We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

We’ve seen a few Delta Amex Offers over the past couple years, and this one is targeting some cardholders. I checked all of the accounts that I manage and none of them were targeted unfortunately.

Amex has several cobranded Delta cards and keeps a close relationship with Delta, and I, nor any of the accounts I manage, hold those cards. It’s possible that people holding Delta branded Amex cards may be targeted vs just Membership Rewards earning cards.

One thing to keep in mind, is that you can cancel Delta flights without a fee currently, and have a credit that should last for a year. So you could book a dummy flight for $300, get the $75 credit, and then cancel that flight to have a $300 Delta credit in our account that you paid $225 to purchase. If you purchase gift card offer just remember to screen cap or save the gift card in your notes section ( that’s what I do anyways ).

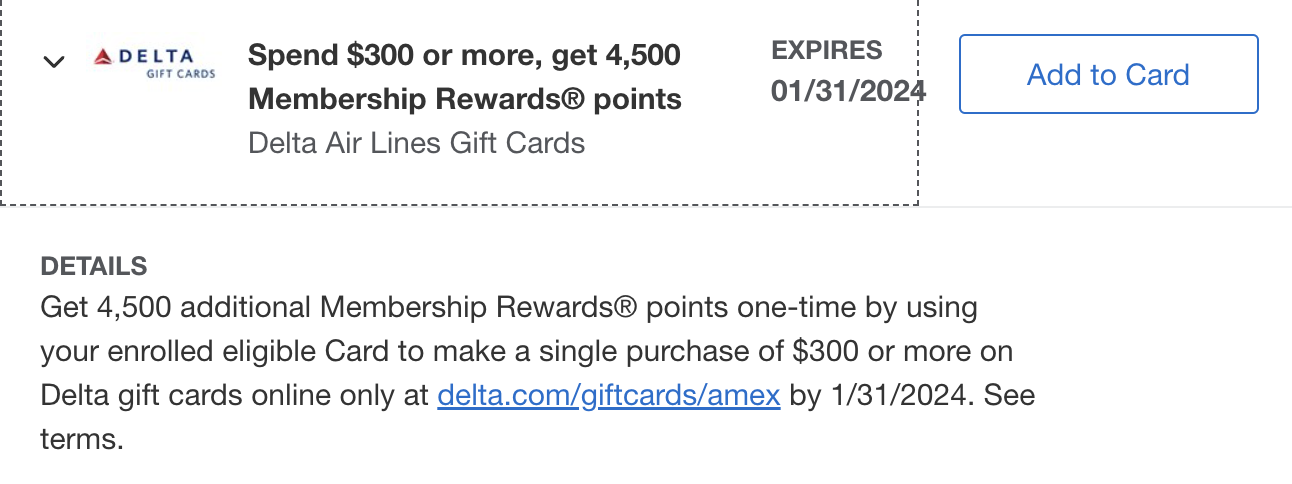

Amex Offers: Delta Gift Cards Spend $300 get 4500 Membership Rewards

My account was just targeted for this offer – Amex points are worth 1.7c to 2c so if you took the conservative valuation you’re getting $76.5 and the more aggressive $90 back in value via points. Pretty good deal!

- Expires 1/31/24

- Must purchase at delta.com/giftcards/amex

- Spend $300 or more get 4500 points

Amex Offers: Delta Airlines Spend $300 get $75 back

My account isn’t targeted for this, but many have been in the past month or so.

- Spend $300 or more get $75 back

- Must be used by 012/31/23

- Must originate in the US

- Must be purchased in USD

- Must be done online, via the Delta App, or the US reservation phone line

- valid on: airfare, fare upgrades, seat fees, bag fees, standby fees, and Delta Sky Club membership

History of this offer:

- Amex Offers Delta

- Winter 2021 – Spend $300 get $125 Back

- Spring 2023 – Spend $300 get $75

- Winter 2023 – Spend $300 get $75

Amex Offers

If you read the blog often, you know I’m a huge advocate and fan of Amex Offers. While Amex cards that don’t carry a fee get targeted, I often have instances where my cards that have high fees will get specific offers that others won’t. That happened to be the case with this Delta offer. My Amex Business Platinum had this offer targeted, but none of my other Amex cards did.

If you’re unfamiliar with Amex Offers you can read our full breakdown here.

Here are the 10 American Express Cards that I keep and links to their current offers and why we have them in our wallet and recommend your consideration.

- American Express Platinum

- American Express Gold

- 3 American Express Business Platinum

- 3 American Express Business Gold

- 2 American Express Blue Business Plus

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.