This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Scott Kirby’s United compensation package

It was big news yesterday. Scott Kirby was leaving American Airlines. What happened? Did he leave or was he let go? Well Scott received a very healthy severance package and apparently a loose non-compete because we were informed later in the day that he was helming a newly made position within United…as their President. Holy smokes. If you follow any airline analysts the consensus was that this was quite a net positive for United. Looking into the SEC Filings it was a HUGE day for Mr Kirby. So what is Scott Kirby’s United compensation package?

Use Sec.gov to search any publicly traded company’s SEC filings

Yes, these are also on the company website, but I find it much easier just to go to the source for searches.

Go to Company Filings

United files under United Continental…not United Airlines.

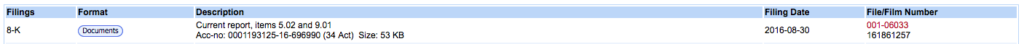

Look for 8-k filings.

Because this was so recently announced it wasn’t difficult to find the filing that MOST likely contained the new agreement that was struck. Public companies must divulge 5 compensation packages of their executives. Because Scott has been in the top 5 at both American and United it was going to be filed. The terms are held within:

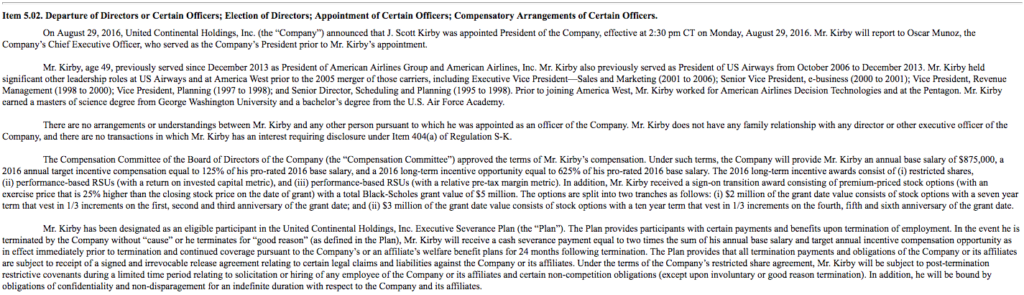

Scott Kirby’s United compensation package

Notables

- Base: $875k

- Bonus: 125% Salary

- LTIP: 625% of salary

- Sign on bonus of $5 million in options ( Black-Scholes valued at 25% higher than date of grant closing price)

- 2 vesting dates

- $2 million with a 7 year term, 1/3 vesting on years 1,2,3

- $3 million with a 10 year term, 1/3 vesting on years 4,5,6

- 2 vesting dates

- Total potential compensation with options: $12.4 Million

- This could obviously go up based on other perqs – this valuation is based off the current 8-k filing

As Pizza in Motion revealed earlier today… Mr Kirby received roughly $13M to leave American. I’m not sure this even included the vesting of options, NPV of his retirement package, etc.

While other United perquisites weren’t mentioned, and they’ll be disclosed in another 8-k soon, I’m sure they are quite nice.

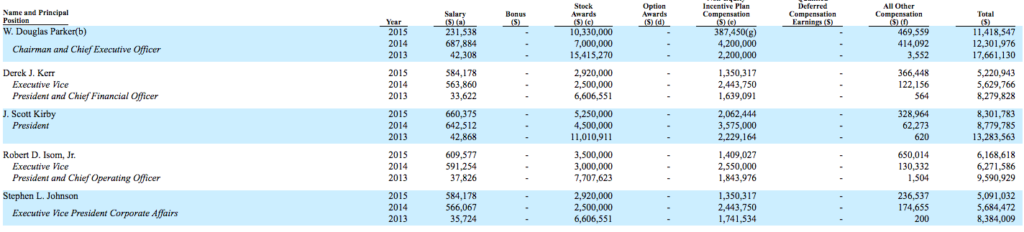

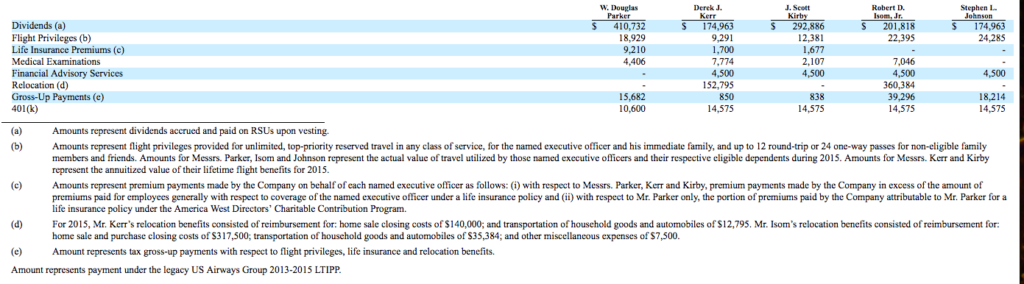

In case you’re wondering, here was his AA pay.

Looks like Mr. Kirby has received a healthy bonus to his base salary of 660k in 2015. He hasn’t received a bonus in quite some time whereas United has a potential %125 bonus. We all know the big bucks are made off of RSU, LTIP, Options, etc. I haven’t dug deep into his contract which you can find here, but I’d imagine the large increase you can see in the third column ( Stock Awards) was a result of the US Air/ AA merger. Doug Parker ( the then head of US Airways) also received a LARGE stock award that year as well. Regardless…Mr Kirby has done quite well.

And some details pertaining to other compensation…interesting bits about his airline travel benefits. Pizza in Motion wrote an article earlier today showing some of those perks he’ll maintain in perpetuity. Perpetuity! I’d imagine that Mr. Kirby secured a commensurate package with United. The most surprising element of the package was the relatively low value of those flight privileges, $12,381 for Mr Kirby in 2015.

Would like you like to learn more about Mr. Kirby’s Executive Travel Privileges?

- His plan falls under: “Travel Privileges entitled American Airlines Group Positive Space Leisure Travel Program for Officers of American Airlines”

You can read all about that here:

http://www.amrrc.net/documents/Travel_QAs_01_02_14.pdf

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.