We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Everything you need to know about Amex Offers.

We post about Amex offers quite often. Here’s the crazy thing: in our day to day conversations with friends and family I’m always surprised at how few people take advantage of them, and how much money/points is left on the table.

I find throughout the year the savings that can be had by adding Amex Offers to your targeted cards can outweigh your annual fee without taking any other benefits into consideration. Maybe not the entirety of the $2000+ that I pay in Amex Annual fees from my 11 cards, but every bit helps.

Here are the 11 American Express Cards that I keep and links to their current offers and why we have them in our wallet and recommend your consideration.

- The Platinum Card® from American Express

- American Express® Gold Card

- 3x The Business Platinum Card® from American Express

- 3x American Express® Business Gold Card

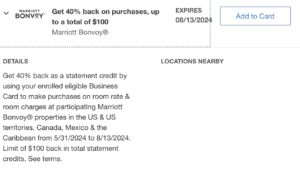

- Marriott Bonvoy Business® American Express® Card

What are Amex Offers?

These are targeted offers that populate in your card account after log in. Typically they come in these variants

- Spend a certain amount, get a statement credit

- Spend a certain amount, get bonus points

- Get bonus points on purchases with a certain retailer

- usually capped a specific total, but not always

Who gets Amex Offers?

Simply, if you have an Amex, you’ll have offers.

Where can I see Amex Offers?

After you log in to your account simply scroll down on the login page and you’ll see Offers and Benefits. Each of your cards will have specifically targeted offers ( the max is 100 ), usually in varying total amounts, and they will look like this:

Is my card automatically enrolled?

No, you need to add each individual offer to the card it’s targeted for, and use that card to pay. For instance, using the above images. My Amex Platinum is targeted for a Sam’s Club statement credit. Even though I have multiple American Express cards, I would need to use my Amex Platinum at check out in order to get the credit on my statement.

More than one card is targeted for the same offer. Can I double dip?

This used to be something that happened quite often, but Amex has cracked down on cardmembers utilizing the same offer across multiple cards. In fact, Amex has started to rake back points accrued via this method, and your account could get flagged for abuse. Personally, I wouldn’t recommend trying to circumvent the system.

How quickly do points post?

In my experience, very quickly, in fact, most of my points post within 3 days of using the offer. However, typically, Amex states the bonus points should populate your account within 90 days

Are Amex Offers Stackable?

Yes as long as you meet the terms and conditions. For instance, if your Amex Gold card is targeted to receive bonus points at a specific restaurant, you’ll get your 4x points in addition to the Amex Offers bonus.

Additionally, if you want to stack a hotel offer with Amex Platinum Fine Hotels and Resorts, you can. But, be aware, many times these offers need to be booked via the hotel’s reservation channel, but not always, and sometimes FHR triggers the credit anyways. Also, let’s say you book a Four Seasons offer via Fine Hotels and Resorts. Since the room wasn’t booked via Four Seasons you may not get the bonus on the room rate, but as long as you charge incidentals to the room, usually the charge still triggers. YMMV.

How valuable are Amex Offers?

The value depends on each and every offer, but I’ve found that over the course of a year, a large amount of my total annual fees ( across 7 cards ) is earned back via point bonuses and statement credits. Very worthwhile for this monkey.

My favorite Amex Offers are those with bonus points that help put us in aspirational first class cabins like Lufthansa First

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.