We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

While I’ll end up flying roughly 120k butt in seat miles this year, I’ll unfortunately fail to reclaim Alaska’s top-tier MVPG75k status. It’s not all bad – I’ll still end up with MVP Gold and its stellar 100% bonus for 2019 and perhaps still get the lustrous MVPG75k. How? A soft landing/ Fast Track offer. Stay with me.

Mid year, after a couple of paid business class flights on Alaska partner flights got cancelled this year I quickly realized I wouldn’t have enough organic travel to hit the 90k partner + Alaska mileage requirement for MVPG75. Those trips were never rescheduled and instead of trying to route myself in crazy ways to make up the difference, I decided to not go for it.

I used miles on some trips I’d have normally paid for to get EQMs, flew direct when I could, and began to think how I’d strategize for a Soft Landing/Fast Track offer – if I were so lucky to get targeted.

If you recall, last year a TON of people were targeted for soft landings. Here were their offers:

Most started mid January and needed to be fulfilled by Mid April – 90 days in total – only on Alaska Metal. No partners.

- MVPG75 was 20k

- MVG was 10k

- MVP was 5k

20k is a ton of miles in 90 days, but seeing as though I knew this was an offer that has floated about for a few years, I figured I’d parlay travel in 2018 to early 2019 in order to potentially accommodate the Fast Track. So far I already have roughly 13,500 miles of travel planned during those 3 months.

Granted, I have no idea if I’ll be targeted, but it doesn’t hurt to be well positioned.

20k in 3 months is a lot. Is it worth it?

For just the status…eh…BUT

Anecdotally, I read where people not only got the MVG75 status for the rest of the year, they also got the 50k bonus. Who knows if this will be repeated, but that’s a big time incentive to run. 50k is enough for that sweet seat below on Cathay from the States to Asia.

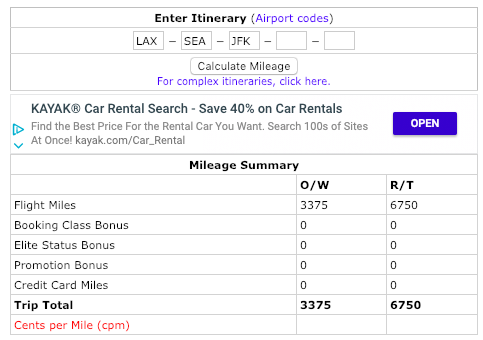

It was also a big incentive for me to move trips I could have done in Nov/Dec to Jan/Feb in order to prepare for a soft landing. As I mentioned above, I already have roughly 13,500 miles planned during the presumed Fast Track timeframe. A trip from LAX-SEA-JFK is over 6500 miles and available on many dates for roughly $260 and I could run to hit the Fast Track requirement.

If I was lucky enough to get a Fast Track/ Soft Landing offer I’d be crazy not to spend the extra $260 and go for it. Even if I didn’t get 50k bonus miles I’d be top priority for upgrades and earn 13k+ miles for the trip.

MVPG is the sweet spot status.

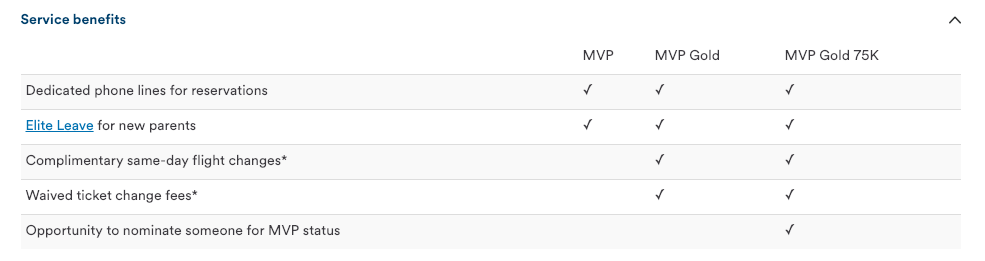

While I’d love to have MVPG75, aside from the 50k bonus, comped MVP status, extra guaranteed upgrades, and 25% incremental more bonus on miles – it’s not THAT much better than MVPG. I’m not sure how much lower my upgrade percentage would be with MVPG than MVPG75, but I’d be surprised if it dropped more than 25%.

Most people I casually speak to on planes who have been upgraded with me are Golds, rarely do I encounter an MVPG75.

The benefit that has saved me the most money is fee free changes to tickets. These fee free changes are granted to both MVPGs and MVPG75s and the reason why I made sure to nab MVPG status by year end. That will save me a ton of money as I like to book trips and move them around.

Also, the big jump in bonus miles occurs from MVP to MVPG – 25% to 100%.

If you’re thinking of mileage running for status, it’s at least worth considering the possibility you may be targeted for a fast track or soft landing offer.

This was my strategy since mid-year. Why wear myself down with runs when I may get an offer that will get me my desired status in the first 3 months of 19? Fingers crossed.

Anyone utilize one of these offers earlier this year?

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.