We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Table of Contents

11 of the Best Ways to use Amex Points

The American Express Membership Rewards program is one of the very best in the business. I personally have 7 American Express cards and the best part of the program, in my opinion, is the fact that you can transfer Amex Membership Rewards into 22 different partner programs. Why? These programs have their own sweet spots. It’s utilizing points for sweet spot redemptions that make your instagram or TikTok seem like your bank account has an extra comma 🙂

Here’s a look at all the wonderful partners of American Express Membership Rewards

- AeroMexico Club Premier

- Aer Lingus

- Air Canada Aeroplan

- Air France FlyingBlue

- Alitalia Millemiglia

- ANA

- Avianca LifeMiles

- British Airways Executive Club Avios

- Cathay Pacific Asia Miles

- Choice Privileges

- Delta SkyMiles

- Emirates Skywards

- El Al

- Etihad Guest

- Iberia Avios

- Hawaiian Airlines

- Hilton Honors

- JetBlue

- Marriott Bonvoy

- Qantas

- Singapore Airlines Krisflyer

- Virgin Atlantic

Amex Cards I would Recommend

- The Platinum Card® from American Express

- Lounge access, 5x on flights, Fine Hotels and Resorts, Uber Cash, and one of the best offers we’ve ever seen

- American Express Gold® Card – our most used Amex

- 4x on all dining, 4x on U.S. supermarkets up to $25k a year, $120 a year in Uber Cash, $120 a year in dining credits ( enrollment required), it’s one of my all time fave cards

- American Express Green® Card

- A Chase Sapphire Reserve killer – 3x dining, 3x travel, transit plus Lounge Buddy and Clear credits

- American Express Business Platinum Card

- Lounge access, 1.5x on purchases over 5k, Dell Credits, etc

- American Express Business Gold Card

- Earn 4X Membership Rewards(R) points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter).

- American Express Blue Business Plus

- 2x on every single purchase up to $50k a year, then 1x on additional purchases after that threshold is met

#1: Avianca Lifemiles

- US to Europe or South America for 63k in business or 87k for First Class

Odds are, unless you’re a Points and Miles geek like me, you may not realize that this South American airline has an incredible award chart. In late 2018, Avianca was added to Amex’s partner list and it has proved to be a great addition. Better yet, Avianca updated their website to make online redemptions easier, and while it isn’t fool proof, it’s much improved.

Pro tip: If you are seeing Star Alliance partner award space populate on United, but not on Avianca, you can email Avianca to manually pull the space. I’ve had to do this in the past and typically it’s resolved within 24-48 hours. Don’t forget that Avianca periodically has point sales, so if you’re short on Amex points, you may have the opportunity to fly

Not a bad way to fly for 63k points in business class

And of course Lufthansa First Class for 87k points

Another great use of Avianca miles is to simply fly within the United States on United in economy.

You can fly within the US for just 8750 miles. That is amazing. You can fly transcontinental business class for just 25k miles – keep an eye out for the 787-10 which features this business class

Within USA

- Economy 8750

- Business transcon 25k

USA to Europe

- Business Class 63k

- First Class 87k

USA to Africa

- Business Class 78k

USA to Asia

- Business Class 78k

- First Class 90k#2 :

#2: Virgin Atlantic

Yes, Virgin offers amazingly cool ways to fly, but did you know that some of the very best ways to use their points aren’t even on their own airline?! Virgin Atlantic has an incredible sweet spot when you use their points to redeem for ANA business and First Class roundtrip. What’s even better is that ANA released brand new first and business class cabins on their 777s.

ANA

This is the Virgin Atlantic Award Chart for ANA redemptions.

- Business Class

- Australia / Canada / Western USA:

- 105,000 points round-trip, 52,500 points one-way

- Europe / Central & Eastern USA / Mexico:

- 120,000 points round-trip, 60,000 points one-way

- Australia / Canada / Western USA:

- First Class from US to Japan ranges

- Australia / Canada / Western USA:

- 145,000 points round-trip, 72,500 points one-way

- Europe / Central & Eastern USA / Mexico:

- 170,000 points round-trip, 85,000 points one-way

- Australia / Canada / Western USA:

ANA stunned the world with their new 777-3ooER “The Room” Business Class and you can see why. It’s massive

Not to be outdone…let’s take a gander at “The Suite” – their new First Class offering

Air France/KLM

Yep, you can use Virgin Atlantic miles to fly on Air France. The chart is based on peak/off peak and business class one way from the USA to Europe ranges from 48.500 miles to 97,500 miles. Clearly, you want to find options that are off peak otherwise you could always search on Air France since it’s a transfer partner of Chase as well.

Read our review of Air France business class here

Delta

You can use Virgin Atlantic miles to fly on Delta as well, and in particular, to fly business class between the US and Europe for just 50k miles one way. This is significantly cheaper than Delta would charge using their own points, but this rate only applies to flights that aren’t going in/out of the UK.

This is a great redemption theoretically…in practice, finding the award availability for Delta One from the US to Europe is quite difficult, but still possible.

This is a great redemption theoretically…in practice, finding the award availability for Delta One from the US to Europe is quite difficult, but still possible.

Note that surcharges are now quite high on Delta flights booked using Virgin Miles

Virgin Atlantic flights

Don’t forget about using Virgin Atlantic miles on Virgin Atlantic itself…there are quite a few great ways to do this; however, be prepared to pay some taxes and fees.

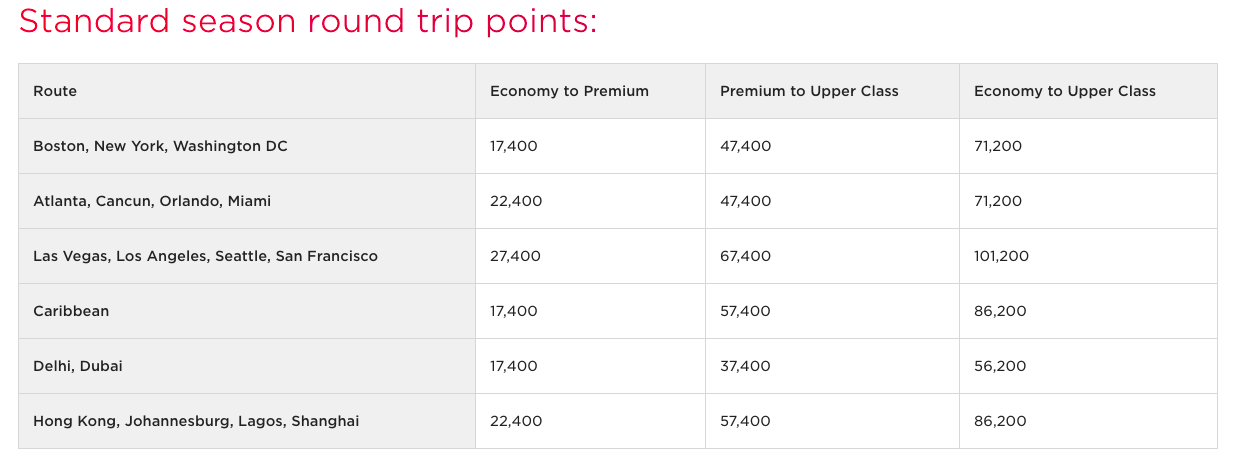

Upgrading a qualifying fare

Virgin Atlantic runs promos all the time, and you’ll often find Economy Classic or Delight pricing at $500 to $600 roundtrip from select US airports to the UK. A great use of Virgin miles is to upgrade those tickets to Premium Economy or Upper Class. That is done so using the following table ( add on a few more miles if its peak season )

You could use 71,200 miles to upgrade your roundtrip from Economy to Upper Class ( you’d still earn miles on the base ticket too ).

You could use 71,200 miles to upgrade your roundtrip from Economy to Upper Class ( you’d still earn miles on the base ticket too ).

Upper Class

Upper Class

Watch out for those taxes and fees…but Virgin Atlantic releases a lot of award space on their own flights. Like..a lot. With rates starting around 47,500 miles for a one way upper class flight, it may be worth paying $600+ in taxes and fees to fly Upper.

#3: Air Canada Aeroplan

Aeroplan just recently updated their award chart, and while devaluations occurred, they weren’t nearly as bad as some expected and much value was retained. You’ll be able to fly from the US to Europe for 70k miles in business class, and 100k in first class. A big thing that they added was the ability to incorporate a stopover for 5k miles and eliminated the surcharges that dissuaded many from using the program over say Avianca. A great redemption would be throwing 70k Amex points over to Aeroplan to ride in Swiss Business Class…especially if you get a throne. You could add in 5k miles to stop in Zurich for a while before heading on to Greece to complete your holiday.

North America to Europe:

- Business Class for 60k to 70k Miles

- First Class for 100k Miles

Within North America

- Under 500 mile flights – 6k miles in econ

- Under 1500 miles –

- 10k in economy

- 20k in business class

- Transcon

- 12.5k in economy

- 25k in business class

North America to Asia/SouthPacific

- USA to Japan/Taipei/Korea

- Business Class 75k

- First Class 110k

- USA to most of Asia

- 87.5k in Business Class

- 140k in First Class

- USA to New Zealand

- Business Class 90k

- USA to Australia via Abu Dhabi

- Business Class 115k

- First Class 150k

Aeroplan also announced that they were partnering up with Etihad.

Etihad unfortunately announced that their A380s aren’t going to fly the skies again. But…their 787s and 777s have an impressive first class and you can fly it from the East Coast of the USA to Australia for 140k. You could add in a stopover in Abu Dhabi for another 5k and experience some real Middle East luxury to break up the trip. It’s too good to even begin to describe.

#4: Emirates

One little “suite” spot of the Emirates chart is flying from Milan to New York on their A380 for 85k points. Now, before you jump for joy, the route isn’t currently being operated; however, I think once things normalize it’ll be up and running again. Emirates First Class should be more exclusive since they yanked award space from partners. To make matters better for those redeeming Emirates points, they also eliminated most of the fees as well. Those used to clock in at $500+ each way and now usually are less than $100.

One thing to also note…Emirates prices Europe to Dubai flights at 85k each way as well. So if you’re in Europe and looking for an amazing experience…it’d be a great redemption.

You’ll enjoy a suite with doors that close, top shelf champers, pjs, a vanity, and if your heart desires…a shower at 7 miles in the sky.

US to Europe

- Roundtrip Business Class to New York to Athens or Milan

- starting at 90k

- One Way Business Class NYC to Athens or Milan

- staring at 62.5k

- Roundtrip First Class to New York to Athens or Milan

- starting at 135k

- One Way First Class NYC to Athens or Milan

- starting at 85k

US to Dubai

- Roundtrip

- Business Class – from 145k

- First Class – 272,500

#5: Singapore Airlines

Using Amex points to experience one of the best first classes is just plain redonks. Make sure you utilize Singapore Airlines “Book the Cook” feature and try out the lobster Thermidor. Better yet…Singapore eliminated taxes and fees on their own metal a year or two ago which makes redemptions even better.

- US to Europe

- Business Class 81k

- First Class 121k

- JFK to FRA on Singapore Airlines

- Business Class 81k

- First Class 97k

- Houston to Manchester on SQ

- Business Class 81k

- From Singapore to India

- First Class 57.5k

- From Singapore to North Asia

- First Class 58.5k

I will note…Singapore is retrofitting their 12 A380s with the new first class and they aren’t currently bookable at the time of publishing. But, I would guess sometimes in 2021 they will be up and running and you and your partner can look forward to redeeming just 53k Singapore miles to fly within Asia on this bad boy.

If Singapore puts the A380 back on the JFK to FRA route, you could nab this insane experience for just 86k

Another hidden gem in the Singapore Airlines route map has always been Houston to Manchester. A great way to get to Europe…again we’ll see how this evolves post Covid, but assuming they reinstate this route, you could fly it for just 72k miles. A great hop across the pond

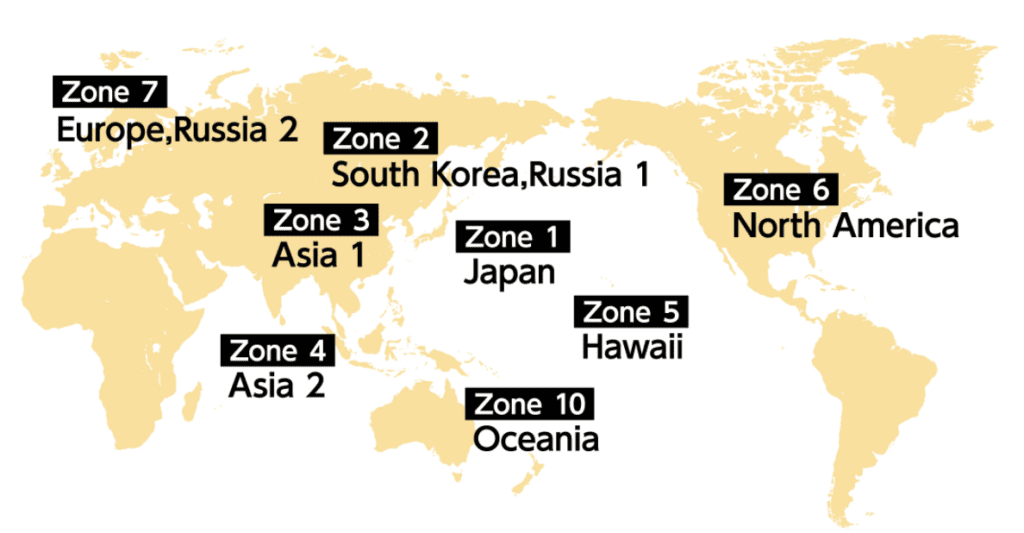

#6: ANA

ANA is a great transfer partner of Amex when you use them on flights to Japan, a few select airlines, or you don’t mind paying some crazy taxes and fees to save points. Let’s crack open this cool transfer partner.

Protip – If you use ANA miles on the following airlines you can avoid high surcharges.

- Air Canada

- Avianca

- Copa

- United

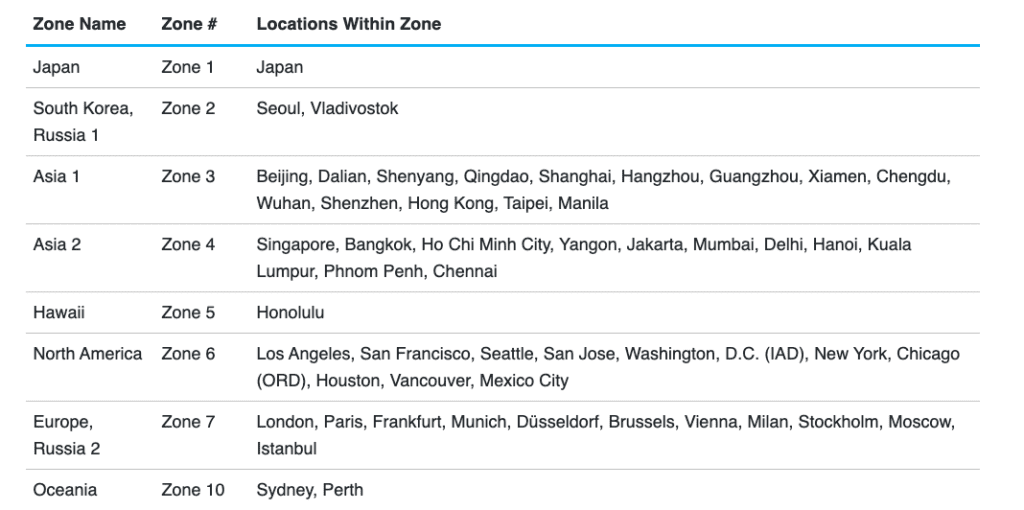

Here is how ANA divides the world like this:

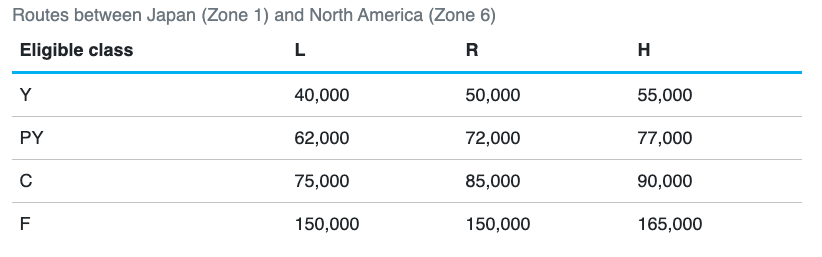

Examples to Japan + Asia that are pretty stellar – r/t biz from 75k

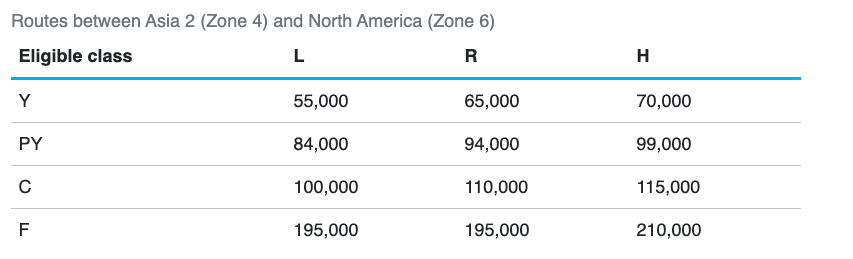

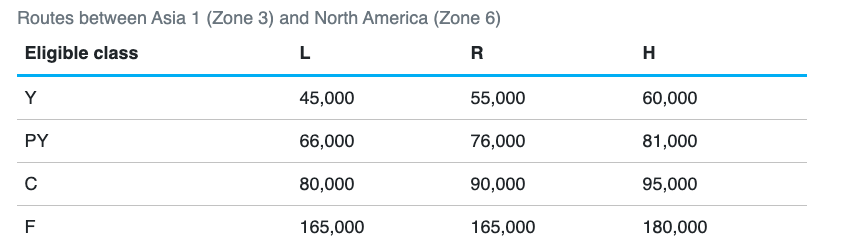

As you can see in the charts below, which divide the year into low, standard, and high seasons – you can land some incredible roundtrip business and first class deals.

- 85k Business Class Standard roundtrip from North America to Japan

- As low as 75k in low season

- 110k Business standard roundtrip from North America to Asia 2 ( Southeast Asian countries: Singapore, Vietnam, Thailand, Indonesia, etc )

- As low as 100k

You can fly roundtrip to Japan in The Room for just 75k points in low season. That is absolutely incredible.

Example: Roundtrip US to Europe in business class for just 88k miles.

You could fly in Lufthansa Business Class over and Ethiopian Business Class back and pay just 88k miles. You could also pay $500+ each way…so is it worth it?

Fancy a trip around the world?

You could fly in business class ALL THE WAY around by redeeming ANA miles. You could do an amazing trip on some of the best Star Alliance airlines in the world for 170k in business class. Just make sure you keep an eye on those taxes and fees.

I would highly recommend incorporating EVA if you can. Their business class is pretty much a first class experience.

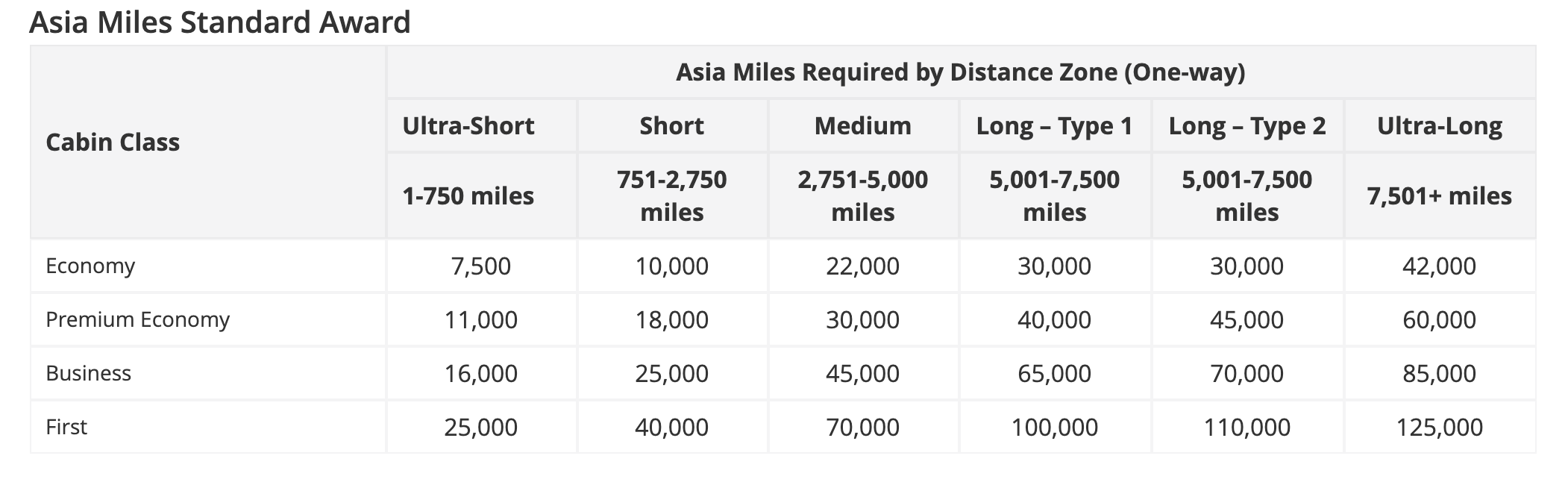

#7: Asia Miles

Asia Miles are the award currency of one of the best airlines in the world: Cathay Pacific. Like many airlines, they reserve a certain amount of award inventory for their own loyalists and this is where you could score seats before everyone else.

Get better access to Cathay Pacific First and business class

These rates are the lowest you’ll find for flights on Cathay’s own planes and they’re really pretty competitive.

You can have access to more award space and lock in business class to Asia from Anywhere in America for 85k miles. If you’re sites are set on Hong Kong and you live west coast…you’ll need just 70k. That’s an amazing price for one of the best rides in business

One of the absolute best first class products in the sky is Cathay Pacific First Class. Unless you’re 10 months out, it’s very rare to find award space outside of 14 days from departure if booking with a partner currency. Using Asia Miles will give you greater access, but you’ll end up spending more miles than you would on Alaska Airlines for example. However, 110k miles to fly an outstanding first class for more than 14 hours from LAX to HKG is worth 110k miles in my opinion

Fly up to 14k Miles in Business Class for 135k points when transferring to Asia Miles

One of the coolest redemptions you can do with Asia miles involves a TON of flying for only 135k miles. Check out the link above if you want to read all the ins and outs, but when you use their multi-partner award chart, which requires you building an itinerary with 2 non Cathay Pacific airlines, or 3 airlines if you include Cathay Pacific. If you flew

#8: British Airways

The biggest thing to watch out for when using British Airways Avios are the taxes and fees. So how do we get around them? Using them for flights on British Airways partners and upgrades on British Airways. Let’s take a look

Upgrading with British Airways Avios

BA makes it pretty simple to figure out whether or not you can use points to upgrade. If an award seat is available in the next cabin up, odds are, you can upgrade.

There are exceptions to these rules:

- Your ticket was issued by a partner airline American, Finnair, Japan Airlines, Cathay Pacific, etc

- You booked a fare coded as Q, O or G.

How many points will you need? Whatever the difference in a award price from your cabin to the next cabin up. The easiest tool I’ve found is the avios calculator here.

I have done this many times – the best…using 25k points to upgrade from a cheap business class ticket into BA first class from LA to London. You can read the review here

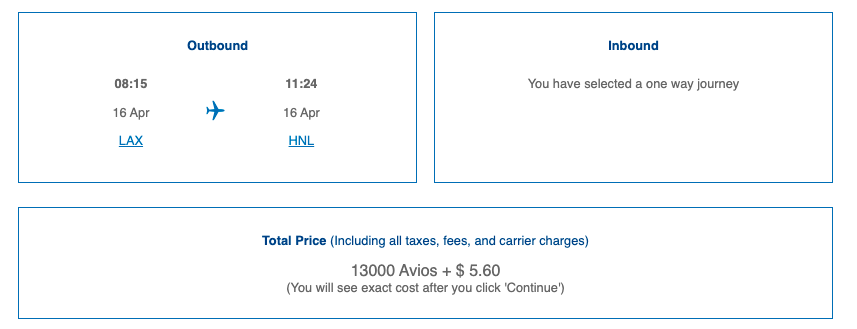

Using British Airways Avios for short haul flights on partners

This is another great use of British Airways Avios. Since their program is distance based, and they don’t tack on fees for flights on AA, this is a great thing to keep an eye on. Especially for flights to places like Hawaii. For instance, AA charges, at its cheapest 22.5k miles from LA to Honolulu in economy. That same flight, if you used Amex to transfer to BA, would cost you just 13k points. That’s pretty incredible especially given the fact that Amex runs 30-50% transfer bonus promos annually on Amex to BA transfers.

#9: Air France

Air France is an amazing Amex transfer partner and one that I have used consistently in the past for my own travels as well as award clients. One time to pay close attention to Air France is during their Flying Blue promo periods where they discount award prices between specific city pairs and cabins. These can drop prices by up to 50%. However…you don’t need promo periods to get great deals. Let’s take a look

Using Air France to fly on Air France Business Class

I think Air France offers one of the very best business class products from the US to Europe. One thing to note…avoid the A380. Other than that, especially with equipment upgrades, you’ll get a stellar product to fly flat and experience some tasty champagne and food in flight. One thing to note – Air France uses dynamic pricing which means there is no table, but if you can book biz between 50-72k you’re getting a solid deal. I booked the 77W in business class and you can read the full review here.

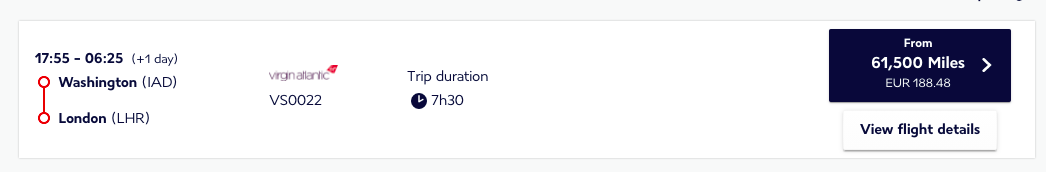

Using Air France to fly Virgin Atlantic Upper Class

This is a great use of American Express points that takes advantage of the partnership between Air France and Virgin Atlantic. Air France doesn’t throw as many taxes and fees on bookings vs what Virgin puts on their own award flights. You should be able to book Virgin Atlantic Upper Class starting at 61k + $200 give or take.

Don’t forget there is the classic herringbone styled Virgin Atlantic Upper Class seen below on the A330.

But also the new Upper Class featured on the A350

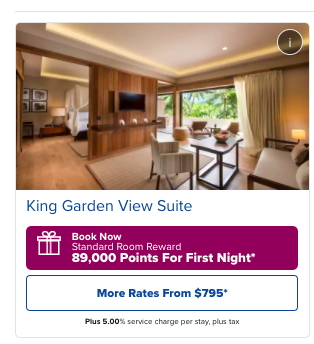

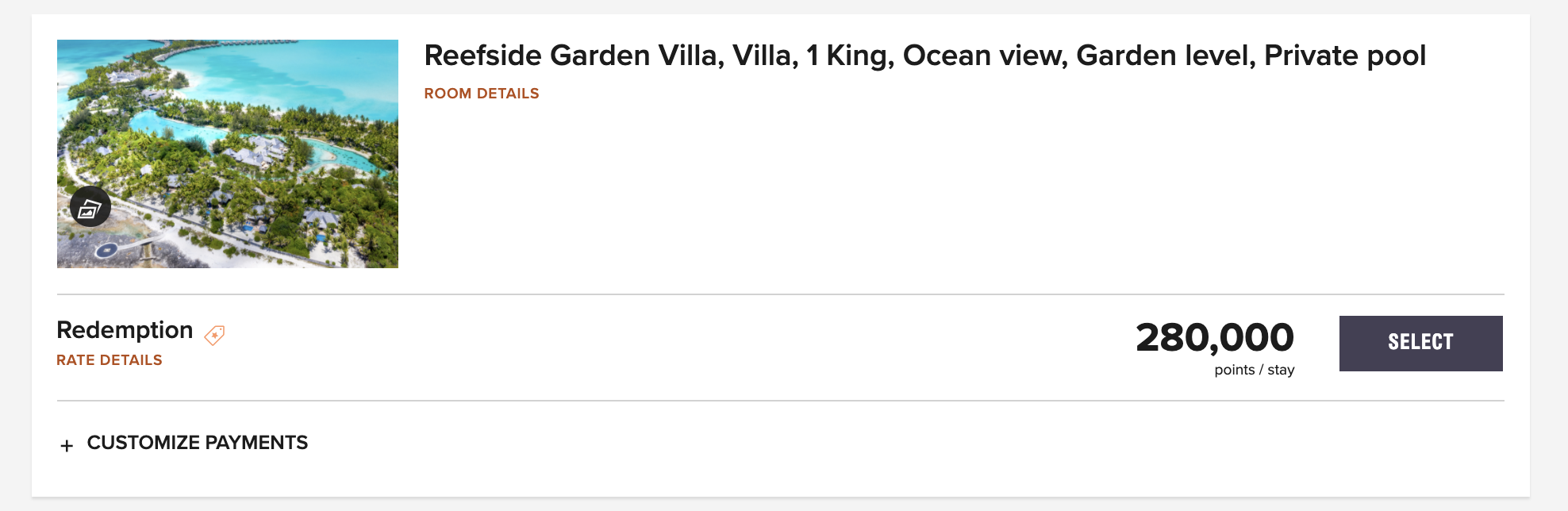

#10: Marriott at super expensive resorts

Usually I would never advocate transferring Amex points to any of their hotel partners, but for every rule there are exceptions. When you look at properties like the St Regis Bora Bora it’s hard to argue against transferring Amex points to Marriott…especially when there is a transfer bonus – currently you can get a 30% bonus.

This is the cheapest you can find the resort – 70k a night with a 5th night free. You could turn 216k Amex Points into just over 280k Marriott Bonvoy Points. The resort charges over $1k a night for this room, meaning you’re getting nearly $5k of value out of 216k points. That’s hard to argue against, but again…I wouldn’t be looking to Marriott for most of your Amex redemptions.

Best Ways to use American Express Membership Rewards #11:

Hilton at super expensive properties

I want to preface this by saying that usually transfer to Hilton are horrible deals. Hilton points are worth less than 1/2 of a single penny and Amex points are worth roughly 2 cents. Even with the transfer of 1:2 you’re still nearly 50% underwater. Unless…the value of the redemption far exceeds and makes up for this valuation gap.

Let’s look at the Conrad Bora Bora

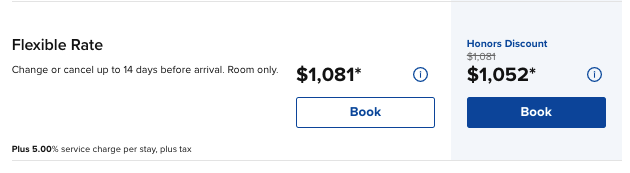

This is for January 2022 – a basic room is $1052 after taxes

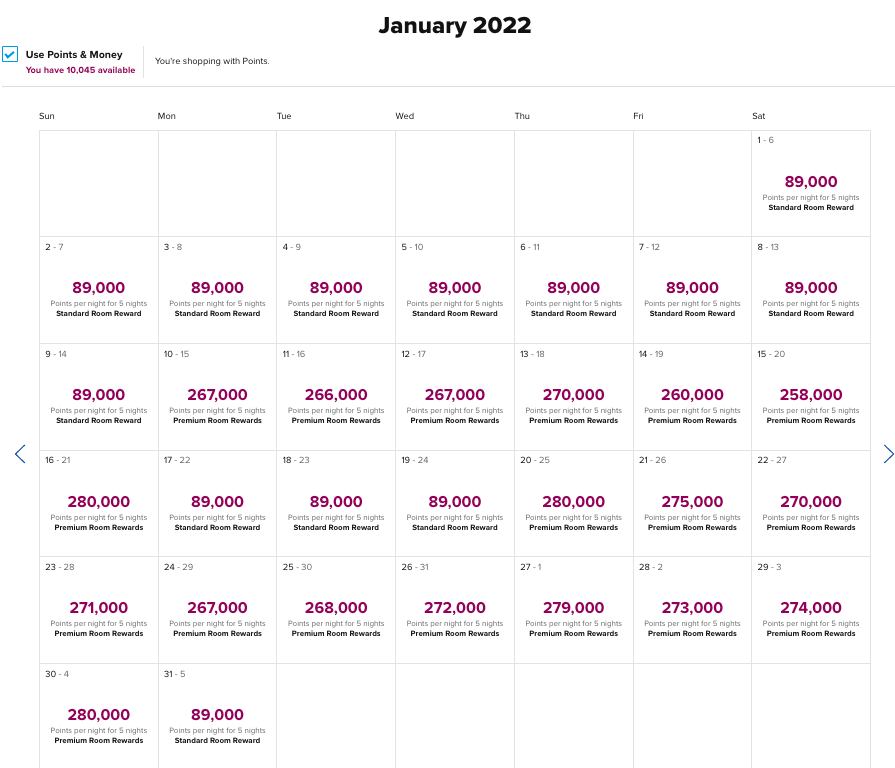

However…it could set you back 89k Hilton Honors

Loads of space right now too

Many, many more

This is just scratching the surface of amazing uses of American Express Membership Rewards, but hopefully you can see how the use of transfer partners can really increase the value of your points.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.