We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

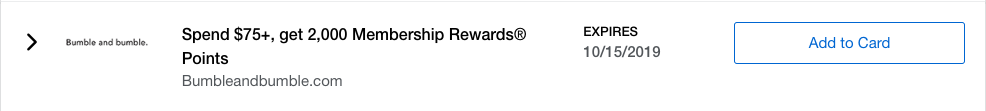

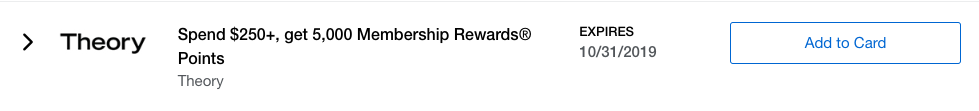

2k bonus MR at BumbleandBumble.com and 5k at Theory

We call those great deals, especially when you check out the spend requirements. Spending $75 at Bumble and Bumble is hardly a challenge at the luxury hair care company, but earning 2k Membership Rewards is the equivalent of earning $40 back and that may just tempt you to splurge a bit on those split ends.

Theory. One of my favorite luxury apparel lines is no stranger to big ticket items. When I saw the chance to earn 5k bonus points for spending $250 I began to plot my attack. At 2 cents, that’s the equivalent of earning $100 back on my purchase. Also note, that Theory regularly offers 15% off for new email subscribers. This specific offer ends 10/31 in my account, maybe you’ll be luckier, as I find post Thanksgiving sales to be the most rewarding, but you never know when you’ll find an end of season gem marked down by 40%

Make sure you double check the terms and conditions on any Amex Offers

Unsure what Amex Offers are all about? We have an entire post dedicated to them. Read it here.

I find throughout the year the savings that can be had by adding Amex Offers to your targeted cards can outweigh your annual fee without taking any other benefits into consideration. Maybe not the entirety of the $1200+ that I pay in Amex Annual fees from my 5 cards, but every bit helps.

Here are the 5 American Express Cards that I keep and links to their current offers and why we have them in our wallet and recommend your consideration.

- American Express Platinum

- American Express Gold

- American Express Business Platinum

- American Express Blue Business

- American Express Blue Business Plus

The Amex Offers:

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.