We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The American Express® Gold Card has just added new language that makes it markedly harder to qualify for a welcome offer. I have added this restriction to our Comprehensive Guide to American Express Application Rules, but here’s a look at the new language on their Offer Terms:

As you can see below, you’ll no longer qualify for a welcome offer if you’ve had the following Amex cards in the past:

- Premier Rewards Gold Card,

- The Platinum Card® from American Express

- the Platinum Card® from American Express Exclusively for Charles Schwab,

- the Platinum Card® from American Express Exclusively for Morgan Stanley

- or previous versions of these Cards

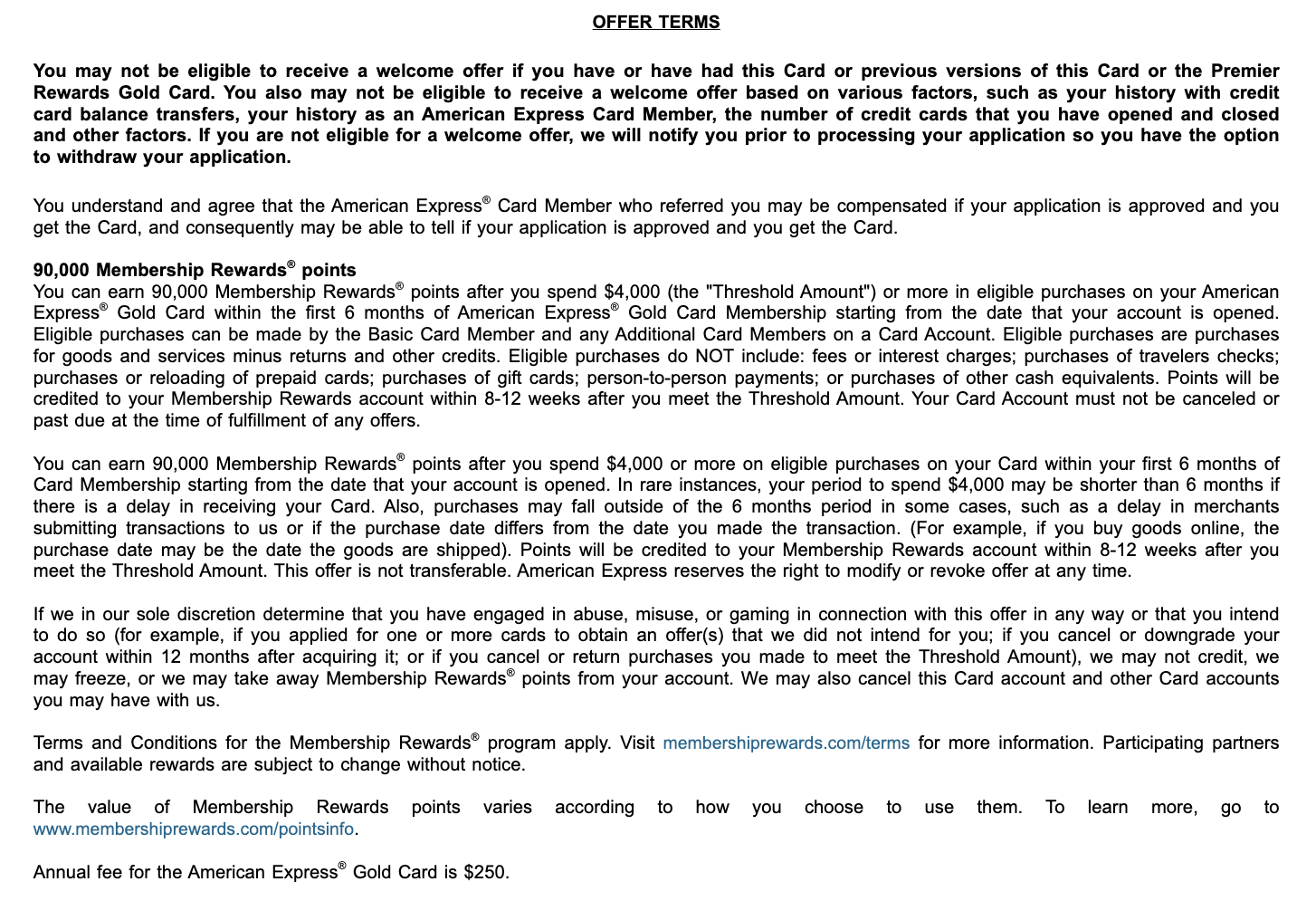

OFFER TERMS

You may not be eligible to receive a welcome offer if you have or have had this Card, the Premier Rewards Gold Card, the Platinum Card®, the Platinum Card® from American Express Exclusively for Charles Schwab, the Platinum Card® from American Express Exclusively for Morgan Stanley or previous versions of these Cards. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.

Amex Referrals don’t have the language yet

Even though the Referral language doesn’t include the Amex Platinum exclusions… most people are getting Pop Up messages indicating that they don’t qualify.

What does this mean?

You can get an Amex Platinum welcome offer if you’ve had Gold, but not the other way around.

Amex recently added restrictions to their Delta cards that followed the same strategy. If you’ve had a more premium version of a card in the family, you’ll be restricted from qualifying for the welcome offer on a lower version within the family.

Simply put. It means that, if you think you’ll ever want both an Amex Gold or/and Amex Platinum in the future, you should start with the Amex Gold. This is your new best bet on being able to qualify for the welcome offer on both cards in the future. Assuming they don’t change the rules again.

I wouldn’t be surprised to see if they don’t add in restrictions to their Hilton and Marriott iterations as well.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.