This site is part of an affiliate sales network and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Zachary Abel is also a Senior Advisor to Bilt Rewards. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Chase Sapphire Preferred, a 2nd time?

I recently signed up for the Ink Business Preferred which offers 80k bonus points after $5k spend in 3 months. I also have a Chase Sapphire Preferred, a Freedom, Ink Plus, and an IHG card from Chase. As long as I maintain one premium Ultimate Rewards earning card, I keep the ability to transfer rewards into that account which allows me to then transfer to travel partners like Singapore Air, Hyatt, and Korean. I, like many others, now have 2 premium cards ( Chase Sapphire Preferred + Ink Business Preferred). It got me thinking…what do I do next? I’m not sure I want to keep both the Ink Business Preferred and the Sapphire Preferred open and pay the fees. I’d wanted to get the Chase Sapphire Reserve with the 100k offer, but alas, it has expired and I wasn’t able to get in on the deal. It’s currently sitting at 50k – while I think that’s a fair offer, I’d rather wait and see if they don’t have an increased bonus at some point. In the meantime, I have to figure out what I’m going to do…and one of those options is potentially getting the Chase Sapphire Preferred a 2nd time.

The Sapphire Preferred was keeping my points transferrable

The main reason I was keeping the Sapphire Preferred was just that reason. I have an Ink Business Cash and a Freedom. Both of those cards are technically Cash Back cards and the points can only be transferred to partners if I keep a premium card open. Now that I have an Ink Business Preferred I don’t need the Sapphire Preferred to do that job.

I won’t cancel the account, but will try to downgrade/convert to a Freedom

Keeping the card open helps your credit score because it lengthens your account history which in turn makes your score stronger. So I wouldn’t cancel the account, and would instead convert it to a Freedom. Miles to Memories has done this several times and creates the opportunity to stack up category bonuses.

That would be 2 Freedoms, 2 sets of quarterly category bonuses – 48k bonus points annually if maxed out.

You can get a bonus every 24 months with Chase

It’s been well over 24 months since I picked up the Sapphire Preferred. This means…as long as I’m not currently carrying the card, I can sign up for it and get the bonus again. My fee is due in September and I drop another opened account in August. I’m in no rush tho, but instead of just keeping the card as is, I could have a 2nd Freedom and reapply for the Sapphire Preferred to get the sign up bonus for a 2nd time.

Why not get a Sapphire Reserve?

Makes sense, right? I’ve never had it, and before my annual fee is due in September I’ll be under 5/24 again ( if i’m not already) so I could pick up the Reserve at the 50k offer.

- Reserve is $450 annual ( $300 travel credit ) nets to $150

- Preferred is $95 annual fee

I’ll be the first to argue that the $55 incremental cost of the Sapphire Reserve compared to the Sapphire Preferred is worth the annual fee. I still think the Reserve is the best card in the marketplace. However…I’m not sure I want to burn my application for the Reserve on just 50k points. The battle of premium cards goes back and forth and for some reason I think the Reserve will have some targeted, limited time, etc etc offer for more than 50k in the next couple years.

I have an Amex Biz Plat and a Citi Prestige so I’ll still have lounge benefits, primary car rental insurance, 2x dining bonus ( albeit a different currency), but I’ll be able to get similar category bonuses and card benefits.

Right now I’m leaning towards keeping my Citi Prestige, downgrading my Sapphire Preferred to a Freedom, and determining which cards make most sense

*The links I provided are my bonus referral links. Much appreciated if you use them as it helps me continue to earn points, review products ( like the feature picture in Singapore First), etc – if you’d like to leave your own referrals you can do so in the comments section.

Ink Business Preferred 80k after $5k spend

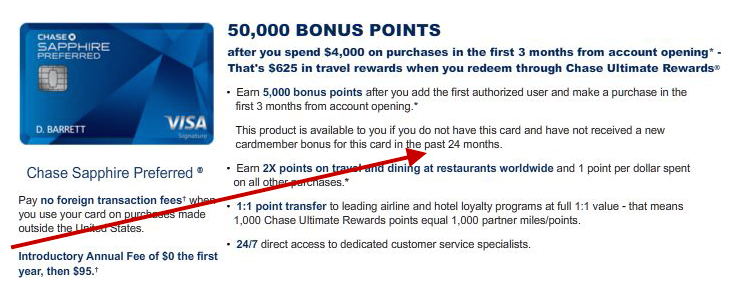

Chase Sapphire Preferred 50k after $4k spend:

Chase Freedom: $150 ( 15k points) after $500 spend

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.