This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Menage a Credit: American, Citi, and Barclay strike deal

American, Citi, and Barclay strike deal that allows Aadvantage miles to be earned by two banks. I read an article on Forbes yesterday as well as numerous reports in the blogosphere that American was going to be a bit of a credit Lothario. Basically they are going against the normal protocol of branding with one credit card issuer and will allow new card sign ups with two banks: Citi and Barclay.

I think this is flipping great: More choice, more churn

The more options there are to sign up means the more way we can earn points. Citi recently changed their churn rules to every 24 months. It used to be 18 month between card sign ups. That made it more restrictive to get the bonuses, but now that Barclay will be rolled into the signup-o-sphere it will allow more options for rotation. Also, as long as you have one AA branded card, you miles won’t expire

How can we sign up?

Well Barclay will start issuing cards January 1st, 2017. At that point you’ll have the following sign up options.

Citi:

- Online

- Direct Mail

- Admiral’s Club

Barclay

- Airports

- Flights

Why would American do this? DOLLAR BILL$$$$

American’s projections of earnings just off these deals:

- 2016: $200 Million

- 2017: $550 Million

- 2018: $800 Million

That’s $1.55 Billion over 3 years. American’s stock price jumped nearly 10% on this news. Which was much welcomed by shareholders because their stock is getting slaughtered this year, down almost 20% AFTER the recent surge. Let’s just say I’m not quite sure these sunny estimates will be reached, but I think it says something for how lucrative these relationships can be.

My history with the banks.

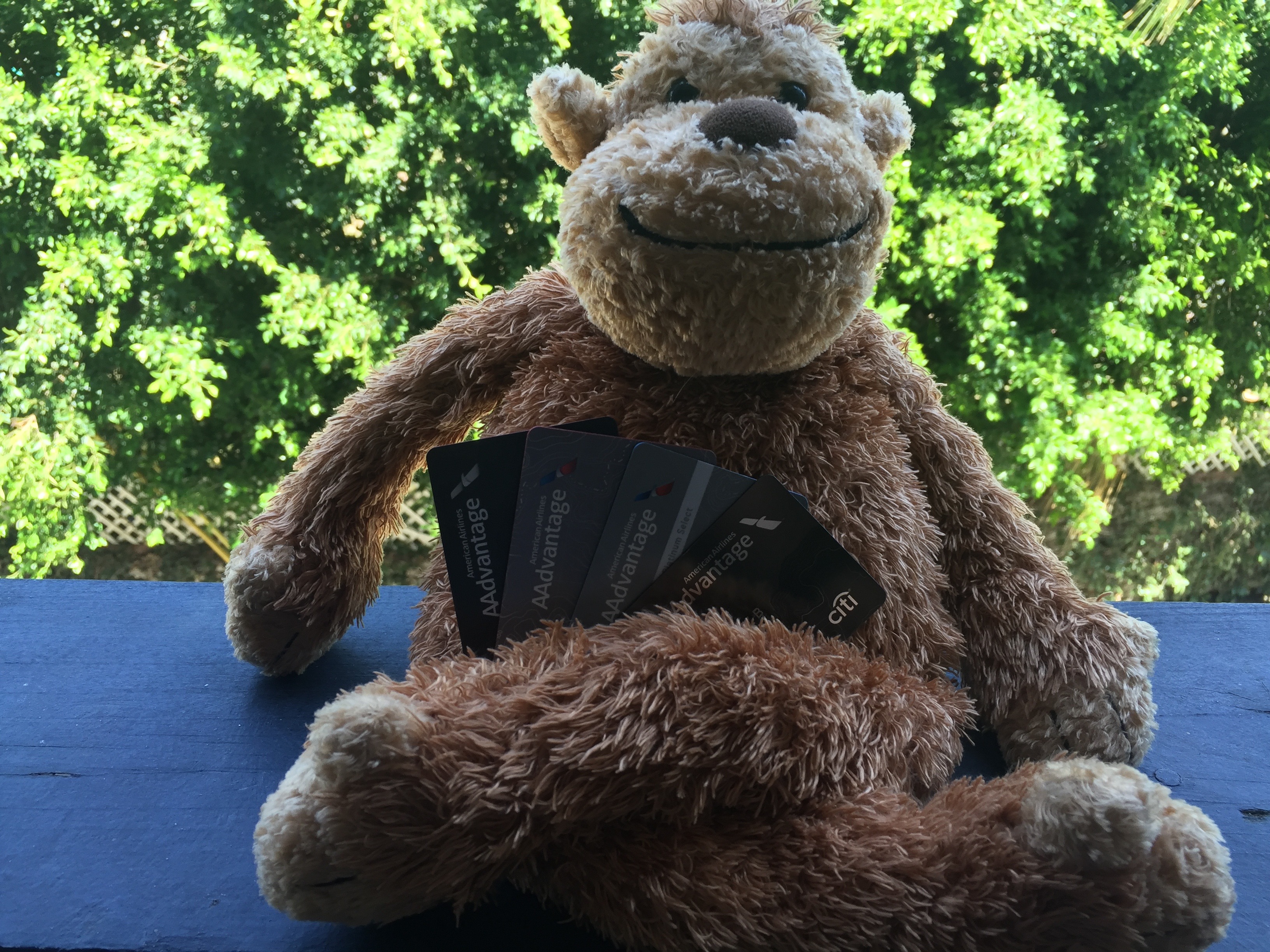

I’ve signed up for almost all the currently offered cards: except citi gold. I’m on a rotational hold because of the time needed between sign ups.

- Citi platinum: 50k

- Citi Platinum biz: 50k

- Citi exec: 100k

- Aviator x2: 100k

I signed up for two cards when there was a U.S. Airways Barclaycard and they were offering 50k points after first purchase. An incredible deal that netted me 100k points. I did this with the knowledge that they would be rolled into AAdvantage miles once the merger was complete. At the time that was enough points for a roundtrip business class ticket to Europe or Asia. Unreal redemption for what ended up being two cups of coffee worth of spend. On top of that, I got back to back targeted spend offers of 15k bonus points for $750 per month for 3 months. Another great deal! I also used my Aviator card to fund a CitiGold bank account when they were offering 50k for a new checking account. That netted me another 75k AA.

My US Airways cards were rolled into Barclay Aviator Red Mastercards. There are actually 4 versions of the AA Barclay Card.

Should I wait to sign up?

Well, you can’t sign up for any of the Barclay issued cards right now. If you have them, like I do, I wouldn’t do anything until more information is released. We have no idea what the new cards will be, their benefits, and if we’ll be allowed to have a grandfathered aviator and a newly issued one. That would be the best case scenario as it’d provide the best points earning possibility.

I made the choice to keep my Aviator Red card for the 10% off Aadvantage redemptions *up to 10k per year. That alone is worth the annual fee, although I did get it waived last year, and am looking to negotiate that deal again here in the next month.

What we should hope for is that their will be some sort of card that, with enough spend, eliminates the EQD spend requirement for Elite status. EQD is something that American is introducing on their loyalty program next year.

Why do you want AA miles? BIDNESS

Biz class baby BIZZZZZZZZ. Ok First class too, but I do love me some BIDNESS. Check out these product reviews that all were acquired with AA miles.

- Etihad Business Studio

- Etihad Pearl Business

- American A321T Review

- American 777-300ER Review

- British Airways 777 First Class Review

- American 777 First Class Review

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.