We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Earlier this year Hyatt and AA launched a partnership that resulted not only in bonus points being earned when staying at Hyatt or flying on AA, but targeted Elite challenges. Many Explorists, like myself, were given AA Gold status for 3 months along with a challenge to retain the status until January 31st, 2021.

Why would I want AA Gold?

- Elimination of close-in booking fees ( $75 under 21 days)

- Already made use of this once when I needed to book Etihad flights last minute

- Also when I make use of AA reduced mileage awards which happen almost always under 21 days

- Access to Priority seating at booking and Main Cabin Extra within 24 hours

- Comped Same Day standby ( would otherwise be $75 )

- Award processing phone fee waived

- Free checked bag ( although this is really is redundant with an AA credit card )

- There are others like 7x earning, etc, but the above are of most impact to me.

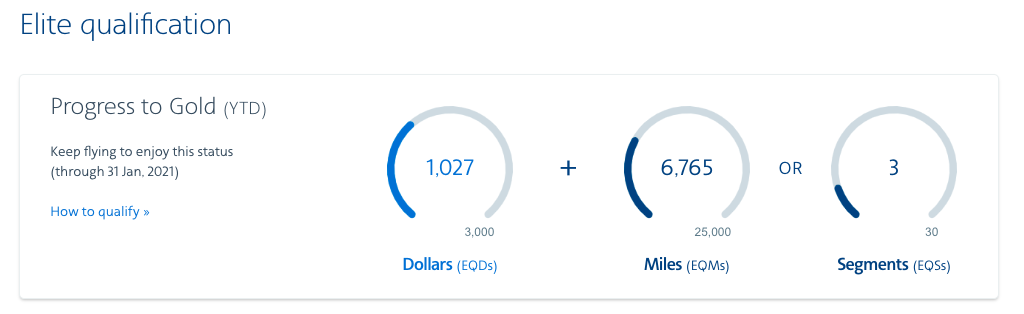

Here is the normal means of qualifying for AA Gold

While those benefits are nice, they certainly aren’t worth spending $3k on EQD and flying a whopping 25k EQM. Since I earn the bulk of my EQM on partner business class ( Think great BA flights out of Continental Europe and those earn mega points on Alaska ) I’d never pivot my business to hit Gold organically.

With the challenge, however, it’s a different story.

Honestly, I thought I’d end up taking advantage of Gold status for the trial period, but wouldn’t switch any of my business away from Alaska. I was wrong. It started with me using some AA gift cards on a flight back from Indianapolis shortly after I signed up for the promo in July. Since it was booked via AA.com it wouldn’t earn Alaska miles/status as those need to be booked with AS flight numbers. Then, we ended up flying to NYC, and the AA legs between JFK and LAX aren’t eligible for Alaska earning, so suddenly I was within striking distance of the challenge.

I’m currently writing this on my qualifying flight that will push me up and over the EQM threshold for the status challenge. I never thought I’d pick up AA Gold with this challenge, but hey…they lured me back and I’ll definitely make use of the benefits for the next year and a half.

For me, it’s a great lesson in always signing up for challenges, temporary status, etc. Circumstances may change and suddenly you’re prepared to take best advantage of your travel/spending.

If you’re unfamiliar with the promotion and want to learn more, or you have status and want to link your accounts: you can do so here.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.