We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The American Express® Gold Card

The American Express® Gold Card gets more swipes than almost any other card in our wallet. Why? I’m pretty much like any other American. Take away housing and transportation, Americans just like me spend more money on food than anything else. If only there was a card that aligned to those spend categories?

The American Express Gold card that earns 4x points on restaurants, 4x points U.S. supermarkets ( up to $25k a year, then 1x ), and a $120 annual dining credit (enrollment required), and $120 annual Uber Cash credit (enrollment required).

In terms of premium cards on the market – I’m not sure you could convince me there is anything better. Add in an amazing 60k Membership Rewards after $4k spend in 3 months offer and this card is a must have. (Rates and fees)

Amex didn’t stop at food either – Amex Gold will earn you 3x points on flights purchased directly with the airline or Amex travel. Like swanky hotels? Use your Amex Gold to gain access to The Hotel Collection for upgrade opportunities and resort credits just booking via the portal

When this card debuted in 2018, I named it the most compelling card of the year. It still continues to get more swipes than any other card in my wallet, and my wallet has a lot of them.

Let’s take a deep dive into the American Express® Gold Card

Is this the highest public offer we’ve ever seen

When this card debuted back in 2018 the public offer was 35k. It popped to 40k for most of 2019, and now referrals are offering up to 90k. The annual fee Is $250 (Rates and fees)

Amex Gold Benefits are truly incredible:

- Annual Fee is $250 *Rates and Fees; terms apply

- 4x points at restaurants

- 4x points at US supermarkets ( up to $25k a year, then 1x) )

- 3x points on flights purchased directly with the airline or Amex Travel

- up to $10 per month Uber Cash credit valid in US only (enrollment required)

- up to $120 Dining Credit at select restaurants (enrollment required)

- Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations.

- No Foreign Transaction Fees

- 1x everywhere else

- Access to The Hotel Collection

- *Rates and Fees; terms apply

That Sexy Rose Gold is back!

As you can see in our picture up above, we chose a Rose Gold Amex back in 2018. It doesn’t carry any additional benefits aside from the fact that it’s dope, a conversation starter, and even manages to make you feel sexy behind a mask wreaking of hand sanitizer.

If it’s something you’d prefer…you simply choose it

4x on US Supermarkets up to $25k a year – US Only

An average family of 4 spends $547.80 a month at supermarkets.

That’s almost 2200 points a month or over 25k points a year simply by spending what you’d normally spend a month at the supermarket.

I know quite a few people that when you combine dining out and supermarkets are easily spending a $1k a month. You’re talking about 50k a year just in those categories.

4x on dining – Worldwide

If you’re like me, dining out is one of the purchases that hits the top of your monthly spend and Amex Gold rewards you with 4x points on those purchases. That is incredible. You’ll also earn 4x on qualifying takeout and delivery.

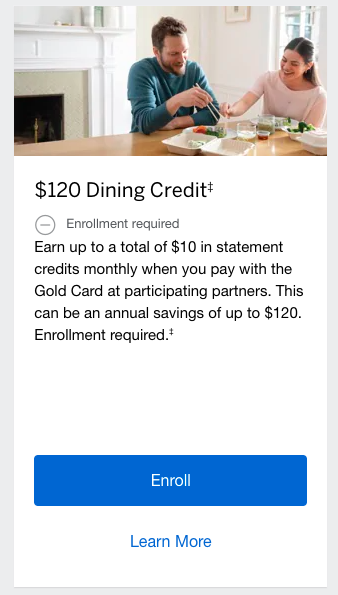

$120 Dining credit – don’t forget to enroll!

Once you’ve enrolled your Amex Gold it’s time to save some buckaroos! I’ve found that on months where I’m not going to hit one of the listed restaurants I can simply buy a gift card for that restaurant, in store, and use it down the road. These have been crediting, and after a few months I can go in and enjoy $20 or $30 all at one time. Or…I just have GrubHub deliver and enjoy $10 off my food. Win-win.

$120 Uber Cash Credit

This is a $10 a month credit and can be applied to Uber. Note that you need to add your card to enroll and receive a credit. Valid in the US only.

Annual fee is $250

This is a premium card and the fee should definitely be considered, but if you’re making use of the dining and uber credits, you’re wiping $240 of that annual fee off without even factoring in the welcome offer or the bonus spend categories. Personally, I think it’s the most bang for buck

3x points on airfare

Sure there are Platinum variants that offer 5x, but this card offers you a great 3x earn rate on airfare purchased directly from airlines or Amex Travel and is $300 less than an Amex Platinum.

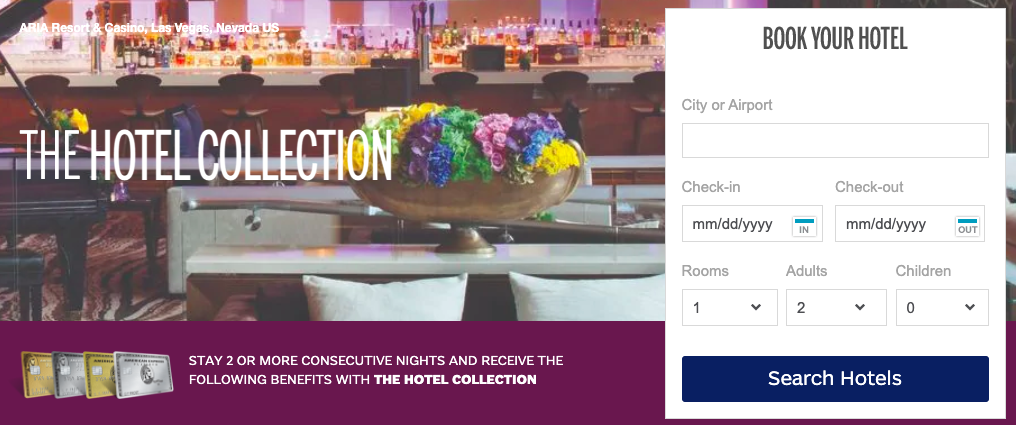

Access to The Hotel Collection properties

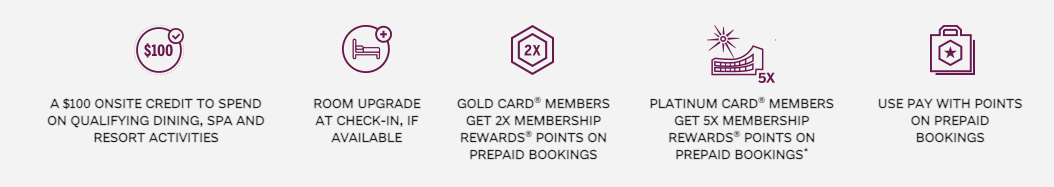

The Hotel Collection is a VIP hotel booking program, and is listed in our “Secret List of Hotel VIP programs.”

Amex Gold along with Platinum and Centurion cardmembers get access to The Hotel Collection program. This is a group of hotels that Amex has deals with to get guaranteed benefits just by booking via the portal.

It’s always worth checking rates and included benefits to make sure you’re getting the best deal.

Here’s a peek at the benefits you can expect to receive when booking via The Hotel Collection program.

The best part….Access to Membership Rewards!

The Transfer partners are amazing – and we included some aspirational redemptions

Lufthansa First Class for 87k points when transferred to Avianca.

87k points to fly in a cabin that would set you back 5 figures?! Avianca is also an instant transfer partner, meaning once you see the space, wham, bam, transfer your points and book your ticket.

Emirates First Class for 85k points when transferred to Emirates

One little “suite” spot of the Emirates chart is flying from Milan to New York on their A380, or Athens to Newark on their 777-300ER for 85k points. You’ll enjoy a suite with doors that close, top shelf champers, pjs, a vanity, and if your heart desires…a shower at 7 miles in the sky ( on the A380 ).

ANA First Class ROUNDTRIP for 170k when transferred to Virgin Atlantic.

One of the best bargains out there, and when you’re earning points in multiple programs that are partners with Virgin Atlantic, it makes access that much easier.

Singapore Suites for 53k when transferred to Singapore Airlines

Again, a mutual transfer partner of both Chase and Amex, and a great opportunity to fly in one of the world’s best first class products: Singapore Suites. For just 53k points you can fly between Singapore and India sipping Krug and feasting on lobster Thermidor. Better yet…Singapore eliminated taxes and fees on their own metal. BYAH!

Fly up to 14k Miles in Business Class for 115k points when transferring to Asia Miles

Asia Miles is a transfer partner of Amex and has many hidden sweet spots. One of which is their multi-partner award chart. Check out the link above if you want to read all the ins and outs, but you can fly A LOT for just 115k miles when you use Asia miles and fly on 2 or more One World partners of Cathay Pacific.

Overall

Since it debuted in 2018, Amex Gold has been a staple in my wallet, and continues to be one of my most recommended cards for people looking to earn a bunch of points where they spend the most, and enjoy fringe benefits they will actually use.

To see the rates and fees for the American Express cards featured, please visit the following links: American Express Gold Card: See Rates and Fees

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.