This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Waived credit card fees for active-duty military

First off, thank you for your service. Second, did you know that if you’re active-duty military you could get your credit card fees waived? This includes late fees, those premium card annual fees, and even caps on interest rates. Well, you can.

Thanks to the Service Members Civil Relief Act and Military Lending Act protections have been put in place to do just that. The biggest caveat in terms of qualifying is the credit cards must have been acquired prior to active duty service. However…Amex, Chase, Citi, and Discover all give those benefits on many of the cards acquired DURING active-duty service ( Capital One provides them on cards acquired prior to joining ). Let’s take a look.

Table of Contents

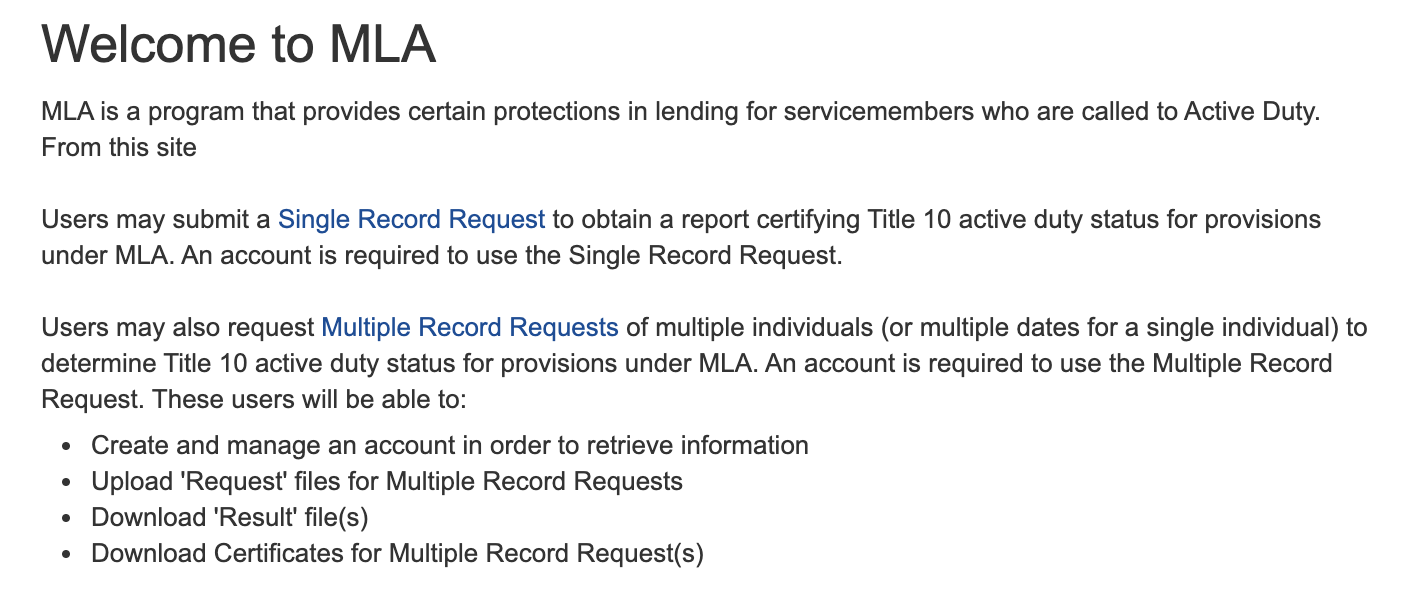

First Off – go to the MLA website and make sure you qualify

Which cards should you get?

Personally, I’d be looking to get all of the premium credit cards with high fees that provide a litany of amazing benefits. Just because an annual is waived for an active duty military member or even their spouse doesn’t preclude them from enjoying all of the credits that comes with the cards.

Amex:

- American Express® Green Card

- American Express® Gold Card

- The Platinum Card® from American Express

- Marriott Bonvoy Brilliant(R) American Express(R) Card

- Hilton Honors Aspire Credit card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Platinum American Express Card

Chase

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- United Club(SM) Infinite Card

American Express Active-Duty Military Benefits

American Express extends benefits no matter when you get the card as long as its a personal card. That really helps out active-duty service members who acquire new cards after becoming active-duty.

Amex will grant waived annual fees and late fees even on cards you pick up while active-duty. However, they will only cap interest rate charges at 6% on the cards you had prior to active -duty so, for instance, if you picked up an Amex Hilton Aspire while active-duty, the annual fee would be waived, but any interest charges wouldn’t be capped at 6%.

Pro-tip: You could pick up an Amex Platinum while active-duty and get the entire $695 annual fee waived. Pretty awesome.

American Express Platinum Card

How do you notify them?

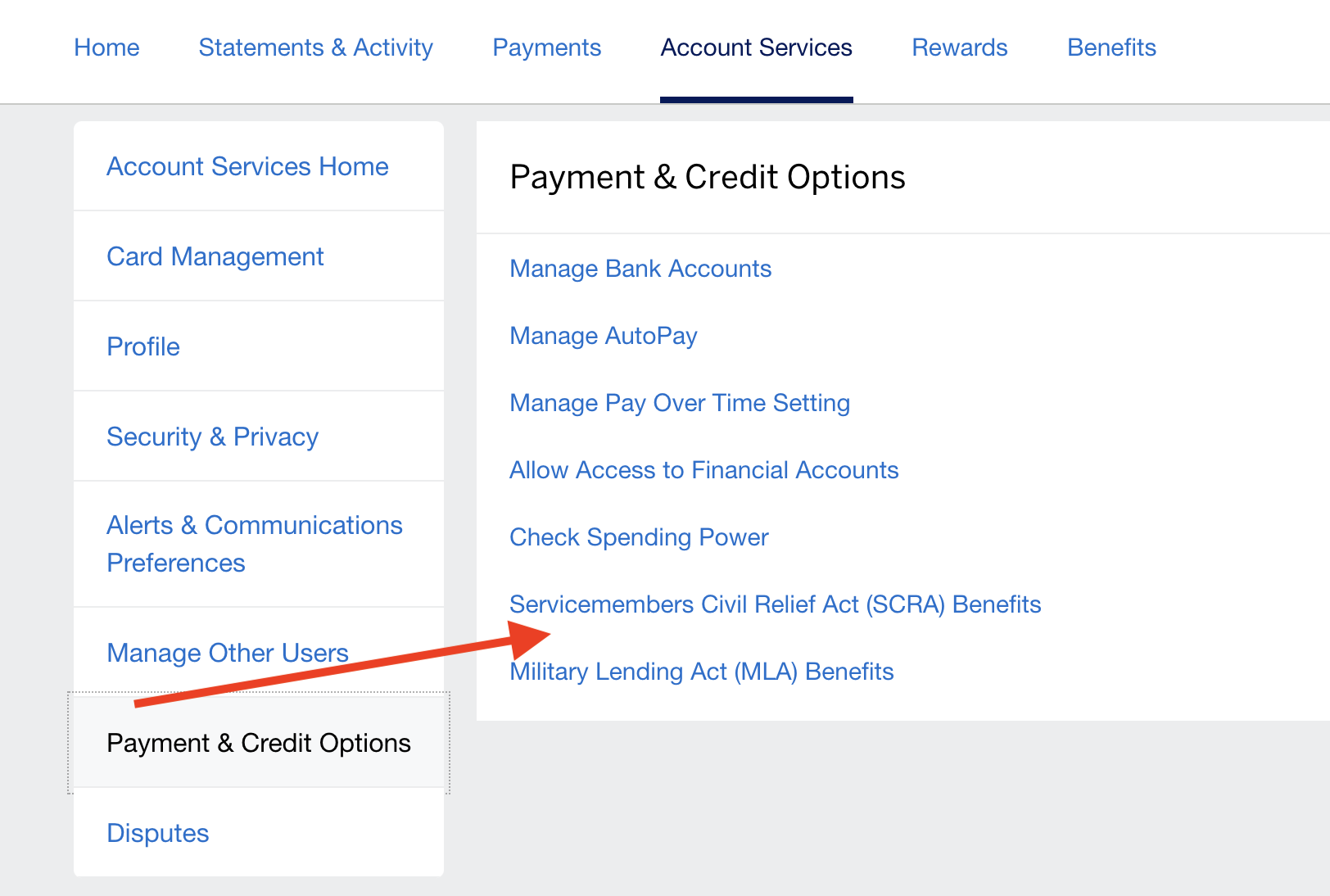

First off, make sure you are on the MLA website and qualify for benefits.

4 ways:

In your account: Go to Account services and click SCRA and follows the steps. Most simple and straight forward way.

Call them

- 800-253-1720

Fax your documents to

- 623-444-3000

Mail Them

- American Express, Servicemembers Civil Relief Act (SCRA), PO Box 981535, El Paso, TX 79998-1535

Capital One Active Duty Military Benefits ( Fees only waived on cards prior to joining )

Capital One has made the decision to lower interest rates loans and credit products to 4%…from the 6% mandated by the SCRA. However, they will not waive fees on credit cards if you acquire the card AFTER joining the military. If you have the card PRIOR to joining the military, they will waive fees. That’s an important distinction to pay attention to in acquiring a new card. You can read more here

The SCRA provides an interest rate of no more than 6% on all eligible loans and credit products. However, Capital One offers an interest rate of no more than 4% on eligible loans both owned and serviced by Capital One. Also, no fees are assessed except for bona-fide insurance.

The SCRA provides benefits on accounts that were opened before the start of the Servicemember’s active duty period. This includes credit cards and lines of credit, auto loans, mortgage and home equity loans, and installment loans.

How do you notify them?

Capital One will review military orders and check the Defense Manpower Data Center (DMDC). If they can’t verify, you’ll get notified in writing to submit verification materials.

Chase Active-Duty Military Benefits

Here’s the great thing about Chase. As long as you picked up your card after September 20th, 2017 Chase will waive annual fees on their personal cards. Business cards aren’t included.

So you could get a Chase Sapphire Reserve, which carries a $550 annual fee have the entire fee waived as long as you are active-duty. Personally, I prefer the Chase Sapphire Preferred, but then again, I have to pay the annual fees, and the Reserve comes with some incredible benefits like a $300 travel credit, Priority Pass Select memberships, and higher category bonuses

Chase Sapphire Reserve

How do you notify them?

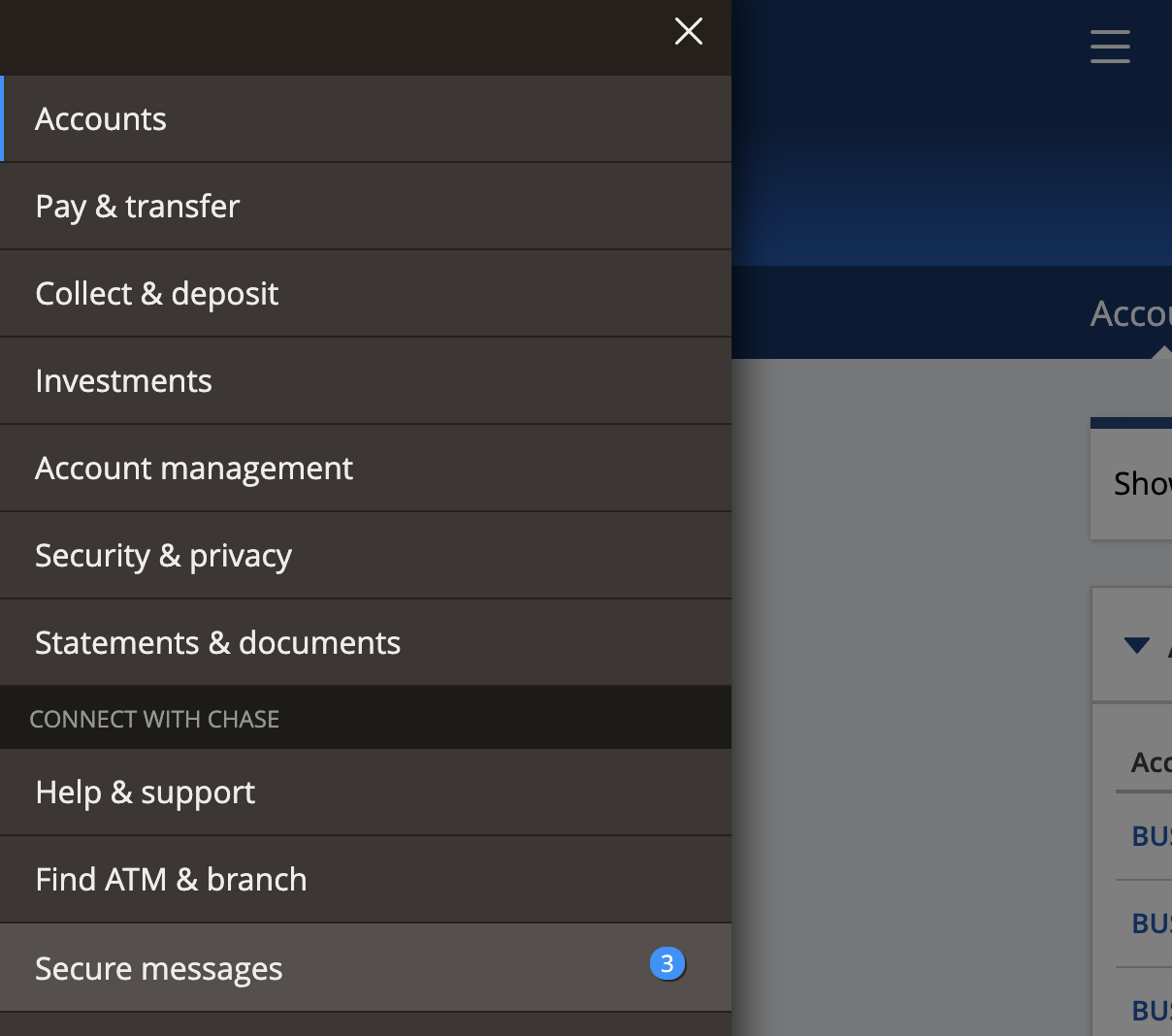

First off, make sure you are on the MLA website and qualify for benefits.

The easiest way to notify Chase:

Via Secure message. Simply message them and upload your documents proving that you qualify. You can find secure message on your log in screen…it looks like this:

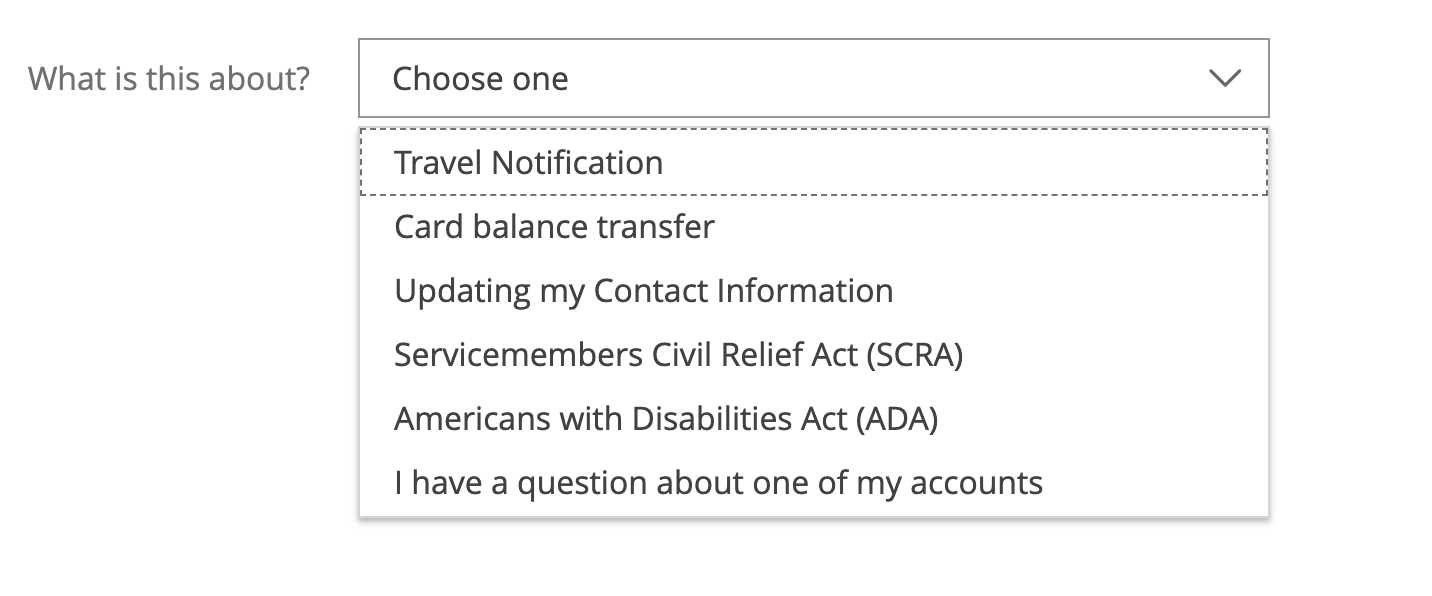

Click new message and a drop down menu will appear, just select SCRA

Click new message and a drop down menu will appear, just select SCRA

Via Mail:

- Chase

Attn: SCRA Request

PO Box 183240

Columbus, OH 43218-3240

Citi Active-Duty Military Benefits

According to MilitaryMoneyManual, Citi will waive some annual fees as well even if you acquired the card while being active-duty . I haven’t found this to be universally true, but it is certainly worth inquiring.

How do you notify them?

First off, make sure you are on the MLA website and qualify for benefits.

Then simply email them

You can email: MILITARYORDERS@CITI.COM – also inquire about getting 0% interest.

Citi Thank You Premier

Discover Active-Duty Military Benefits

If you know anything about Discover you probably already know that their cards don’t have annual fees so there is nothing to waive. But…Discover shows support for active-duty military by waiving other fees and reducing interest.

- Interest Rates are maxed at 5.9%

- Late fees and over limit fees are waived

How do you notify them?

First off, make sure you are on the MLA website and qualify for benefits.

4 ways to notify them

- Phone – Call 1.844.DFS.4.MIL (1.844.337.4645). If you are overseas, call 1.801.451.3730. (If your active duty time period is in the future, please make sure to provide your active duty dates).

- Online – Log into your Discover account at Discover.com/S.C.R.A. Not registered? Click HERE

- Mail – Discover Attn: S.C.R.A Department P.O. Box 30907 Salt Lake City, Utah 84130-0907

- Fax – Attn: S.C.R.A Department 1.224.813.5767.

Other banks

If you acquired a card prior to becoming active-duty make sure you notify the other banks as well

Bank of America:

Abides by the law, waives fees, and caps interest rates at 6%

Barclays:

Abides by the law, waives fees, and caps interest rates at 6%

USAA

Abides by the law, waives fees, and caps interest rates at 6%

U.S. Bank:

Abides by the law, waives fees, and caps interest rates at 6%

Wells Fargo

Abides by the law, waives fees, and caps interest rates at 6%

Overall:

If you’re thinking about picking up a new Chase or Amex in the future and you’re active-duty military – you could save an enormous amount on fees alone and utilize some incredible card benefits. Again, thank you for your service!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.