We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

You need to select your American Express Airlines Fee credit

It’s a new calendar year which means all of your Amex airline fee credits have refreshed. I have 4 cards that provide a total of $800 in incidental airline fee credits, and my wife has $850 ( good lord ) so we need to be very strategic in our selections. Amex Airline fee credits are limited to what Amex defines as incidental. Namely those include bag fees, pet fees, in flight refreshments, etc, but other things have triggered it in the past. Let’s take a closer look and identify where we intend to use ours, which airline we chose, and all those juicy details.

Don’t forget you can officially select until 1/31/24

*unofficially many people have had success changing the airline well past this date, but this is on a case by case basis and I would recommend selecting your airline by the due date to avoid confusion.

Table of Contents

Which American Express Cards Include an Airline Fee Credit?

- The Platinum Card® from American Express $200

- The Business Platinum Card® from American Express $200

- American Express Hilton Honors Aspire $250

We’ve used Amex Membership Rewards to accomplish many of our travel goals.

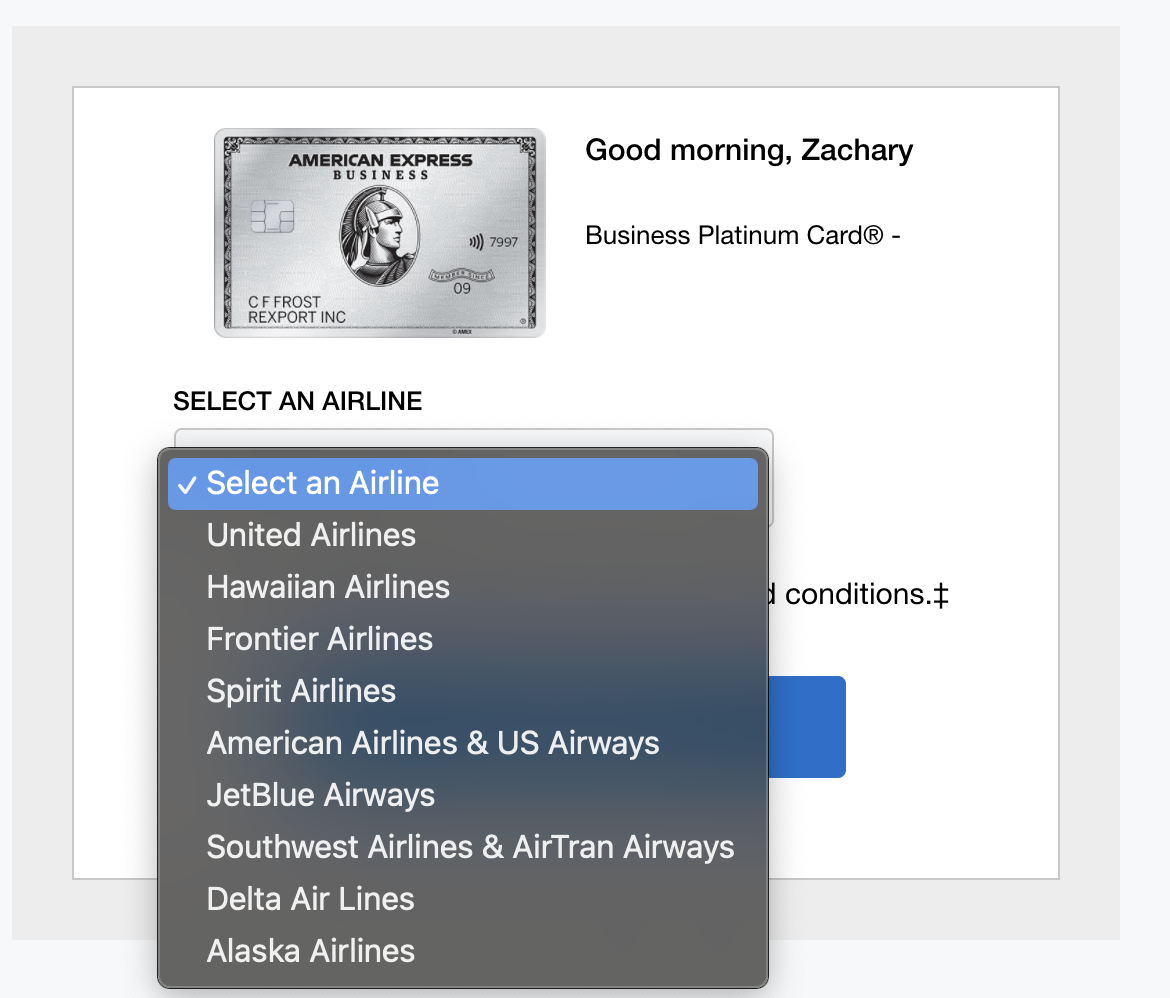

Choosing an airline for your Amex Incidental Airline Fee Credit

If you’re unfamiliar, for each card that you hold with Amex that includes an Airline fee credit, you’ll need to choose which airline you want to apply it to. We have readers that are saying the United Travel bank is still triggering the credit and some people are even having $100 fares refunded with JetBlue. It all comes down to how Amex codes the purchases, but just an FYI.

- You have until the end of January to choose an airline

- Alaska Airlines

- American Airlines

- Delta Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

Which fees have been included in the past?

The following fees will only trigger the credit when you purchase them on your selected airline.

- Airport Lounge membership and passes

- Checked bag fees

- Overweight or oversize fees

- Inflight purchases like food and beverage – note that WIFI may not trigger it since it can be processed by 3rd parties

- Pet flight fee

- Phone reservation fees

- Seat assignment fees

- If you’re get a economy plus, etc

- Ticket Change fees

Amex changed how incidental fees are credited

In 2019, Amex eliminated the ability to purchase under $50 tickets on Alaska and get reimbursements, but also the ability to purchase gift cards for future travel on AA, Delta, and Southwest. Anecdotally, it seems some people are still getting reimbursement, but it can’t be counted on, and is few and far between. Throughout 2020, United’s Travel Bank still was triggering the incidental credit, but I added funds in 2022 and this wasn’t recognized by Amex as incidental.

Where we will use our fee credits

My wife and I have 5 Amex Business Platinum cards between us, 2 Amex Platinum, and an Amex Aspire, and since we quite often travel with our dog, it hasn’t been an issue using up all of the incidental credits seeing as those pet fees can often be $95 to $150 each way. We have $1650 in airline fee credits, which is kind of hard to imagine, but for 2023, we suspect we’ll use them up again.

This year I will spread them across a few different airlines: Delta, Southwest, and AA are our choices.

Terms and Conditions from Amex

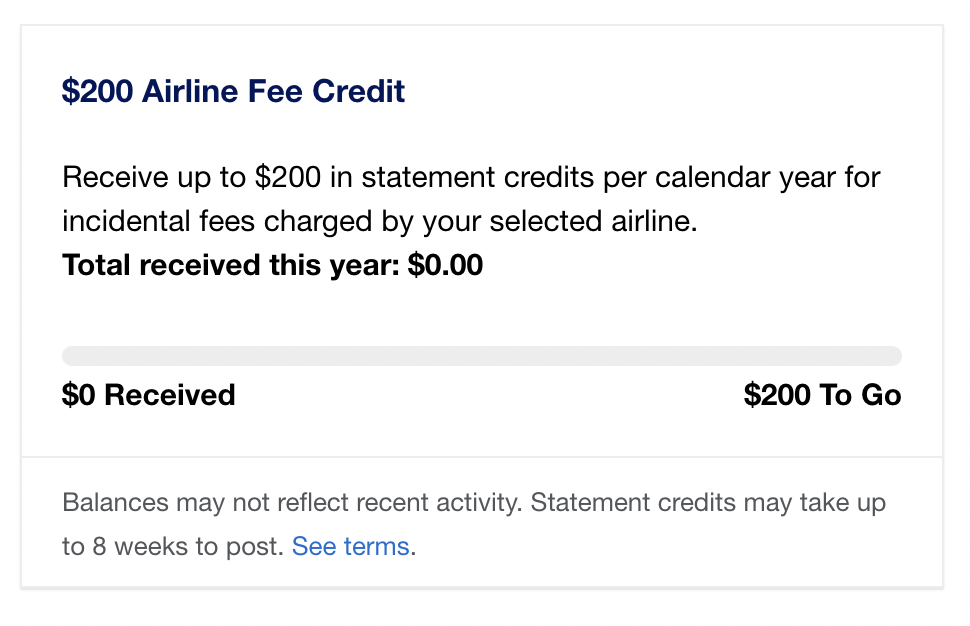

$200 Airline Fee Credit

Benefit is available to Consumer and Corporate Platinum Card Members only. To receive statement credits of up to $200 per calendar year for incidental airline fees charged to the eligible Card, Card Member must select one qualifying airline through their American Express Online Account or the link for their Card below:

• American Express Platinum Card®: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/platinum

• Goldman Sachs Platinum Card®: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/goldman-platinum-card

• Morgan Stanley Platinum Card®: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/morgan-stanley-platinum-card

• American Express Platinum Card® for Schwab: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/schwab-platinum-card

• American Express Corporate Platinum Card®: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/corporate-platinum

Qualifying airlines include Alaska Airlines, American Airlines, Delta Airlines, Hawaiian Airlines, JetBlue Airways, Spirit Airlines, Southwest Airlines, and United Airlines. Only the Basic Card Member or Authorized Account Manager(s) on the Card Account can select the qualifying airline. Card Members who have not chosen one qualifying airline will be able to do so at any time. Card Members who have already selected one qualifying airline will be able to change their choice one time each year in January through their American Express Online Account or by calling the number on the back of the Card. Card Members who do not change their airline selection will remain with their current airline. Statement Credits: Incidental airline fees must be charged to the Card Member on the eligible Card Account for the benefit to apply. Incidental airline fees charged by both the Basic and Additional Card Members on the eligible Card Account are eligible for statement credits. However, each Card Account is eligible for up to a total of $200 per calendar year in statement credits across all Cards on the Account. Incidental airline fees must be separate charges from airline ticket charges. Fees not charged by the Card Member’s selected airline (e.g. wireless internet and fees incurred with airline alliance partners) do not qualify for statement credits. Incidental airline fees charged prior to selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee. Please allow 6-8 weeks after the qualifying incidental air travel fee is charged to your Card Account for statement credit(s) to be posted to the Account. We rely on airlines to submit the correct information on airline transactions, so please call the number on the back of the Card if statement credits have not posted after 8 weeks from the date of purchase. Card Members remain responsible for timely payment of all charges. To be eligible for this benefit, Card Account(s) must be not canceled and not past due at the time of statement credit fulfillment.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.