We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Amex Offers for Hyatt hotels

Early in 2022 we saw our first Amex Offer targeting Hyatt. Well…Amex Offers is back with another one targeting Hyatt properties in Mexico, and another for Grand Hyatt properties. Let’s take a look

Note the Mexico offers excludes the AMR properties, but if you’re looking to hit up a Hyatt Ziva like I did in Puerto Vallarta a few years ago, you could save some mulah via this Amex Offer. Let’s take a look.

If you read the blog often, you know I’m a huge advocate and fan of Amex Offers. While Amex cards that don’t carry a fee get targeted, I often have instances where my some of my cards get the offer and others do not. My Amex Gold had the offer and none of my other 10 cards got it.

The more offers I see targeting annual fee cards, the lower the net cost actually is, and the more the benefits outweigh the costs.

If you’re unfamiliar with Amex Offers you can read our full breakdown here.

Here are the 10 American Express Cards that I keep and links to their current offers and why we have them in our wallet and recommend your consideration.

- American Express Platinum

- American Express Gold

- 3 American Express Business Platinum

- 3 American Express Business Gold

- 2 American Express Blue Business Plus

Spend $300 get $60 back at Grand Hyatt

- Spend $300 get $60 back

- 9/15/22 until 12/15/22

- Reservations must be direct through Hyatt, Hyatt.com, or via World of Hyatt app

- Excludes

- all other Hyatt properties, including Hyatt Place, Hyatt House, Park Hyatt, Miraval, Hyatt, Andaz, Hyatt Centric, The Unbound Collection by Hyatt, Hyatt Zilara, Hyatt Ziva, Hyatt Regency, Hyatt Residence Club, Destination by Hyatt, JdV by Hyatt, Alila, AMR Collection brands and Thompson Hotels

- Not valid on purchases of gift cards, World of Hyatt points

- Offer only valid on room rate and room charges

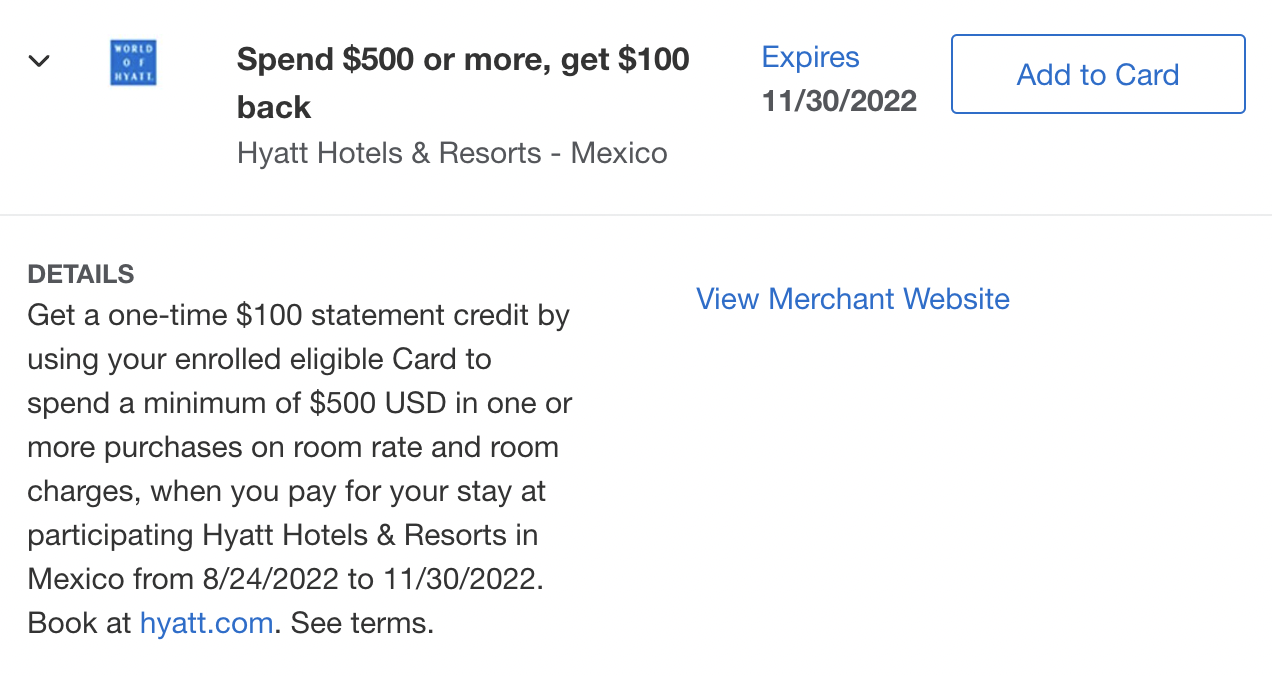

Spend $500 get $100 back at Hyatt Hotels and Resorts Mexico

- Spend $500 get $100 back

- Valid between Now until 11/30/22

- Reservations must be direct through Hyatt, Hyatt.com, or via World of Hyatt app

- Excludes :

- All other Hyatt properties, including AMR Collection

- Not valid on transactions on Exhale Spa, Hyatt Residence Club and Timeshres

- Gift Card Purchases

- Restaurant and Retail

Recap

I’m liking the fact that Amex is offering more and more deals for Hyatt properties!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.