This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

My experience using Singapore Air to book Lufthansa First

I’m headed to England to watch my beloved Colts play at Wembley. Good Lord is Miles excited. He’s feeling verrrrrry “Luck”y to be flying across the pond for the game and then a little jaunt around England, Scotland, and Ireland. I was looking for a flight back for us from Dublin ( I booked a r/t from Dub-Lax-Dub earlier as part of the wedding weekend in London) and stumbled upon quite a bit of avail on Lufthansa First. Now…how would I book it? Here’s my experience using Singapore Air to book Lufthansa First.

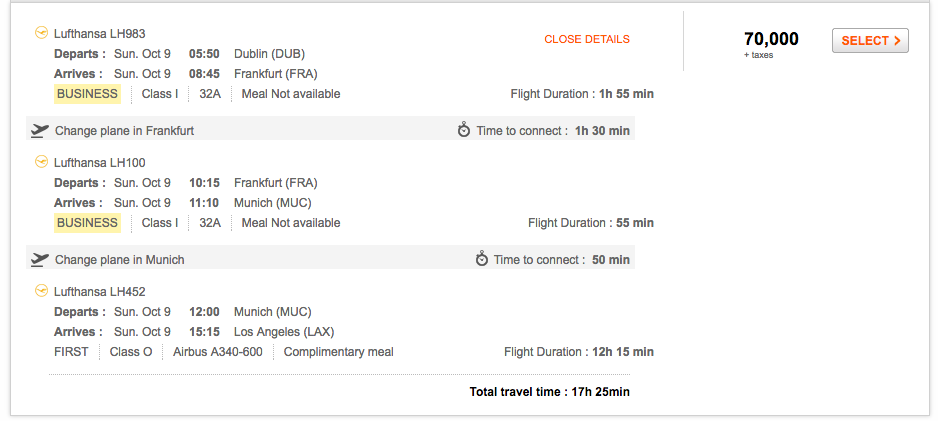

I found the avail on Aeroplan.

However, I only have 2k in my Aero account and I didn’t really want to transfer over Amex to shore it up.

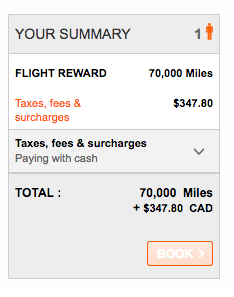

with taxes and fees

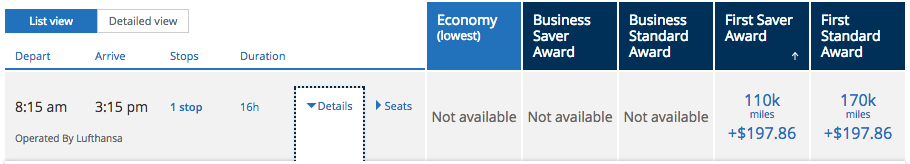

And then on United

I’d hate to spend 110k!!!! GOOD GOLLY

But how about Singapore Air

I’m not going to get around paying taxes and fees to fly Lufthansa First, and I’ve never flown it, so I’m willing to give it a go and pay the cost. Singapore Air costs 80k plus taxes and fees. I called them up because I wondered exactly how much I’d have to pay. Turns out it was $297. More than what Aero or United would levy, but not as horrible as $400 or $500 that I was expecting.

I really wish Singapore allowed online bookings with the 15% discount for partners, but alas, that is still a pipe dream.

The reasons for Singapore Air are:

- I’d transferred over a lot of miles for a Turkish flight two years ago that I ended up canceling

- Rebooked them for a Singapore Air 1st class flight that I had to cancel ( sheesh!)

- Miles expire after 3 years so ya gotsa use them up

- Singapore Air Krisflyer Miles are the easiest miles to accumulate through partner programs

- Chase Ultimate Rewards, Amex Membership Rewards, and Citi Thank You all transfer in 1:1

- Starwood does as well, but I always think of them as a separate program

- Chase Ultimate Rewards, Amex Membership Rewards, and Citi Thank You all transfer in 1:1

I really value the flexibility of points that reside in my flexible accounts. If I can use points that are already deposited, even if it’s not the absolute best deal, I’ll often go in that direction. Had I had 50 or 60k Aero already sitting in my account, I would have pulled that trigger because I could have saved some points and some $$, But to drain almost 70k Amex points…not worth. I’d rather spend the 10k extra, use points that will expire sooner than later, and have those Amex points ready to deploy for another trip.

The final deal: 80k Krisflyer + $297

I called up Singapore. I would HIGHLY recommend the following

- After finding your flights on AeroPlan – write down the exact flight numbers

- Pull up the military alphabet to use to recite those flight numbers

- Be prepared to spend some time on the phone

- Ask for the Lufthansa ( mine was the same as Singapore, but ask anyways) and United booking reference numbers for seat selection

It ultimately took about 45 minutes to book these tickets, multiple times on hold, but the rep was SUPER nice and apologetic about it taking so long and got it all booked.

Needless to say I’m verrrrrrry excited. In addition to getting to try out Lufthansa First, I’ll also be able to try out United’s new 787-9 on one of the legs as well. Ultimately I think it’s a great deal using Singapore Air to book Lufthansa first, especially because the miles were going to expire within the next year.

I mean look at this product!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.