This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Reminder: How to use CreditKarma to check account openings & 5/24

The Chase Sapphire Reserve brought a rule that Chase had imposed front and center: 5/24. If you don’t know about this rule, it simply means if you’ve opened more than 5 credit cards, with any bank, in the last 24 months you will be denied by Chase. There were some exceptions to the rule ( namely Private Client, pre-approvals, and targeted offers), but a lot of those have been changed, and not all cards are affected by it. Namely, it is geared at UR earning cards and since Chase is allowing signups in branch for the Reserve 100k offer until March 12th, it’s worth knowing if you’ll be eligible or not. A good indicator if you’ll get approved over 5/24 is if you’re pre-approved for a card in-branch and they give you your APR rates, but if you’ll dip under 5/24 by March 12th, I’d just hold off and apply once you’re under 5/24. Even Chase Private Clients are reportedly not able to work around the 5/24 rule, so the restrictions seem to be getting worse than better. So how do you accurately check when you opened new cards, and when you will dip under 5/24? Here’s a reminder on how to use CreditKarma to check account openings & 5/24 status.

If you don’t have a CreditKarma account…get one, it’s free!

You should be keeping an eye on your credit and this is my go to site to do just that. If you have one already, good on ya. If not…stop reading and sign up.

Log in: Check out the left column – specifically credit reports

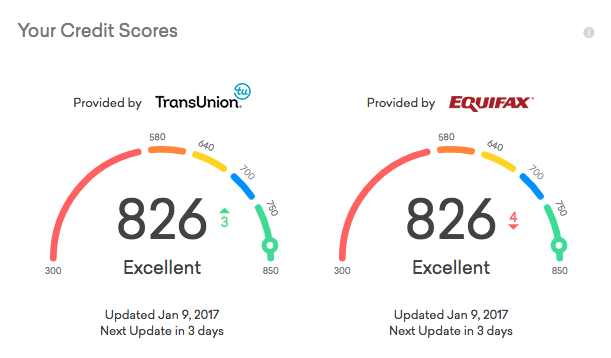

You’ll then see your credit scores pop up

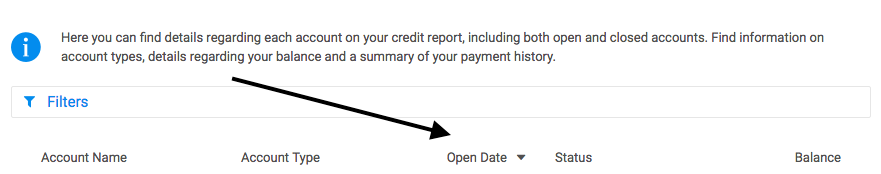

Click on either report, I clicked on TransUnion. Organize by Open date

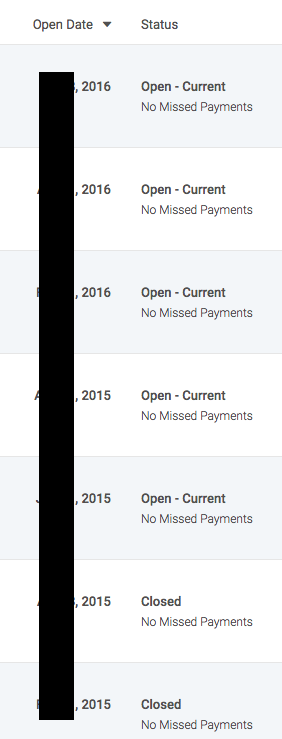

While inquiries won’t show up on individual reports unless pulled, opened accounts will who across the board.

You can now start counting backwards – it doesn’t matter if they’ve been closed. It’s how many cards you’ve opened in the last 24 months regardless of closure.

- If you’ve opened an account and closed it…doesn’t matter you still opened it and it counts against 5/24

- Business accounts other than Chase business accounts don’t show up on your personal credit report so they won’t go against your 5/24

- There is some evidence to support those who show less than 5/24 on their personal reports, but have opened more than 5/24 when including Chase business accounts being approved if it passes the automated approval system. However, if the application goes pending, and a person has to analyze your application – they can see your Chase business cards openings and may count this against your 5/24 and deny you.

- If you’ve applied and been denied it doesn’t count.

I won’t hit 5/24 by March 12, but I’ll be close, and hopefully get pre-approved in-branch. I’ll end up getting a Reserve no matter what, but those extra UR would sure be nice to redeem for EVA Royal Laurel across the Pacific. I loved my intra-Asia flight

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.