We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

American Express® Business Gold Card

The best aspect of the American Express® Business Gold Card is the ability to earn 4x points on 2 qualifying categories where you spend most in a month, up to a combined $150k a year. It’s an absolute workhorse for your point balance. You don’t have to select which categories you want to earn the 4x on because Amex does the work for you…whichever categories you spend most in a billing cycle will earn the 4x points. One month you wine and dine some clients and book a ton of airline tickets? BOOM! 4x. Another month, you’re buying online ads ? Boom…4x.

Let’s take a look at the American Express® Business Gold Card in further detail

Benefit Overview

- Earn 4X Membership Rewards® points on the top two eligible categories where your business spends the most each month from 6 eligible categories.

- While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter).

- Purchases at US media providers for advertising in select media (online, TV, radio)

- U.S. purchases made from electronic goods retailers and software & cloud system providers

- U.S. purchases at restaurants, including takeout and delivery

- U.S. purchases at gas stations

- Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

- Only the top 2 categories each billing cycle will count towards the $150,000 cap.*

- While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter).

- Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.*

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.

- Get up to a $12.95** statement credit back each month after you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. **Up to $12.95 plus applicable taxes on one membership fee.*

- The Business Gold Card now comes in three metal designs: Gold, Rose Gold and Limited Edition White Gold. White Gold design is only available while supplies last. Make your selection when you apply on Americanexpress.com.

- *Terms Apply

- See Rates & Fees

Earning 4x points on 2 categories made simple

Look at the categories listed below. The two categories you spend the most money on in a billing cycle will earn 4x points on those purchases. No need to select or activate categories…you’ll just the get bonus points.

The combined purchases in which you’ll earn 4x on are capped at $150k/year. That means there is whopping 450k bonus points on the table. It’s pretty awesome that restaurants, transit, and gas are all included bonus category.

- 4x on your choice of purchase at any 2 of the following categories

- U.S. purchases for advertising in select media (online, TV, radio)

- U.S. purchases made directly electronic goods retailers and software & cloud systemrs providers

- U.S. purchases at gas stations

- U.S. purchases at restaurants, including takeout and delivery

- Transit purchases

- including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

- Capped at $150k total on combined categories

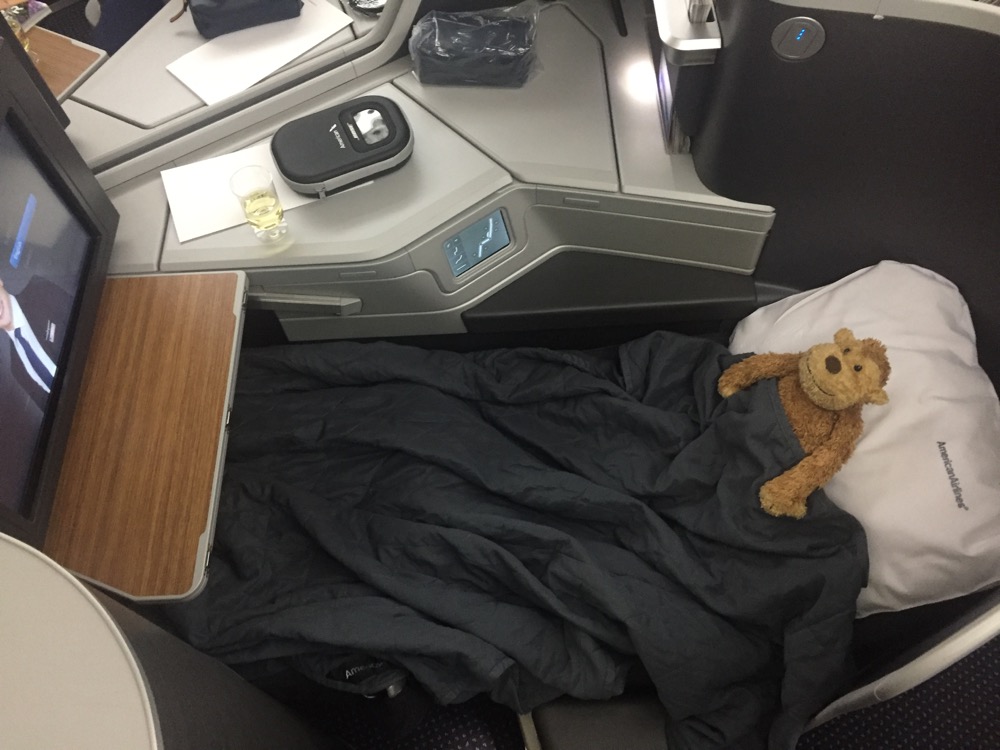

Etihad flights can be booked via Aeroplan and Etihad – both Amex transfer partners. This is a photo of the Etihad Apartment

Statement Credits

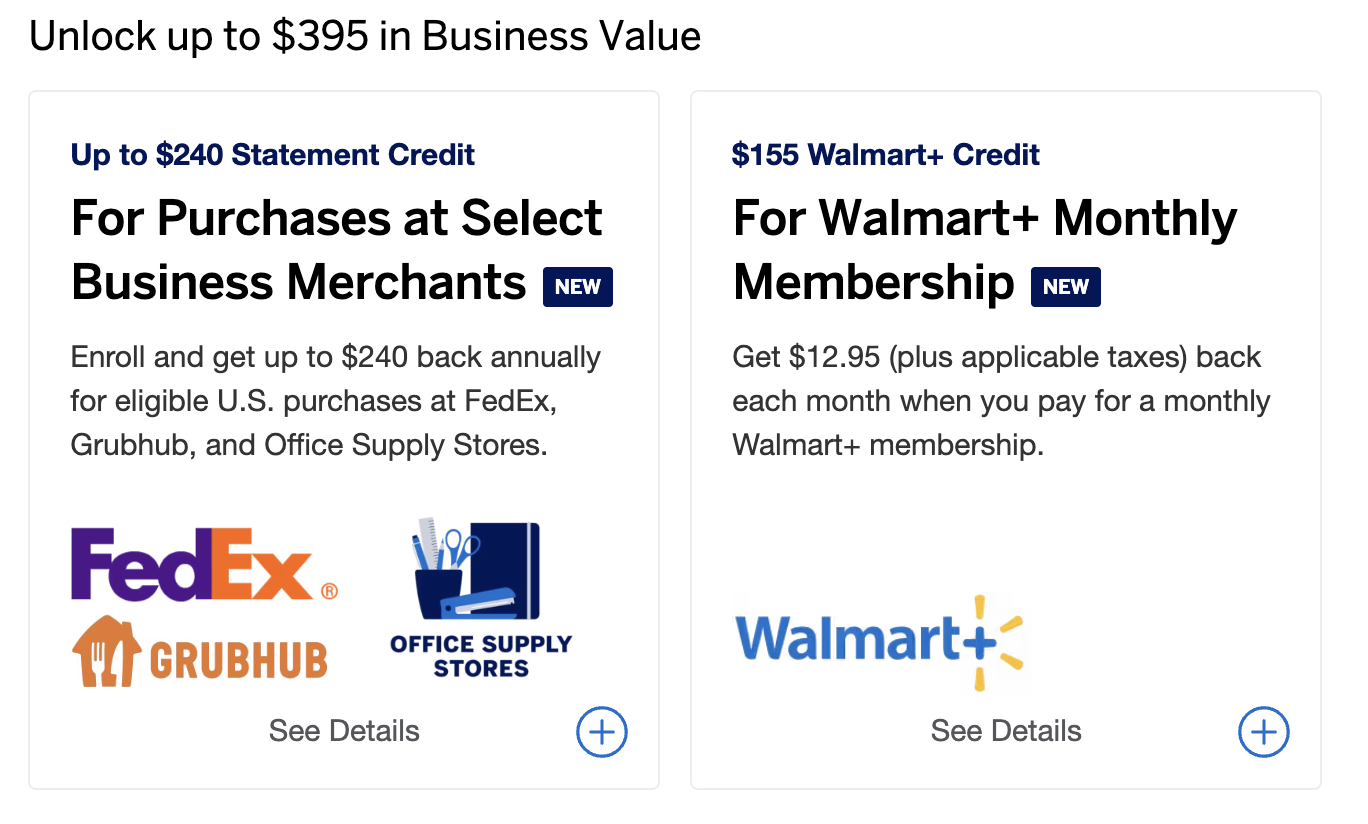

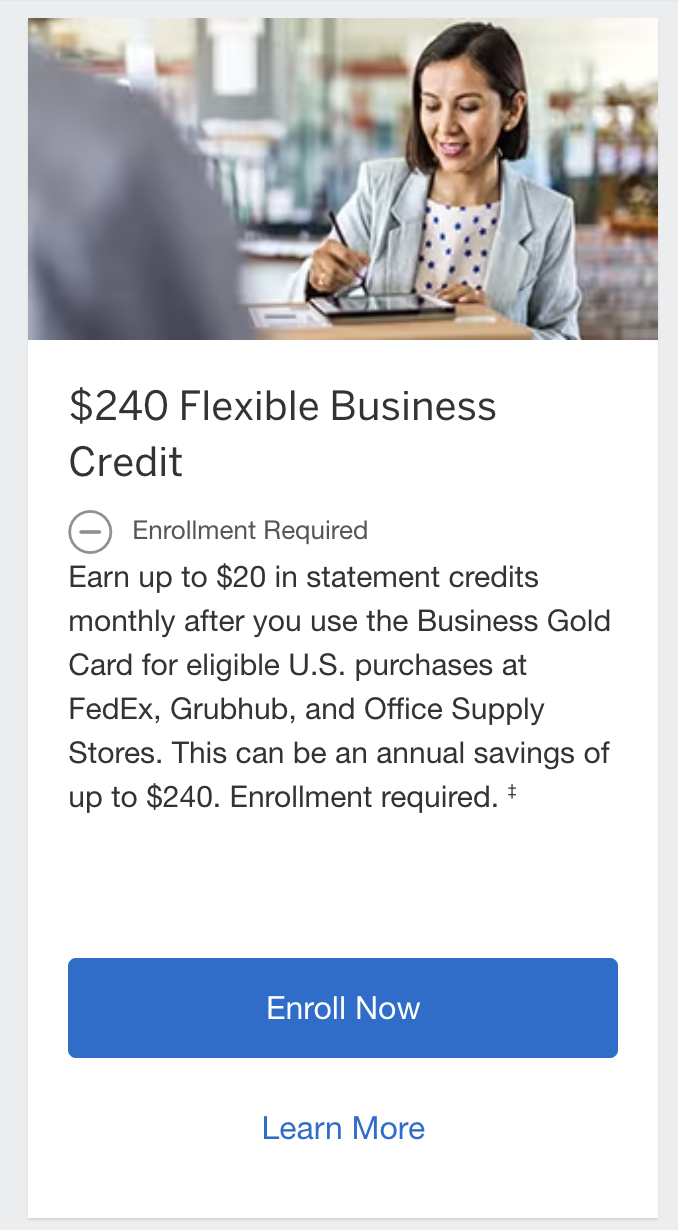

These statement credits need to be enrolled, and if you utilize them, can help offset much of the annual fee. Personally, I will be focused on Office Supply and Grubhub

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.

- Get $12.95 back in statement credits each month when you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. $12.95 plus applicable taxes.

Just remember that you need to enroll to get these some of these credits

Just remember that you need to enroll to get these some of these credits

Is this the best offer we’ve seen?

This is one of the best public offers we’ve ever seen. However, some people are receiving targeted offers anywhere from 70k to 90k with the same spend requirements. Keep an eye out for those!

But I don’t have a small business, Miles. You may, and not know it. Keep reading.

American Express is very friendly to entrepreneurs and small business owners alike. In fact, if you haven’t been in business for long, or you haven’t established yourself with an EIN, you can still apply as a Sole Proprietor ( fill in your SSN ). If you run a small side business (think bloggers, ebay sellers, tutors, consultants, Uber Drivers, DoorDash, etc – people who get 1099 income) and want a card to segregate your business income from your personal income at tax time…this is a great opportunity to earn a load of points and help yourself out. Please seek the advice of a tax professional, I’m simply explaining my personal experience.

Personally, I have two businesses that I run, one has an EIN, and one doesn’t. I still need to keep all of their records separate, and so I have cards for each business. And we love to fly like this: United Polaris from Brazil to Chicago and Newark to Tel Aviv.

American Express Membership Rewards transfer partners

This is the best part of holding Amex cards that earn Membership Rewards…the transfer partners. Amex has more than 20 transfer partners and these are the key to taking truly aspirational vacations.

What are some awesome uses of Amex points?

I’d highly recommend reading our list of best uses of Amex Points, but here are a few to whet your palate

Transfer to Aeroplan to fly United’s new Polaris

Or move miles to Avianca to fly Luftahnsa First Class

You could transfer to Emirates to fly in Suites

You could also transfer to Asia miles to fly Japan Airlines First Class

Recap

This card is crucial for business owners who spend a lot of money on the listed bonus categories. The ability to earn 450k bonus points in a calendar year where you’re already pushing a ton of spend is incredible and should be heavily considered. The $295 annual fee is something that should be considered, but if your business spends a lot on the listed bonus categories, you’ll quickly realize you’re earning a lot more value than you’re spending in the annual fee.

To see the rates and fees for the American Express cards featured, please visit the following links: American Express® Business Gold (Rates and Fees)

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.