miles long haul and getting value from their promo rewards

Being a member is a no brainer

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.