We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex Everyday Preferred Referral Bonus up to 30k

Information about this card has been collected independently by Monkey Miles. Card issuer is not responsible for the information or accuracy.

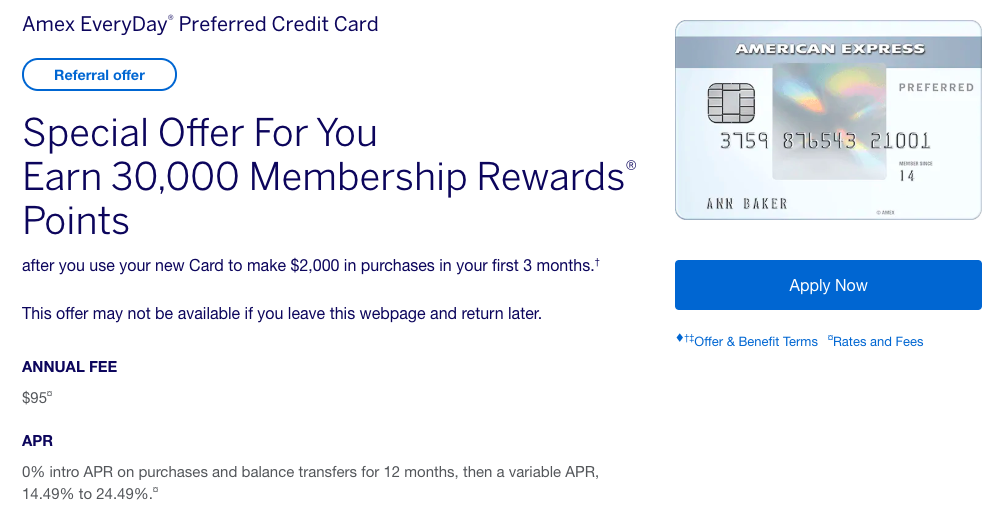

American Express has made a lot of noise recently with the revamping of both the Green and Gold card that resulted in us adding both cards to our wallet. A card I’ve long had my eye on has been the Amex Everyday Preferred card, and as I was perusing my referral offers, noticed it was at, what I believe to be, it’s highest ever offer: 30k Membership Rewards after spending $2k in 3 months.

It’s worth noting that the card comes with an annual fee of $95 and it isn’t waived the first year with this offer. Also, unfortunately, if you’ve ever had this card before in your life you can’t get the sign up bonus again. Mega bummer.

The card comes with great benefits like travel insurance, lost baggage coverage, car rental loss and damage insurance, and roadside assistance. You can read more about those benefits here, but those bennies aren’t the reason I like the card so much.

Here’s how it works with our site and referrals: do not spam post or I’ll block your referral

First off, this is meant to help everyone. So, if you’re posting your referral a dozen times a day, week, month, and trying to manipulate the comment section, I’m going block your referral for abuse. No ifs ands or buts – if I see you’re doing it, or you’re flagged by another use, I’ll just block you from ever posting. Let’s not ruin a good thing.

We earn commission when you use our links via our partner Cardratings or CreditCards.com and are really grateful when you do, but we also publish other deals that may be attractive to you. Referrals, are one of those other deals, and is a way we can give back to you for supporting us since you earn a referral bonus when someone uses your link.

We want to give you an opportunity to earn some valuable points as well, and so this is how we go about doing it.

- We add our own referrals first

- Because we use a ton of points every year and publish reviews of the flight and hotels we take, but we quickly max out

- We add those of friends and family to load up their accounts

- Once those are maxed out

- We then import your links from the comments section below to help you out.

- We usually leave those up for a few weeks and cycle through them, or when we get an email notifying us that someone’s account has maxes out

You can also leave referrals for

- The Platinum Card® from American Express

- American Express® Gold Card

- The Business Platinum Card® from American Express

- American Express® Green Card

- American Express® Business Gold Card

- Hilton Honors American Express Aspire Card

- Blue Business® Plus Credit Card

- The American Express Blue Business Cash™ Card

- Amex EveryDay® Preferred

*I would note that you get more action when the referral is correlated to the article.

Amex Everyday Preferred Referral Link

Why I think the Everyday Preferred card is so great

It earns multiple Membership Rewards per dollar spent.

- 3x points on all U.S. grocery store purchases up to $6,000 in a year

- 2x on all U.S. gas purchases

- 1x on all other purchases

- 50% bonus on all points if you spend 30 times on the card in a month.

- $95 annual fee

With this earning structure you can earn 4.5x points on all grocery store purchases and 3x on gas!

As long as you spend 30 times in a month, you’ll get a 50% bonus on all points earned….including the bonus categories. That means if you maxed out your grocery spend for the year you’d be racking up 27,000 MR every year

- 3* 6000= 18000 + (0.50*18000) = 27000MR

If you put 50 a week in gas you’d end up earning this:

- 50*52= $2600/year in gas purchases

- 2600*2 + 2600 bonus= 7800 MR

Between these two categories you’d be earning 34,800 MR every year and spending $700/month

That’s an incredible earn rate for points that are so valuable. In fact, if you just spent money on groceries and gas, and made sure you hit 30x per month, you’d earn almost 65,000MR your first year. That’s incredible.

- 30k Membership Rewards after hitting $2k Minimum Spend

- 34,800 by maxing out bonus categories

Why are Membership Rewards so valuable? The Transfer Partners

American Express has some of the very best transfer partners around. In fact, I used Membership Rewards to transfer to Aeroplan to fly on Lufthansa First Class earlier this year as well as the new Virgin Atlantic Upper Class on the A350. Both of these flights incurred heavy fuel surcharges and fees, but they are impressive ways to utilize your points.

Lufthansa First Class for 87k points

Virgin Atlantic Upper Class for 47.5k points.

You can use Aeroplan to fly Etihad now…hello Apartment!

Referrals + How our site works

In addition to earning a fantastic welcome bonus you can earn referral bonuses, up to 55k per year, on this card. The best part, is you don’t even have to refer to the Amex Everyday Preferred card. You can actually refer to ANY Amex card. This means, that in your first 12 months of card membership, you can refer people and earn 55k points in 2019, and then another set of 55k points in 2020. Add that to your welcome offer, and your category bonuses, and you’ve earned yourself a heap of points and spent just $95 on annual fees.

Here’s how it works with our site:

Referral offers is how I make upwards of 500k points a year, but it’s also how I can help you out. Since I’m constantly trying to use points on my travel for the site, I cycle through my referrals first, and usually very quickly I max out. I then work my friends and family through the site, and finally, I start adding your links to the body of my referal posts.

I leave them up for a few weeks and then cycle in another one. My Amex Gold card referral gets hit pretty hard every month so you should also leave links, for the Amex Gold, on that post as well.

Additionally, you can leave links on these posts:

- American Express Platinum

- American Express Green Card

- American Express Gold Card

- American Express Business Platinum

- American Express Business Gold

- American Express Blue Business Plus

Also…don’t leave the numerical value of your referral. These change all the time and if you’ve left a number that is below the best referral offer currently available, people won’t use your link. Just a bit of advice.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.