We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

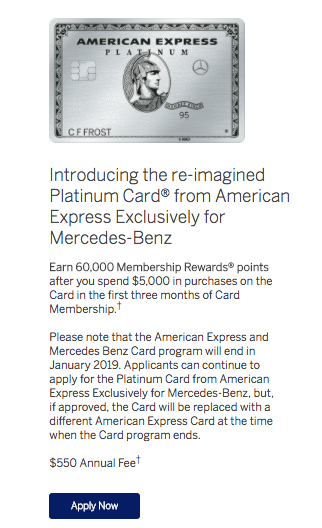

If you once had an American Express Platinum Card and are thinking of hopping back in the Amex Plat pool, this is a great way to do it. Get all those yummy bennies, and get a sign up bonus. Amex limits sign up bonuses to once per lifetime, per card product. Two ways to get a sign up bonus, and get most of the same benefits, but work within the Amex sign up rules may be going away. Yes, that sweet little benzo card may take its last breath tonight. So here’s your chance to pick it up if you’re tempted…

I have no affialiation with Amex, links, etc – so this is just a public link

Why get this card?

If you own or lease a Mercedes there are some nice perks listed above:

- 5x purchases on Mercedes

- If you’re thinking of buying one. Ask to use this credit card. If they say no, tell the dealer you’ll pay the processing fee. On a $30,000 car you’ll pay several hundred bucks in processing fees but earn another 150,000 points. Totally worth it IMO. At just $0.02 you’re earning $3,000 back. Way more when redeemed for international air travel.

- $1000 certificate when you spend $5000

- 2000 overage miles waived on a lease

- $100 credit towards accessories

Honestly, none of those apply to me, and probably don’t apply for most people. However, here’s a list of things I think would would benefit you:

- 60k bonus points = valued at just $0.02 per point that’s worth a $1200

- $200 annual airline fee reimbursement – in your first cardmember year, you’ll qualify twice for this – that’s $400

- The airline reimbursement is per calendar year vs the cardmember year of which the annual fee is based.

- Global Entry fee reimbursement – worth $100

- Priority Pass Select membership – worth ~ $400

- lounge access around the globe

- Delta Sky Club lounge access – when flying on Delta

- Centurion Lounge access – network expanding and very worthwhile

- Access to Fine Hotels and Resorts

- Amazing benefits such as free breakfast, resort credits, room upgrades, early check in, late check out, etc

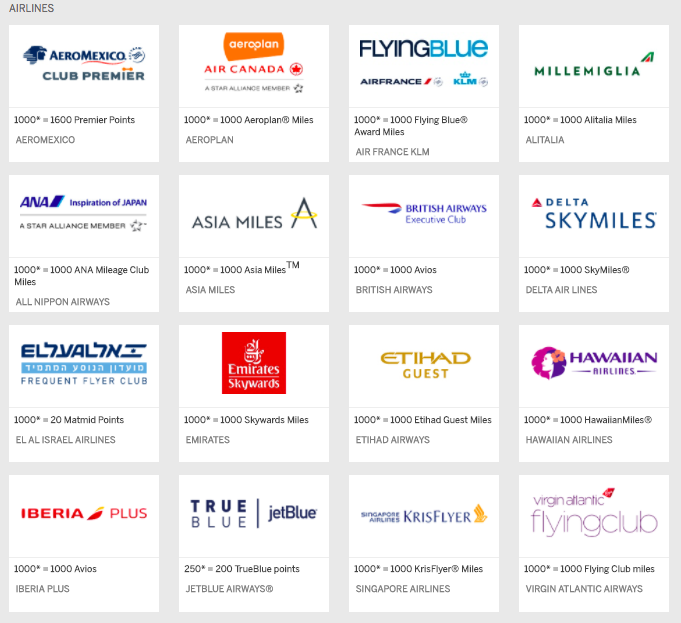

- Over 20 transfer partners: like Singapore Air, Air Canada, Air France, British Airways

- SPG gold status = Marriott Gold Status = CLUB ACCESS

- Hilton Honors gold status

- Boingo free wi-fi at more than 1,000,000 hotspots around the globe

- The Hotel selection

- slightly different that Fine Hotels and Resorts, but provides great benefits, credits, and upgrades

- Return protection on goods a store won’t take back, you get reimbursement up to $1000/year $300/item

Those Amex Airline transfer partners that get you evvvvvvvver so close to lie flat biz and first.

Ahhhhhhh – feels so good

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.