We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The Platinum Card® from American Express

The Platinum Card® from American Express is one of the most talked about cards in the marketplace. It immediately draws attention anytime someone whips it out especially since its made of hefty metal. But, all that glitz and glam comes with a hefty $695 annual fee (Rates and Fees).So, is it worth it?

$695 is a lot of money, but if that $695 annual fee creates value in excess of $695, it’s a deal, right? That’s exactly how I look annual fees – they are the cost of doing business, and in business, both parties are happy when value is created. On the low end, I’ll extract $779 in value out of the card every year just in statement credits given toward items I purchase anyways.

Personally, I keep The Platinum Card® from American Express because it provides a lot of value for WHEN I travel, and ultimately put more spend on my Amex Gold to earn points TO Travel. Both are great cards, but let’s break this bad boy down so you can make an educated decision on whether it’s worth it to you or not.

A quick overview of the benefits:

What do you get for $695 a year?

- $695 annual fee (Rates and Fees)

- Up to $200 Hotel credit

- You must pre-book via Amex FHR or The Hotel Collection, which requires a two night minimum stay, via Amex Travel

- Up to $200 Uber Cash yearly credit valid US only (enrollment required )

- Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- You must have downloaded the latest version of the Uber App and your eligible The Platinum Card® from American Express must be a method of payment in your Uber account. The Amex benefit may only be used in United States.

- Up to $240 Digital Entertainment Credit (enrollment required )

- Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal.

- Up to $300 Equinox credit (enrollment required )

- Up to $200 airline incidental credit (enrollment required )

- Up to $100 global entry or $85 TSA Pre credit (enrollment required )

- Up to $12.95 + tax / month Walmart+ membership

- Walmart+ members receive unlimited free shipping with no order minimum on items shipped by Walmart.com, free delivery from stores, as well as mobile and contactless check-out to make shopping faster.

- Up to $25 Soul Cycle monthly credit

- Platinum Card Members will receive a $300 statement credit every time they purchase a SoulCycle At-Home Bike, up to 15x per calendar year.

- An Equinox+ membership is required to purchase a SoulCycle at-home bike and access SoulCycle content.

- Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only.

- This stacks on top of the $25/month Equinox+ statement credit.

- Centurion lounge access

- Priority Pass select membership (enrollment required )

- Rental Car Status

- Hertz President’s Circle

- Avis Preferred Plus

- National Executive

- Access to American Express Fine Hotels and Resorts, The Hotel Collection

- 5x on airfare purchased via Amex Travel or with your selected airline

- Authorized Users

- $195 per authorized user for new cardholders

- Existing users, effective 8/17/23, rate will go up to $195 on your card renewal

- *Rates and Fees; terms apply

Personally I will undoubtedly use the $200 hotel credit (enrollment required ), $189 Clear Credit (enrollment required ), $200 Uber Cash , and $200 incidental airline free credit (enrollment required ). That’s $779 of the $695 without including Priority Pass, Centurion Lounge, etc. Wait, that’s more than the card is worth itself.

Do you qualify?

Amex has a once in a lifetime clause that limits the ability to get a welcome offer more than once, so if you’re had the Platinum card before, you may not qualify for the welcome offer.

Is this the best offer we’ve seen?

The best offer currently is via referral and is 125k after $6k min spend

Great ways to use American Express points: transfer partners

Amex points are some of the most valuable points in the biz. Just look at all of these partners listed below, but if you really want to get a good taste of how luxuriously you can travel with them, read this article on their best uses.

As I mentioned, I have an entire post dedicated to some truly awesome ways you can use your points. The best ways, in my opinion, to make use of American Express points are by utilizing their long list of transfer partners.

One of my favorite ways to fly is Lufthansa First Class which can be accessed by transferring to Aeroplan, Avianca, ANA, or Singapore Airlines.

Here are benefits I think outweigh the $695 fee

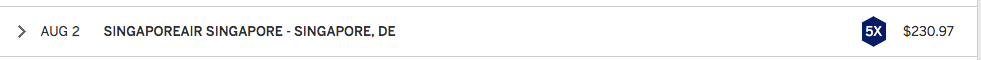

1) 5x points on airline purchases made with the airline of your choosing or Amex Travel

- This is the highest earn rate for any card on the market for indiscriminate airline spend ( Jetblue has a 6x card solely on Jetblue). If you value Amex points at 2 cents a piece…you’re essentially getting 10% off every qualifying flight.

If you spend $1000 a year on your card – you’re earning 5k points back. That’s $75 at a 1.5 c valuation and $100 at 2c.

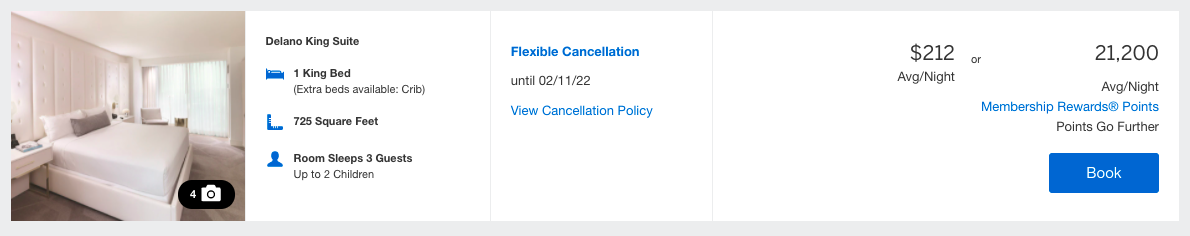

2) Up to $200 Hotel credit

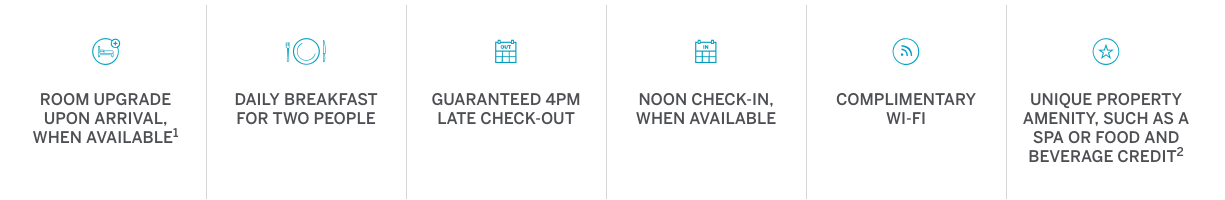

This is a brand new credit that applies to pre-paid bookings with Amex Travel on American Express Fine Hotels and Resorts and The Hotel Collection bookings. I absolutely love the Fine Hotels and Resorts program and will undoubtedly make use of this credit every year

For instance, if you were to book the Delano in Las Vegas for 2 nights over Valentine’s Day 2022, you’d nearly wipe out on of the nights

Plus you’d get all of the typical FHR benefits which include another $100 food and beverage credit, upgrade, breakfast, and 4pm check out. More on this program down below.

3) Up to $200 Uber Cash Credit

- $15 a month and $35 in December on Uber

- Valid in the US Only

- You need to enroll your card by adding it to your profile ( read this article for clarity )

Not everyone makes use of this perk like I do, but I’d be spending $15 a month on uber every month regardless of the perk. It’s an easy $200 recoupment for me. .

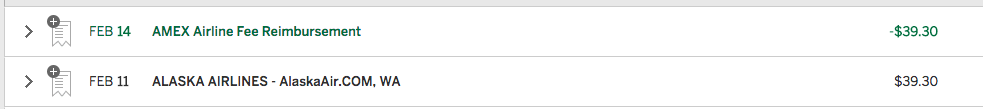

4) Up to $200 Airline Incidental credit

- You must select an airline for the fee to trigger – this will enroll you.

- Each calendar year – which means if you apply now, you’ll get $200 this year, and then another $200 starting 1/1/21

I easily make use of the card each and every year I hold the card. Read this for tips, but it’s a solid $200.

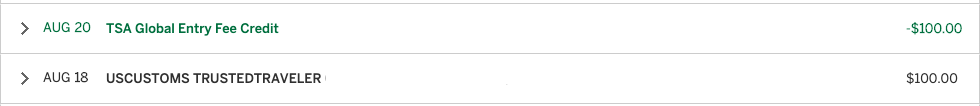

5) Up to $100 Global Entry Fee Credit or $85 TSA Pre credit ( enrollment required )

Global Entry is a phenomenal program that expedites your immigration when entering the country. It’s saved me hours and hours of time over the years. I just renewed my global entry last year and the refund was very fast.

I just renewed my global entry last year and the refund was very fast.

- Once, you’ve enrolled, simply charge to the card and get it refunded once every 4 years

6) Up to $189 CLEAR® Plus Credit

Clear basically expedites your security experience. If you already have TSA Pre this will pop you to the front of that line. If you don’t, you’ll just skip to the front of the normal line. Either way, it’s saved me many a time.

- you need to enroll in Clear to qualify

I’ve had Clear for a few years now, and it’s extremely helpful if you live at a busy airport, not as much elsewhere. In LA, Atlanta, and NYC it’s literally been the difference between making and missing my flight.

Travel is ramping up, and security lines are getting fuller and fuller. It’s a no brainer to pay for it with your Amex Platinum.

Don’t forget to link your Delta SkyMiles account, you’ll get a discount on the yearly subscription which easily puts it under the credit your card gives you.

7) Up to $300 yearly Equinox credit (enrollment required )

I have several friends who are loyal Equinox members and this would be a benefit they’d surely make us of. Personally, I may download the Equinox+ app and see how the workouts are…it’s discounted for Amex Platinum cardholders so it’s a push. Regardless, for those who are members…it’s an easy $300 if you have an eligible membership:

- The credit goes towards monthly Equinox All Access, Destination, E by Equinox, or Equinox+ memberships fees

8) Up to $240 digital entertainment credit ( enrollment required )

Amex has added in a $20 per month credit when you use your Platinum card for eligible purchases at Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. It’s capped at $20, not $20 per company.

I’ve been using this on Hulu with an add on of Showtime.

Take a look at the restrictions as well.

(Peacock: Eligible purchases for Peacock include all Peacock subscriptions, including but not limited to Peacock Premium and Premium Plus, made directly online at peacocktv.com . Eligible purchases do not include subscriptions bundled with cable services or other bundles, promotional offers through third parties, or gift cards. Audible: All Audible purchases made directly through audible.com are eligible, including Audible subscriptions (Audible Plus and Audible Premium Plus) and audiobook purchases. SiriusXM: Eligible purchases for SiriusXM include purchases made directly with SiriusXM (US) online at siriusxm.com, through SiriusXM telephone sales, or direct mail order purchase transactions. Eligible purchases do not include SiriusXM safety, security, or Telematics services (Connected Vehicle), SiriusXM for Business subscriptions, SiriusXM ad sales, or Pandora. The New York Times: Eligible purchases for the New York Times include any subscriptions (including digital or print news, NYT Cooking, and New York Times Games) made directly through nytimes.com. Eligible purchases do not include advertising services, NYT conferences, gift cards, the Times Digest , or purchases from the NYTimes company store)

9) Cell Phone Protection

If you pay your cell phone bill with your Amex Platinum you now have cell phone insurance. The prior’s month bill must be paid with your card, but the actual phone itself doesn’t need to be purchased with your Amex Platinum.

- Reimbursement, up to $800

- Towards the repair or replacement

- If damaged or stolen

- $50 deductible

- 2 approved claims per 12 months.

10) Centurion Lounge access

I probably visit Centurion lounges 1/2 a dozen times a year. At just $5 saved on a coffee or beer it’s worth min $30.

11) Fine Hotels and Resorts

- Insane benefits including

- Upgrade upon arrival when available

- Unique property amenity ( this is usually in the range of a $100)

- Free continental breakfast

- Early Check-in and guaranteed 4pm late check out

FHR offers incredible value if you like to stay at high end resorts and hotels. The breakfast and property credit are easily worth a couple hundred on every stay over 2 nights. I’ve also had great success with double upgrades, and having a guaranteed 4pm late check out is huge when you have a late flight, and a distinct advantage of Virtuoso.

What’s even better…if you pre-pay the hotel…you’ll earn 5x points on it as well.

12) Hotel Elite Status ( enrollment required )

You’ll need to link both of your Marriott and Hilton accounts, and once you do… you are now carrying elite status in two hotel chains.

- Marriott Gold

- Hilton Gold

Why spend a gazillion nights staying at hotels when your credit card can get you mid-tier status. Hilton Gold is especially nice as it gives you free breakfast credit when using points for your stay.

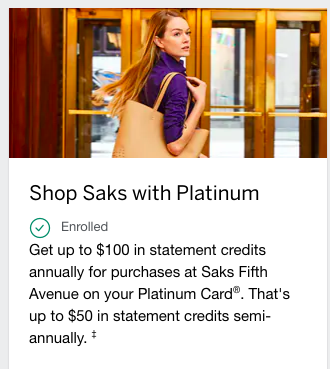

13) up to $100 Saks Fifth Avenue annual credit

- $50 for each 6 months of the year

- note that you need to enroll your card in order to trigger the credit

Once between Jan and June you’ll get $50 back as a statement credit, and then again between July and December. Even if you don’t shop for high end apparel, or accessories, Saks sells a ton of toiletry items that this credit offsets. Think Kiehls, Fekkai, etc

14) Priority Pass Membership

- Access to the global network of lounges and restaurants

- You do need to enroll your card in order to enjoy this benefit

15) International Airline Program

I’ve some absolutely fantastic deals on airfare ( Premium Economy and up ) via the IAP. Highly worth checking out before you book elsewhere. Note that you must be on one of the following airlines departing from the US in Premium Economy, Business, or First Class.

Bonus Reasons:

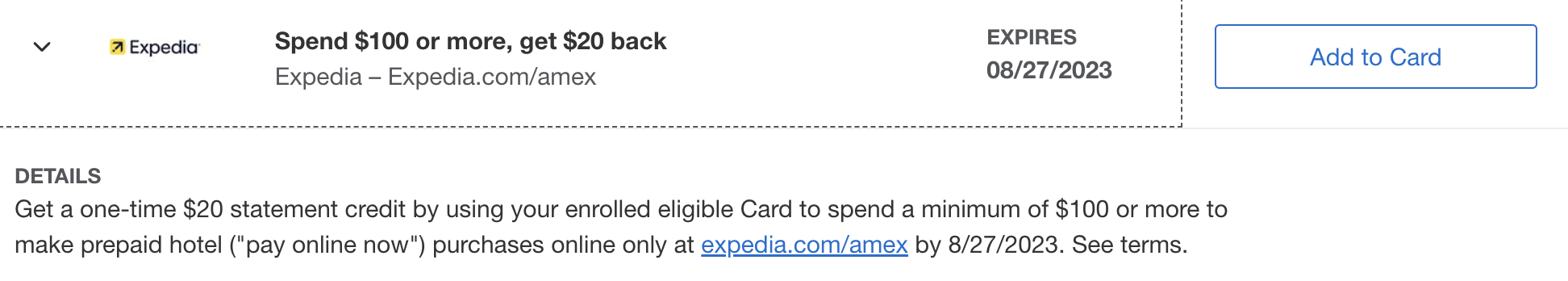

Amex Offers

- These are targeted spend offers that each cardholder can take advantage of by fulfilling spend requirements with certain retailers. The opportunities are frequently updated, and I’ve found that these alone could pay you back for an annual fee.

And Referrals points – 100k a year

You can earn up to 100k points per card every single year. In fact, you can add your referrals to this post. It gets a lot of traffic so many are earning quite a few referral bonuses from us.

Overall:

While the $695 is a lot, I personally, am able to get over $1000 a year in benefits without even taking into account a welcome offer, or the other benefits like Rental car status, rental car insurance, global lounge collection, etc .

What’s even better is how much the card can improve the way you travel. Having a lounge access while you wait can make delays and layovers so much more bearable, and having status at hotels less costly at check out because of comped wifi, upgrades, breakfast, or even just in-room bottled water. Regardless, if you’re a travel geek like me, this card provides an incredible amount of value year after year

To see the rates and fees for the American Express cards featured, please visit the following links: American Express Platinum Card: See Rates and Fees

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.